Meta Platforms has become one of the most closely watched companies in the global tech industry. Each earnings report from Meta offers more than just financial updates; it provides insight into digital trends, business strategy, and consumer behavior. Investors and analysts follow Meta’s performance to evaluate the company’s position in areas such as social media, artificial intelligence, and the Metaverse. As Meta continues to evolve, its quarterly results help stakeholders understand how the company adapts to market challenges and opportunities. This article reviews Meta’s latest earnings and explains what they reveal about the company’s current direction and long-term growth strategy.

Overview of Meta Earnings

Meta Earnings for Q4 2024 showed strong performance across key financial metrics. The company reported $40.1 billion in revenue, marking a 25% increase from the previous year. Net income reached $14 billion, while earnings per share rose to $5.33, exceeding market expectations. These Meta Earnings reflect rising ad revenue and increased user activity on Facebook, Instagram, and WhatsApp.

The report also highlights Meta’s improved cost management and its strategic focus on AI-driven advertising tools. Despite ongoing investments in the Metaverse and rising regulatory concerns, Meta Earnings demonstrate solid profitability and operational strength. The company’s global reach and steady innovation continue to reinforce its long-term market position and investor confidence.

In-depth Analysis of Meta Earnings

Revenue & Growth Engines

Meta Earnings showed a 25% increase in Q4 2024 revenue, reaching $40.1 billion. This growth resulted from higher advertising demand, increased user activity on Instagram Reels and WhatsApp Business, and the rollout of AI-powered tools for advertisers. Businesses resumed marketing efforts following earlier market uncertainty, while Meta’s Advantage+ platform helped improve ad targeting and raised return on investment by 15 percent. These drivers played a key role in the company’s strong quarterly performance.

Cost Management and Operational Efficiency

Meta cut costs and improved margins after restructuring efforts in 2023.

Efficiency Measures:

- Reduced workforce

- Merged departments

- Prioritized profitable programs

| Metric | Before | After |

|---|---|---|

| Operating Margin | 20% | 35% |

| Annual Expenses | Flat | Lower |

| Headcount | Higher | Reduced |

These steps helped Meta increase profit while maintaining performance.

Innovation and Product Development

Meta continues to invest in new platforms despite short-term losses.

| Product | Status | Purpose |

|---|---|---|

| Reality Labs | Operating at a loss | VR/AR experience expansion |

| Threads | Early growth stage | Text-based engagement |

| AI Ad Tools | Widely adopted | Enhance targeting and ROI |

Meta continues to invest in product development despite some ongoing losses. Reality Labs reported a $4.6 billion loss in Q4, but it remains central to the company’s Metaverse plans. Threads is slowly gaining traction as a social media alternative to Twitter. AI tools are widely adopted and help improve ad performance across Meta’s platforms.

Meta Earnings vs Big Tech: Comparison with Other Tech Giants

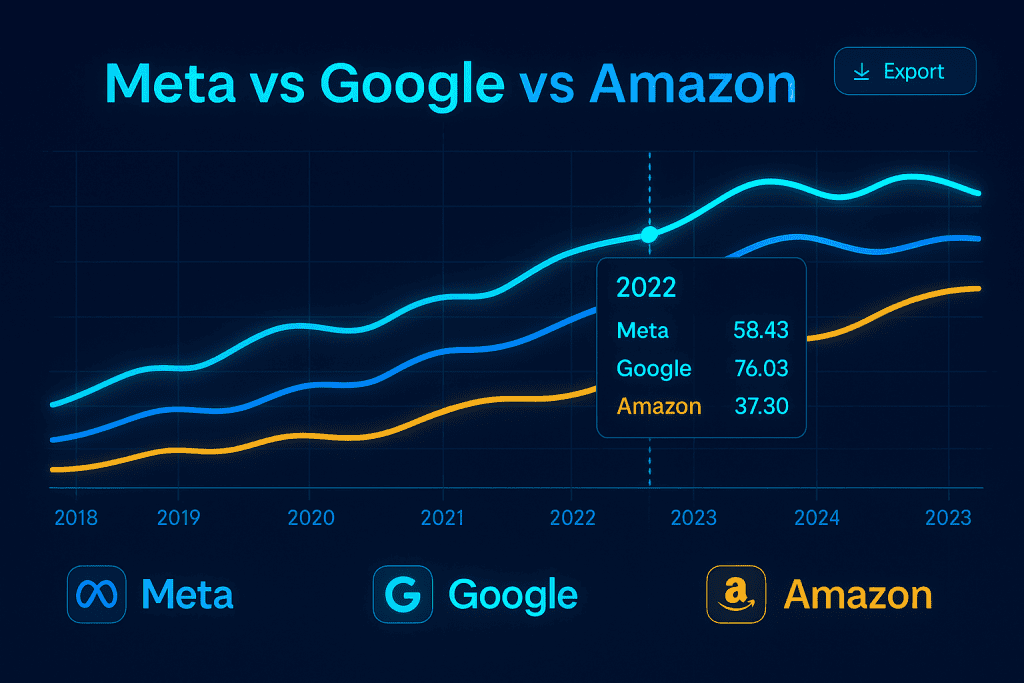

To understand Meta’s performance better, it helps to compare its results with those of other major tech companies. In Q4 2024:

| Company | Revenue | Net Income | EPS | Revenue Growth |

|---|---|---|---|---|

| Meta | $40.1B | $14B | $5.33 | +25% |

| Alphabet | $86.3B | $20.7B | $1.64 | +13% |

| Amazon | $169.2B | $10.6B | $1.00 | +14% |

| Microsoft | $62B | $21.9B | $2.93 | +18% |

Although Meta reported lower total revenue than these companies, its growth rate and earnings per share were notably strong. Its ability to increase profit while reducing operational costs distinguishes it in the current tech landscape.

Pros and Cons

| Pros | Cons |

|---|---|

| Strong ad revenue growth | Reality Labs remains unprofitable |

| Improved cost management | Regulatory challenges continue |

| Increased user engagement | Heavy reliance on ad revenue |

| Progress in AI tools | Metaverse adoption is still slow |

Meta has strengthened its position through operational discipline and product development. However, it still faces challenges, particularly in turning its Metaverse investments into profit and managing regulatory pressure in global markets.

Meta’s Strategic Outlook for 2025 and Beyond

Meta plans to deepen its investment in AI technologies and digital infrastructure. The company aims to improve its advertising ecosystem by integrating more automation and personalization. It will also continue developing Threads as a possible alternative for users seeking a more streamlined social experience.

The company is also focused on regional expansion in emerging markets. Increasing smartphone use and internet access in regions like Southeast Asia and Africa provide growth opportunities. By tailoring products for local users, Meta hopes to strengthen its global reach and increase engagement.

Long-term, Meta expects to build a sustainable digital ecosystem that includes social media, messaging, e-commerce, and virtual reality. If successful, these efforts may open new revenue streams and reduce dependence on ad sales alone.

Conclusion

Meta Earnings for Q4 2024 reflect the company’s strong recovery and focused strategy. With rising ad revenue, improved cost control, and expanding use of AI tools, Meta continues to strengthen its core business. Although Reality Labs remains unprofitable and regulatory concerns persist, the company shows resilience and adaptability.

Meta’s consistent user growth and focus on innovation position it well in a competitive tech landscape. For investors and analysts, Meta Earnings offer valuable insight into the company’s direction and its role in shaping future digital trends. As Meta evolves, its financial performance will remain a key indicator of its long-term potential.

FAQ

What do Meta Earnings tell us about its position in the tech sector?

Meta Earnings signal strong recovery and adaptation in the tech space. It outpaced many peers in advertising revenue and is investing heavily in AI, reflecting a solid position in today’s Economic System.

How do Meta Earnings impact investment planning?

For anyone building an investment plan, Meta’s consistent growth and profitability, especially in a volatile market, make it an attractive option. However, long-term risks around regulation and Metaverse investments remain.

Why are Meta Earnings crucial in economic analysis?

Meta Earnings provide insight into broader market trends—especially consumer behavior, digital ad spending, and tech-sector resilience. Analysts often use it as a barometer in larger Economic System evaluations.

Resources

- Meta. Meta Reports Fourth Quarter and Full Year 2024 Results

- CNBC. Meta Q4 Earnings Report 2024

- The Guardian. Facebook Meta Earnings Report

- PR Newswire. Meta Reports Full Year 2024 Financials

- Statista. Facebook’s Annual Revenue and Net Income