When most people think of McDonald’s, they picture Big Macs, fries, and the familiar golden arches. But beyond its popular menu, the company’s market presence is generating attention in financial circles. As global markets fluctuate and consumer spending habits evolve, McDonald’s has demonstrated an impressive ability to adapt and remain relevant.

For investors building a well-rounded portfolio, McDonald’s Stock stands out due to its consistent dividends, strong international footprint, and trusted brand image. These qualities give it a competitive advantage, especially in uncertain economic times. Whether you’re keeping an eye on its market movements or considering a long-term position, the company offers a blend of stability and opportunity.

In this article, we’ll explore what makes McDonald’s a noteworthy option for investors, how it compares with similar companies, and why it’s frequently listed among the top choices for those seeking resilient investments.

Overview of McDonald’s Stock

McDonald’s stock, traded under the ticker symbol MCD on the NYSE, has long been a go-to choice for investors seeking dependable returns. Known for its iconic brand and consistent performance, McDonald’s is a key player in the consumer discretionary sector, particularly within the global restaurant industry. With a market capitalization exceeding 200 billion dollars, the company stands tall as one of the most valuable fast-food chains in the world.

Despite facing economic turbulence and inflationary pressures, McDonald’s has shown a remarkable ability to remain resilient. One of its major strengths lies in its ability to adapt. The company has embraced technology through digital ordering systems, AI-driven drive-thrus, and mobile app-based loyalty programs that have boosted customer retention and sales. These innovations align with shifting consumer preferences and have helped McDonald’s stay competitive amid rising operational costs.

Its dividend yield, hovering around 2.2 percent, makes it attractive to income-focused investors. Moreover, McDonald’s global presence with more than 40,000 locations offers geographic diversification, helping to mitigate risks posed by local economic downturns.

Although recent challenges include stiff competition and increased sensitivity to pricing, McDonald’s growth strategies, fueled by global expansion and tech-forward approaches, position it as a formidable stock for both short-term observation and long-term investment.

In-Depth Analysis of McDonald’s Stock

McDonald’s stock continues to be a focal point for economic analysis, particularly in the current environment where consumer behavior and inflation are reshaping the fast-food industry. Investors are watching the McDonald’s stock price closely, not only because of its global dominance, but also due to its consistent ability to evolve. MCD stock has proven to be a valuable asset for long-term investment plans, offering a combination of dependable dividends and strategic innovation.

Performance Trends and Stock Price Behavior

The performance of McDonald’s stock has been relatively stable compared to many of its competitors. Over the past year, the McDonald’s stock price has fluctuated between $260 and $300, reflecting the company’s solid fundamentals amid broader market uncertainty. Despite inflationary pressures and higher operational costs, MCD stock has managed to maintain a strong earnings per share, backed by loyal consumer demand and global consistency. Investors continue to value the stock for its reliable dividend payouts and brand loyalty.

Global Reach and Market Resilience

McDonald’s stock benefits significantly from the company’s international presence. With over 40,000 locations spanning more than 100 countries, McDonald’s has built a business model that withstands regional economic downturns. While U.S. markets are stabilizing, emerging markets in Asia and Latin America are contributing to revenue growth. This global diversification adds a layer of security to McDonald’s stock that few competitors can match.

Digital Innovation and Functionality

One of the key factors driving confidence in McDonald’s stock is the company’s commitment to technology. From AI-powered drive-thrus and contactless payment systems to robust mobile ordering and loyalty rewards, McDonald’s is setting a high bar for digital convenience in the fast-food sector. These innovations not only streamline operations but also improve customer engagement, which in turn positively impacts the McDonald’s stock price.

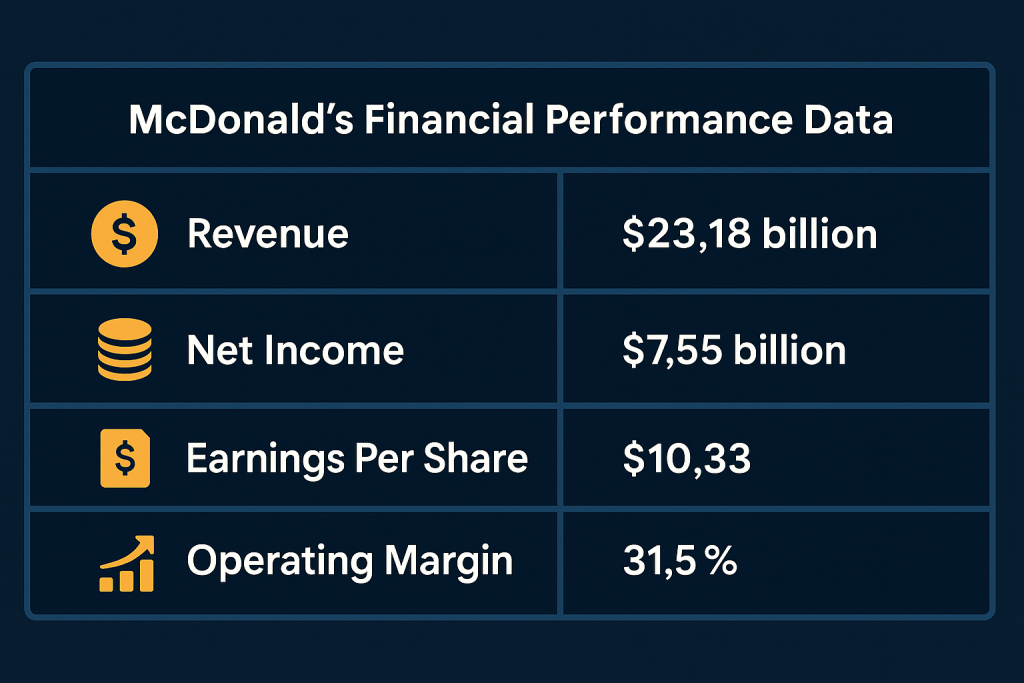

Financial Performance Highlights

| Metric | Value (as of April 2025) |

|---|---|

| P/E Ratio | ~22.5 |

| Dividend Yield | ~2.2% |

| EPS (TTM) | $10.88 |

| Revenue (Last FY) | $25.5 Billion |

| Operating Margin | 42% |

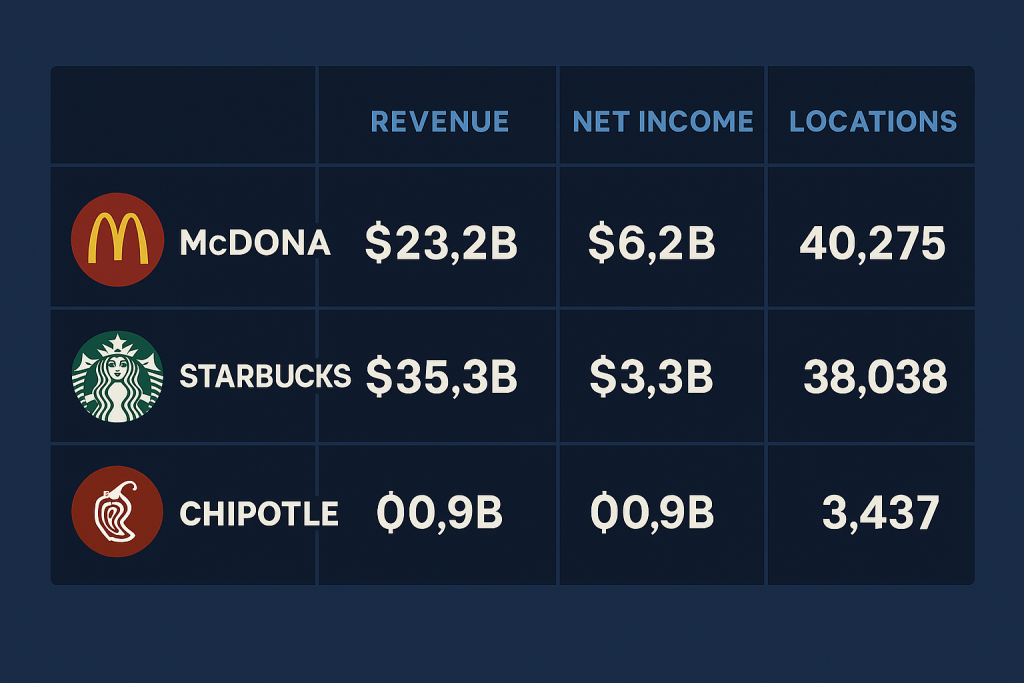

McDonald’s Stock Comparison

When stacking MCD stock against other restaurant titans, a few key points emerge. Let’s compare McDonald’s with Starbucks (SBUX) and Chipotle (CMG).

Industry Comparison Table

| Feature | McDonald’s (MCD) | Starbucks (SBUX) | Chipotle (CMG) |

|---|---|---|---|

| Dividend Yield | 2.2% | 2.0% | 0% |

| Global Stores | 40,000+ | 36,000+ | 3,400+ |

| Market Cap | $200B+ | $125B | $85B |

| Focus Market | Fast food | Coffee/beverage | Fast-casual |

| Price Sensitivity | Moderate | High | High |

This table makes it clear that McDonald’s shines with its dividend stability and sheer size, although it faces challenges in innovating as rapidly as some of its peers.

McDonald’s Stock Pros and Cons

Despite being a reliable performer, no stock is without trade-offs. Here’s a snapshot of McDonald’s stock strengths and setbacks:

| Pros | Cons |

|---|---|

| Global dominance and brand power | Slower growth than emerging competitors |

| Consistent dividend payouts | Sensitivity to input cost inflation |

| Resilient during downturns | Rising consumer pushback on pricing |

| Strong investment plan | Lower innovation pace than startups |

Conclusion

McDonald’s stock continues to be a reliable choice in the ever-changing restaurant and consumer services market. Its strong brand recognition, global footprint, and steady dividend payments make it appealing to long-term investors who value consistency. Despite facing challenges such as rising operational costs and shifting consumer spending habits, the company has managed to adapt through technology, streamlined operations, and strategic menu pricing.

For investors looking for a balanced mix of stability and moderate growth, McDonald’s stock stands out as a dependable option. It may not deliver the rapid gains of high-growth tech stocks, but it offers a level of resilience and predictability that many portfolios can benefit from. While it’s essential to keep an eye on market trends and how competitors are evolving, McDonald’s proactive strategies and international reach offer a cushion against localized setbacks.

In summary, McDonald’s stock is a solid pick for those seeking exposure to the food and beverage sector with lower volatility and reliable returns.

McDonald’s Stock Rating

Given recent challenges and enduring strengths, McDonald’s stock earns a 3 out of 5 stars.

“Why is Brinker stock climbing, while @McDonalds is struggling? Because of @Chilis It’s literally less expensive to have a sit down meal for less than the price of the combos at McD right now.”

FAQ

Is McDonald’s stock a sound long-term investment in today’s economy?

Yes. McDonald’s stock remains a strong option for long-term investors seeking stable exposure in the food and beverage industry. Its global presence, reliable dividends, and consistent performance make it a dependable component of conservative portfolios.

How does McDonald’s stock compare to other top investment options?

McDonald’s may not offer rapid growth like some tech stocks, but it provides strong dividend yields, defensive characteristics, and steady cash flow. It is well-suited for investors prioritizing income and long-term security.

Does inflation have a major impact on McDonald’s stock price?

Yes. Inflation raises costs for wages, food supplies, and utilities, which can reduce profit margins. While McDonald’s often offsets these costs with price increases, this can deter budget-conscious consumers. Its investment in automation, however, aims to lower operating costs over time.

Resources

- Google Finance. McDonald’s stock Overview

- McDonald’s Corporation. Stock Information

- CNBC. MCD Quote

- TradingView. MCD Chart Analysis

- YouTube. McDonald’s Stock Forecast

- Twitter. Brinker vs McDonald’s Price Commentary