Zillow Stock has been a hot topic among real estate investors, tech watchers, and market strategists. Whether you’re building an investment plan or simply eyeing the best stocks to buy, Zillow Group offers a compelling case to explore. Why? It blends real estate fundamentals with digital innovation, creating both hype and concern. In this post, we’ll take a deeper look into Zillow Stock’s current position, analyze its potential in today’s economic system, and compare it with actual competitors to help you decide if it belongs in your portfolio.

Overview of Zillow Stock

Zillow Group (NASDAQ: Z, ZG) stands out in the real estate tech sector, functioning as both a data provider and marketplace. It powers home buying, selling, and renting, making it a pivotal player in the housing economy.

Key Features:

- Ticker Symbols: Z (Class C) and ZG (Class A)

- Business Model: Advertising, Premier Agent services, mortgages, and a recently paused iBuying program

- 2025 Focus: Improving profitability, leveraging AI, and optimizing mobile experience

- Revenue Streams: Agent lead generation, Zillow Rentals, and home loans

In-Depth Analysis of Zillow Stock

Zillow’s journey has been anything but linear. From its iBuying flop to its AI-powered comeback, the stock’s volatility makes it both thrilling and nerve-wracking.

Financial Performance

Zillow saw an impressive rebound in Q4 2024, with revenues rising over 10% YoY despite slowing housing transactions. Much of this success is tied to improved ad revenues and cost-cutting in their tech segment.

User Experience and Functionality

The Zillow app remains one of the most downloaded real estate apps. It offers intuitive navigation, personalized search alerts, and 3D home tours—boosting engagement metrics year over year.

Tech and Innovation

Zillow is leaning heavily into AI and machine learning. Its Zestimate feature, although controversial, is becoming smarter. The company’s integration with ChatGPT-like assistance also enhances its customer service.

Market Positioning

Zillow continues to dominate U.S. home search traffic. However, it’s increasingly focusing on converting traffic into revenue through tools for mortgage pre-approvals, virtual closings, and AI-driven agent matching.

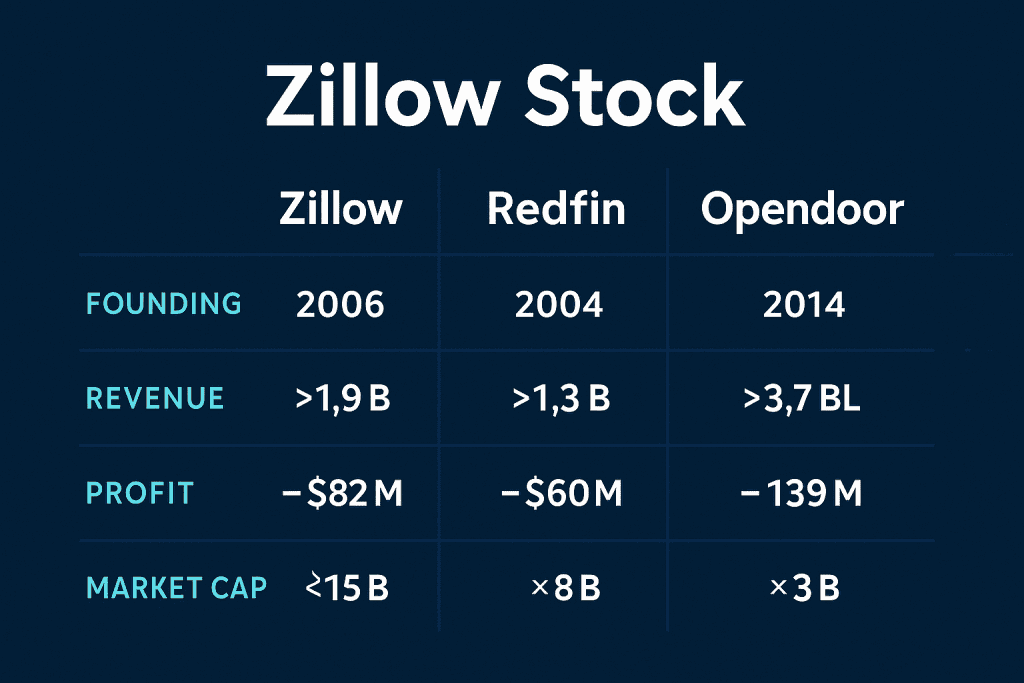

Zillow Stock Comparison

When it comes to performance, how does Zillow compare to its closest peers like Redfin and Opendoor?

| Company | Market Cap (Apr 2025) | Business Model | Revenue Growth | Profit Margin |

|---|---|---|---|---|

| Zillow | $9.8B | Real estate tech/ad sales | 10.2% | 5.3% |

| Redfin | $4.2B | Brokerage/iBuying | 6.5% | -2.1% |

| Opendoor | $3.1B | iBuying | -8.7% | -4.5% |

Zillow shines for its pivot away from risky iBuying toward sustainable ad and tech-driven income.

Pros and Cons

Here’s a quick breakdown to evaluate its position more clearly.

| Pros | Cons |

|---|---|

| Strong brand recognition | Risk of housing market crash |

| Improved ad and mortgage revenue | Past iBuying losses still linger |

| Tech-driven approach with AI | Slower international expansion |

| High app user engagement | Competitive market with low margins |

Conclusion

Zillow Stock is on a promising path, recovering smartly after its iBuying misstep. By sharpening its tech, improving user experience, and capitalizing on data monetization, Zillow appears to be one of the more resilient bets in real estate tech. For investors with a long-term view and a taste for innovation-backed plays, it might just deserve a spot in your diversified portfolio.

Zillow Stock Rating

Zillow has seen meaningful recovery through strong ad revenue and app traffic. While risks exist, its digital-first strategy gives it solid footing.

Rating: 4.2/5

FAQ

Is Zillow Stock a good investment during a volatile economic system?

Yes, if your investment plan includes tech-driven real estate exposure. Zillow has diversified its revenue and trimmed costs, making it more resilient to downturns.

How does Zillow Stock compare to other best stocks to buy in 2025?

Compared to peers like Opendoor and Redfin, Zillow focuses more on tech and less on risky capital-heavy models. This gives it a unique edge among best stocks to buy in real estate tech.

What trading strategies work best with Zillow Stock?

Momentum trading post-earnings, or buy-and-hold strategies work well due to Zillow’s cyclical nature. Swing traders also benefit during quarterly volatility if guided by solid trading strategies.

Resources

- CNN. Zillow Group Stock Overview

- Motley Fool. Zillow Group Financials

- Simply Wall St. ZG Analysis and Valuation

- TipRanks. ZG Forecast and Analyst Ratings

- Yahoo Finance. Zillow Stock Summary