The world of cryptocurrency can be thrilling yet overwhelming, especially for those diving into the crypto market for the first time. With prices fluctuating every second and the ever-changing trends in Bitcoin and altcoins, staying ahead of the game demands time, expertise, and sometimes a bit of tech magic. Enter crypto trading bots—automated tools designed to analyze the market, execute trades, and (hopefully) maximize profits.

But are these bots truly worth the investment? Or are they just another shiny tool that falls short of expectations? In this blog, we’ll break down the pros and cons of 2024’s most popular trading bots, helping you decide if they’re the right fit for your blockchain trading strategy. Let’s dive in!

Overview

Crypto trading bots are essentially algorithms programmed to execute trades based on predefined rules. They monitor the coin market, identify trading opportunities, and act on your behalf. With automation at the core, these tools aim to eliminate emotional decision-making, allowing for precise and calculated moves even during the most volatile market conditions.

Key Features of Crypto Trading Bots:

- Automation: Execute trades 24/7 without human intervention.

- Customizable Strategies: Tailor strategies to match your trading goals.

- Market Analysis: Analyze vast amounts of market data within seconds.

- Backtesting Capabilities: Test strategies against historical data.

- Risk Management Tools: Incorporate stop-loss and take-profit mechanisms.

Pros and Cons of Trading bots

Let’s explore the highs and lows of using trading bots in a simple, easy-to-digest table:

| Pros | Cons |

|---|---|

| 24/7 market monitoring | Can be expensive to set up |

| Eliminates emotional trading | Requires technical knowledge |

| Offers customizable strategies | Vulnerable to technical glitches |

| Backtesting ensures reliability | Performance varies by market |

| Helps diversify portfolios | Not immune to scams |

While trading bots sound appealing, they’re no magic wand. It’s essential to weigh the benefits against the risks before diving in.\

In-Depth Analysis of Trading Bots

It promise efficiency and profitability, but how well do they deliver? Let’s analyze their performance across different dimensions.

Design and User Experience

The best trading bots of 2024 prioritize user-friendly interfaces, making them accessible to beginners and seasoned traders alike. Platforms like 3Commas and Pionex stand out for their sleek dashboards and clear tutorials, easing the steep learning curve that often accompanies these tools. However, some advanced bots, such as HaasOnline, can feel overwhelming due to their complexity, catering more to tech-savvy individuals.

Functionality and Features

Modern bots like Bitsgap and Cryptohopper are feature-packed, offering advanced tools such as arbitrage trading, smart portfolio management, and AI-driven insights. These features enable users to stay ahead of market trends and capitalize on fleeting opportunities. On the other hand, their dependency on API connections to exchanges sometimes leads to delays or errors in execution—something to watch out for.

Performance and Reliability

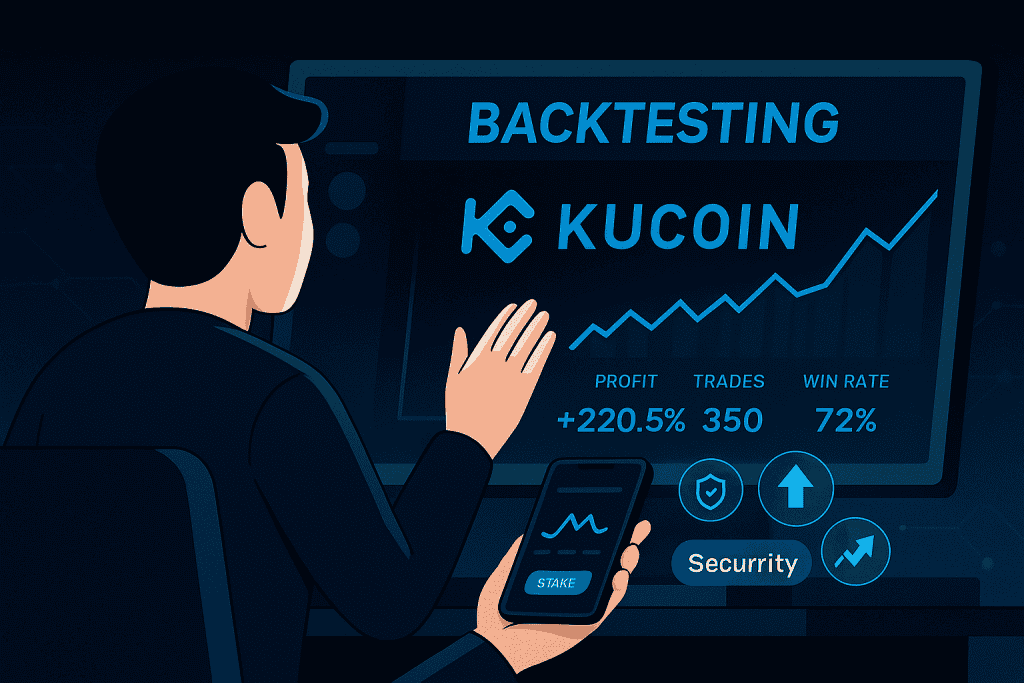

Performance is often hit-or-miss. Bots like KuCoin Trading Bot excel in predictable markets but struggle during extreme volatility. This variability underscores the importance of testing bots in different market conditions. Using backtesting tools can give you a better sense of their reliability.

Security and Trust

With rising concerns over hacking in the crypto market, choosing a bot with strong security measures is non-negotiable. Look for features like two-factor authentication (2FA) and encrypted API keys to protect your funds. Trusted names like Shrimpy and TradeSanta have established reputations, but always exercise caution and avoid bots with limited transparency.

Trading Bots Comparison

Let’s compare some of the top crypto trading bots to see how they stack up.

| Bot | Best For | Price | Key Features |

|---|---|---|---|

| 3Commas | Beginners & Experts | $29–$99/month | Smart trading terminals, portfolio tracking |

| Pionex | Free Users | Free | Built-in bots, no subscription fees |

| Bitsgap | Arbitrage Trading | $24–$149/month | Arbitrage tools, grid bot |

| Cryptohopper | AI Strategies | $16–$99/month | AI-based trading, backtesting tools |

| KuCoin Trading Bot | Exchange Users | Free | Built into KuCoin platform |

These bots cater to different needs, so your choice should depend on your trading goals, experience level, and budget.

Conclusion

If you’re just starting, try free or low-cost options like KuCoin’s Trading Bot to get a feel for automation. Advanced traders can explore premium bots for deeper customization. Whatever your choice, remember: bots are tools, not substitutes for solid strategies and vigilance.

This bot comparison by Bloom highlights the varying performance of different crypto trading bots in copy-trading and sniper strategies, reinforcing a key takeaway from our blog: not all bots perform equally, and their success depends on market conditions, strategy customization, and reliability. While automation offers efficiency, traders must carefully choose bots that align with their goals—whether prioritizing advanced AI strategies, ease of use, or security. As seen in the rankings, even top bots have strengths and weaknesses, making thorough research and testing essential before committing to a trading bot. Ultimately, while bots can enhance trading, they are tools to optimize strategy—not guaranteed profit machines.

Rating

We evaluated these crypto trading bots based on usability, features, performance, security, and overall reliability. Here’s how they rank:

Usability – ★★★★☆ (4.5/5)

Performance – ★★★★☆ (4/5)

Security– ★★★★☆ (4.5/5)

Overall reliability – ★★★★☆ (4/5)

Choosing the right trading bot depends on your strategy, risk tolerance, and experience. While these bots offer powerful automation, success still requires market awareness and smart decision-making.

FAQ

What are crypto trading bots?

Crypto trading bots are automated software tools that execute trades based on pre-programmed algorithms. They help traders save time and eliminate emotional decision-making.

Are trading bots suitable for beginners?

Yes! Many bots, like Pionex and 3Commas, offer beginner-friendly interfaces and pre-set strategies, making them a great starting point for newcomers to the blockchain world.

Do crypto trading bots guarantee profits?

No, trading bots don’t guarantee profits. They’re tools to optimize trading strategies, but factors like market conditions and bot reliability influence success.

Resources

- GoodCrypto. 10 Best Crypto Trading Bots for 2024.

- 3Commas. KuCoin Trading Bot.

- Software Testing Help. Best Crypto Trading Bots.

- YouTube. Crypto Trading Bots Explained.

- X. Trading Bot Insights.