When it comes to choosing the next big thing for your portfolio, understanding the nuances of individual stocks is crucial. Today, I’m diving deep into Soun Stock, a rising star that’s been making waves lately. If you’ve been wondering whether this stock is a worthy addition to your investment plan, you’re in the right place. We’ll explore everything you need to know about Soun Stock Price, Soun Stock Forecast, and its place among the best stocks to buy. Let’s uncover whether this opportunity is music to your financial ears or just background noise.

Overview of Soun Stock

In today’s dynamic world of technology-driven investments, Soun Stock stands out as a fascinating opportunity. Representing SoundHound AI Inc., this company is redefining the future of voice-enabled experiences through advanced AI-powered platforms. SoundHound’s expertise in conversational AI allows them to offer seamless, natural interactions across automotive, hospitality, and smart device industries. Their solutions aren’t just innovative; they’re transforming how businesses and consumers interact with machines.

One of SoundHound’s biggest strategic moves was partnering with Tencent Intelligent Mobility, strengthening its foothold in the automotive sector by providing intelligent voice control for global car brands. Moreover, their impressive quarterly financial results reflect growing demand and a promising outlook for future expansion.

Key Features of Soun Stock:

- Innovative AI and voice recognition technology

- Expansion into the automotive and hospitality industries

- Solid financial performance backed by real-world adoption

- Strategic global partnerships fueling market expansion

- Popular among tech investors crafting smart trading strategies

In-Depth Analysis of Soun Stock

Before throwing your hat in the ring, it’s wise to examine the detailed anatomy of Soun Stock. Let’s explore how it stands up in key categories.

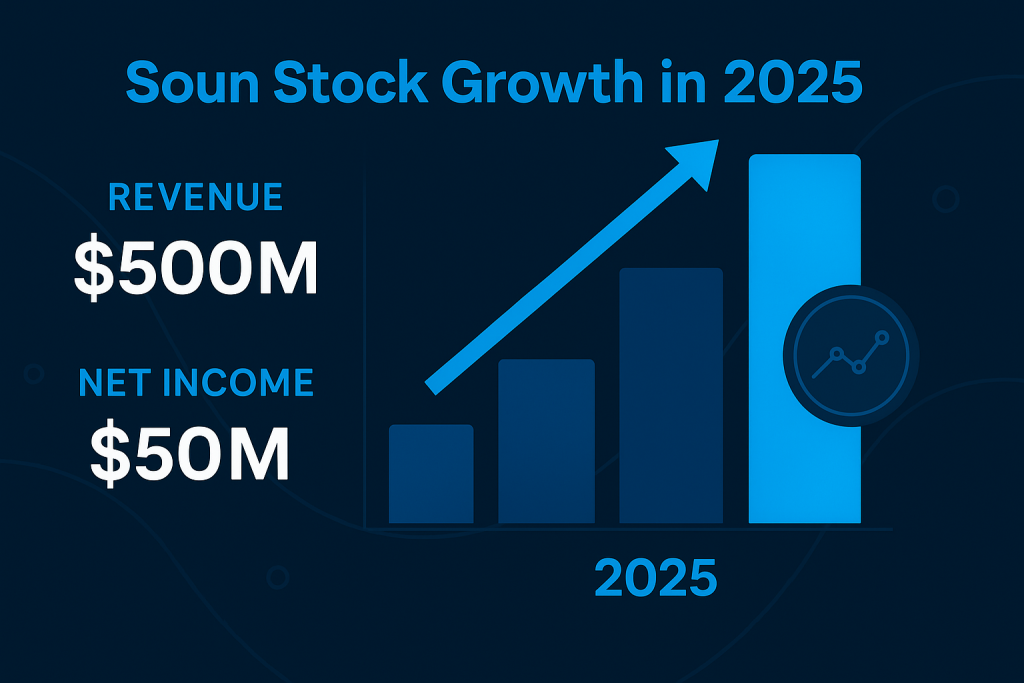

Performance and Financial Stability

SoundHound’s Q1 2025 report highlights strong revenue growth driven by rising demand for conversational AI. The company exceeded Wall Street expectations and showed improving operational cash flow, indicating long-term viability. Its expansion into automotive and enterprise markets supports a diversified, lower-risk revenue model. Analysts view SoundHound as a compelling tech investment with strong momentum and growth potential.

Product Design and Innovation

SoundHound continues to lead with conversational AI that prioritizes user experience and adaptability. Its technology stands out in automotive and smart device applications, offering natural, intuitive voice interactions. Collaborations like the one with Tencent Intelligent Mobility showcase its ability to set new standards in intelligent systems. By merging design innovation with functionality, SoundHound positions itself as a top contender in user-focused AI solutions.

Market Functionality and Usability

SoundHound designs its AI solutions for real-world usability, offering fast, accurate responses that adapt naturally to users’ routines. Its systems excel in diverse environments, from vehicles to hospitality, with seamless integration and support for varied accents and complex queries. The open AI architecture allows flexible deployment across platforms, reducing costs and increasing adoption. This focus on practical, user-centric design enhances SoundHound’s appeal to both consumers and investors.

Strategic Positioning

In a competitive AI landscape, SoundHound has carved out a focused niche by targeting high-growth sectors like automotive, hospitality, and customer service. Instead of directly competing with tech giants, it delivers specialized solutions through strategic partnerships, such as with Tencent Intelligent Mobility. This approach ensures long-term relevance and efficient use of resources. SoundHound’s agility and market-specific focus make it an attractive option for investors seeking targeted growth in the AI space.

Soun Stock Comparison

Let’s put Soun Stock head-to-head with similar tech companies:

| Feature | Soun Stock | Nuance Communications | Cerence Inc. |

|---|---|---|---|

| Focus | Conversational AI | Voice Tech Solutions | AI for Automotives |

| Growth Potential | High | Moderate | High |

| Recent Partnerships | Tencent | Microsoft Acquisition | Auto Manufacturers |

| Financial Outlook | Positive Q1 2025 | Stable | Volatile |

Soun Stock Pros and Cons

Let’s lay it all out clearly:

| Pros | Cons |

|---|---|

| Innovative voice AI platform | High competition in AI industry |

| Strong strategic partnerships | Relatively high market volatility |

| Positive financial forecasts | Still establishing broader brand recognition |

Conclusion

After diving deep into the performance, innovation, and market position of Soun Stock, it’s clear that this company holds strong potential for future growth. SoundHound AI’s advanced conversational platforms, strategic partnerships, and expanding market reach make it a compelling choice for investors interested in technology-driven opportunities. Although recent legal concerns urge some caution, the overall fundamentals remain promising.

For investors crafting a forward-thinking investment plan, Soun Stock could offer exciting upside, especially as demand for AI-driven voice solutions accelerates globally. As always, a balanced portfolio and careful risk management are essential, but adding a slice of innovation like SoundHound AI might be the strategic move your portfolio needs right now.

Soun Stock Rating

While Soun Stock boasts innovative technology and market potential, recent developments urge caution. According to this Twitter post.

SoundHound AI investors are currently facing losses related to a securities class action lawsuit. Shareholders are encouraged to explore compensation routes.

Rating: 3.5 out of 5 stars

FAQ

Is Soun Stock a good long-term investment for economic analysis?

Absolutely! Given its focus on conversational AI and consistent partnership deals, Soun Stock offers strong potential for future returns in economic analysis frameworks.

What should investors know about Soun Stock Price fluctuations?

Soun Stock Price has shown moderate volatility, a typical trait among tech sector stocks. Therefore, building a diversified investment plan can help mitigate short-term swings.

How reliable is the Soun Stock Forecast for 2025 and beyond?

Industry forecasts for Soun Stock predict solid growth, especially as AI integration in vehicles and consumer tech products expands significantly.

Resources

- SoundHound AI. Introduction to SoundHound AI technology and solutions.

- MarketWatch. Soun Stock Price updates and forecasts.

- SoundHound AI Investors. 2025 Q1 financial results report.

- BusinessWire. Partnership announcement with Tencent Intelligent Mobility.

- YouTube. Official video explaining SoundHound’s AI technology and market approach.

- TradeDots on Twitter. Update regarding SoundHound AI investors facing a class action lawsuit.