The Digital Yuan, also known as e-CNY, is China’s Central Bank Digital Currency (CBDC) initiative that is poised to redefine the financial landscape. Developed by the People’s Bank of China (PBOC), the Digital Yuan aims to digitize cash and offer a state-controlled alternative to current technological payment systems like WeChat Pay and Alipay. With its potential to impact both domestic and global financial systems, understanding this digital currency is crucial for economists, businesses, and individuals interested in digital currencies. This review will explore the Digital Yuan’s features, functionality, competitors, pros and cons, pricing, and user expectations to help you understand its future implications.

What is the Digital Yuan?

The Digital Yuan, or e-CNY, is a digital form of China’s national currency, the Renminbi (RMB). Unlike decentralized cryptocurrencies like Bitcoin or Ethereum, which rely on blockchain networks, the Digital Yuan is centrally controlled by the People’s Bank of China (PBOC). The e-CNY aims to serve as a digital alternative to cash, enhancing payment efficiency, lowering transaction costs, and expanding financial access. Designed to complement cash and existing digital payment platforms, it seeks to strengthen China’s financial independence, improve the effectiveness of monetary policy, and decrease reliance on the US dollar for international trade.

Key Features

- Centralized vs. Decentralized Elements: The Digital Yuan is a fully centralized digital currency, managed by the People’s Bank of China (PBOC). Unlike decentralized cryptocurrencies, it does not use blockchain technology to achieve decentralization. Instead, this centralization allows the government to have complete oversight and control over monetary policy. The centralized approach also enables the tracking of transactions, ensuring compliance and security within the financial system.

- Offline Payments: A notable feature of the e-CNY is its capability to facilitate offline payments. Users can perform transactions without an internet connection, making the Digital Yuan accessible in remote areas or where internet access is unavailable. This innovation aims to increase financial inclusion and provide more options for users who may not always have access to online payment systems.

- Privacy and Anonymity: The Digital Yuan is not fully anonymous, but the PBOC plans to add privacy features for low-value transactions to replicate the anonymity of cash. However, for higher-value transactions, privacy is more restricted to comply with anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations. This balance aims to provide some level of user privacy while maintaining necessary oversight for regulatory purposes.

- Interoperability: The e-CNY integrates smoothly with existing digital payment systems like WeChat Pay and Alipay. This compatibility allows for seamless integration into China’s already established digital economy. There are also ongoing discussions about the potential cross-border use of the Digital Yuan, particularly in the context of China’s Belt and Road Initiative. Such developments could expand its use beyond domestic transactions and contribute to its adoption in international trade.

- Accessibility: This digital currency aims to be universally accessible to all residents in China, including those without access to traditional banking systems. This accessibility is crucial in promoting financial inclusion, especially in rural and underserved areas.

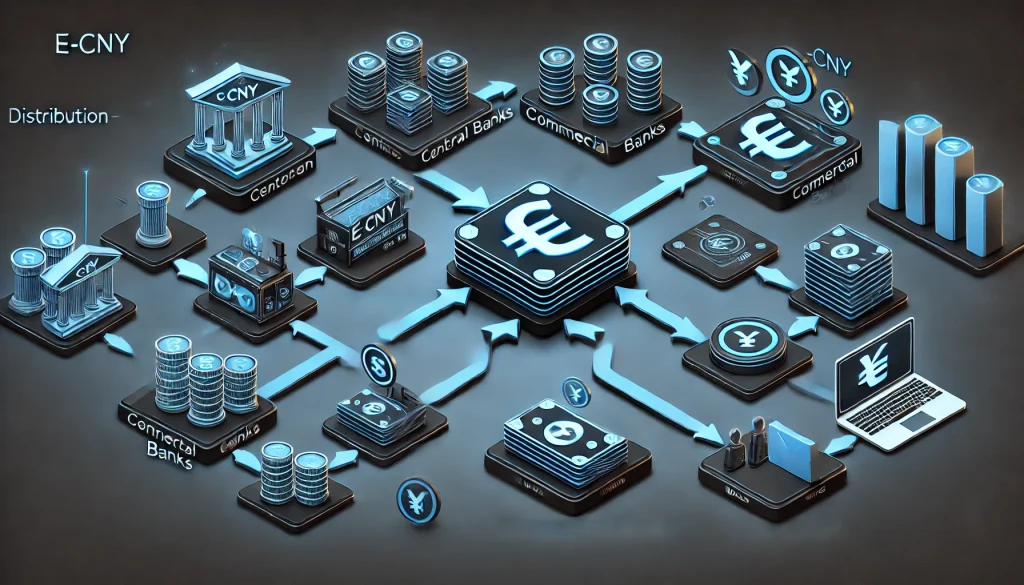

How Does the Digital Yuan Work?

The PBOC issues and regulates the Digital Yuan as a legal tender. It uses a two-tiered system where the central bank first distributes the currency to commercial banks and authorized entities, which then distribute it to the public. Users access the currency through digital wallets on smartphones or electronic devices, allowing them to make payments, transfers, and savings. Transactions can occur both online and offline, offering flexibility and convenience. The centralized nature of the e-CNY ensures regulatory compliance but also raises concerns about privacy and surveillance.

Pros & Cons

| Pros | Cons |

|---|---|

| Promotes financial inclusion and efficiency | Raises privacy and surveillance concerns |

| Reduces dependency on foreign digital payment systems | Potential negative impact on traditional banking models |

| Enhances cross-border trade potential | Could increase government control over financial transactions |

| Offers offline payment capabilities | Implementation and maintenance costs could be high |

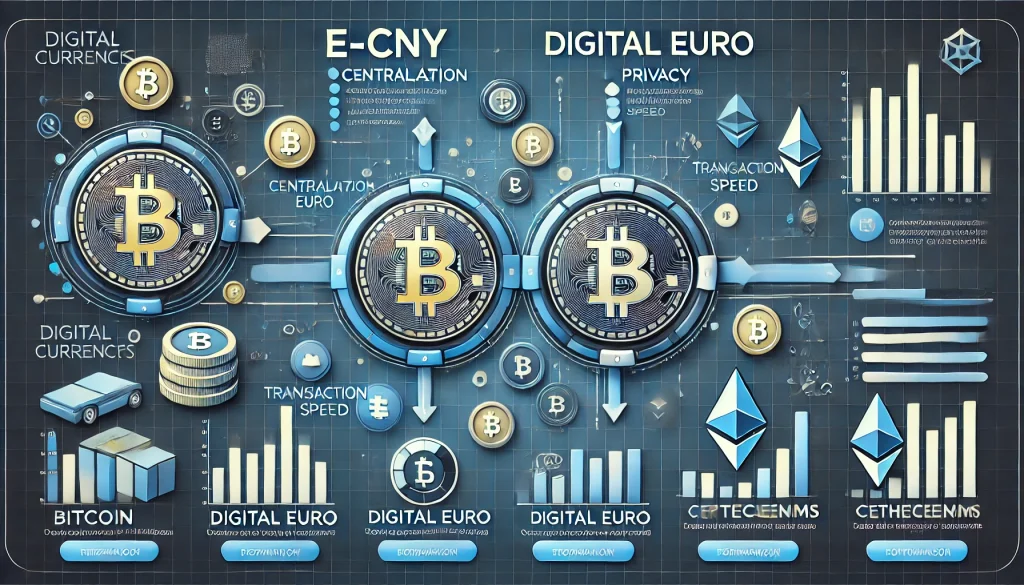

Competitors of the Digital Yuan

Digital Euro

The European Central Bank (ECB) is working on the Digital Euro, another CBDC aiming to provide a digital alternative to cash in the Eurozone. While both CBDCs share centralized control, the Digital Euro emphasizes data privacy more than the Digital Yuan, which prioritizes government oversight.

Digital Dollar

In the U.S., discussions are ongoing about the potential development of a Digital Dollar. Unlike the Digital Yuan, which is well into its pilot phase, the Digital Dollar remains conceptual. However, if implemented, it could directly challenge the Digital Yuan’s influence in global finance.

Cryptocurrencies (e.g., Bitcoin, Ethereum)

Unlike CBDCs, cryptocurrencies operate on decentralized networks, making them less susceptible to government control. However, their volatility and regulatory scrutiny limit their use as stable digital currencies compared to state-backed alternatives like the e-CNY.

Pricing and Value for Money

Implementing the Digital Yuan comes with costs related to technology infrastructure, regulatory compliance, and cybersecurity measures. These costs will likely be borne by the state, but they could indirectly affect taxpayers. The potential economic benefits, such as reduced transaction fees, greater payment efficiency, and enhanced financial stability, could offset these costs. Compared to private technological payment systems like WeChat Pay or Alipay, the e-CNY offers a state-backed alternative that ensures compliance and security, potentially providing better value for money in the long term.

User Reviews and Expectations

- Government Officials: Generally support the e-CNY as a tool for enhancing monetary policy control and promoting financial stability.

- Financial Experts: Some experts warn of potential risks, such as increased government surveillance and impacts on the banking sector’s profitability.

- General Public: The public has mixed opinions. While some citizens appreciate the potential for increased payment efficiency and reduced costs, others are concerned about privacy and government control.

Who Should Be Concerned About the Digital Yuan?

The Digital Yuan’s introduction will most impact:

- Banks and Financial Institutions: Must adapt to the CBDC and potentially reconfigure their business models to remain competitive.

- Businesses and Retailers: Will need to adjust their payment systems to accept the e-CNY, which could require investment in new technologies.

- Chinese Citizens: Will have to consider the implications of a state-controlled digital currency on their privacy and daily financial transactions.

Final Verdict: Is the Digital Yuan the Future of Money in China?

The Digital Yuan represents a bold move by China to digitize its currency and enhance control over its financial system. While it offers potential benefits, such as financial inclusion, efficiency, and enhanced regulatory control, it also raises concerns about privacy and the future of traditional banking. The Digital Yuan’s success will depend on how well it balances these benefits and drawbacks. Overall, it is a significant development in China’s economic landscape, but its broader impact will unfold in the coming years.

FAQs

What is the Digital Yuan and how is it different from Bitcoin?

The Digital Yuan, or e-CNY, is China’s technological currency, issued by the PBOC. It is centralized, unlike Bitcoin, which is decentralized. The e-CNY serves as a digital cash alternative, managed directly by China’s central bank.

How can I use the Digital Yuan?

You can use the Digital Yuan through technological wallets from banks or authorized platforms. It allows both online and offline transactions, similar to apps like Alipay.

What privacy concerns exist with the Digital Yuan?

It offers privacy for small transactions. Large transactions are monitored by the PBOC, raising concerns about user data and surveillance.

Resources

- CNBC. China’s Digital Yuan: What Is It and How Does It Work?

- Forbes. A 2024 Overview of the E-CNY: China’s Digital Yuan

- Investopedia. Understanding China’s Digital Yuan

- Asian Development Bank. The People’s Republic of China’s Digital Yuan: Its Environment, Design, and Implications

- Wired. China’s Digital Yuan Works Just Like Cash—With Surveillance