The Bank of Japan Interest Rate has emerged as one of the most influential economic indicators in Asia and beyond. As central banks worldwide respond to inflation with aggressive tightening, Japan has chosen a markedly different path. This divergence has captured the attention of global markets, investors, and policymakers. Japan’s approach is deeply rooted in its prolonged battle with deflation, a stagnant economy, and demographic shifts such as an aging population. Its rate decisions ripple through currency markets, trade balances, and global investment flows.

This review explores the rationale behind Japan’s current interest rate policy, its broader economic implications, and the potential direction of future monetary actions. Whether you are a financial analyst, policymaker, or simply someone interested in global economics, understanding Japan’s unique stance offers valuable insights into how monetary policy can vary across regions, especially when faced with complex economic headwinds.

Overview of Bank of Japan Interest Rate

The Bank of Japan Interest Rate plays a defining role in shaping Japan’s broader monetary and financial environment. Unlike the more aggressive rate policies seen in the United States or the European Union, Japan has long adopted an ultra-low interest rate approach to counter its persistent battle with deflation and sluggish economic growth. Currently, the policy rate hovers just above zero, reflecting the central bank’s commitment to stimulating domestic spending and encouraging private sector borrowing.

What truly sets the Bank of Japan apart is its unique policy framework known as Yield Curve Control. Rather than focusing solely on short-term rates, the central bank manages long-term interest rates by targeting yields on 10-year Japanese government bonds. This allows the bank to influence not just overnight lending rates, but also longer-term borrowing conditions for corporations and consumers. The goal is to maintain financial conditions that support economic expansion without triggering inflation spikes.

Over the years, Japan’s reliance on this strategy has drawn both admiration and criticism. On one hand, it has helped maintain financial stability and low borrowing costs. On the other, critics argue that such prolonged accommodation risks distorting market behavior and weakening the effectiveness of monetary tools over time.

The Bank of Japan’s interest rate policy reflects its unique economic landscape, shaped by an aging population, modest wage growth, and global pressures. As the world pivots toward tightening, Japan remains cautiously patient, watching inflation trends closely while prioritizing steady, long-term growth over abrupt monetary shifts.

In-Depth Analysis of Bank of Japan Interest Rate

Japan’s approach to interest rates is deliberate and distinct. Let’s examine the depth behind its decisions.

Design and Strategy

The Bank of Japan’s policy design reflects a deep-rooted need to revive inflation and economic momentum in a low-growth environment. By targeting the yield on 10-year government bonds rather than just short-term interest rates, the central bank applies Yield Curve Control to shape broader financial conditions. This strategy keeps long-term borrowing costs stable, encouraging businesses to invest and households to spend without fear of rising loan costs. Moreover, it helps the government manage its massive public debt affordably. Yield Curve Control demonstrates a commitment to maintaining economic fluidity, especially when traditional rate policies lose impact due to already near-zero interest levels.

Functionality in Market Conditions

Amid a global inflation wave, Japan’s central bank faces unique challenges. Inflation has risen beyond 3.5 percent year-on-year, primarily due to external pressures like increased energy prices and a depreciated yen. Despite this, the Bank of Japan has resisted tightening policy aggressively. Officials argue that Japan’s inflation is cost-driven and not demand-led, so rate hikes could harm consumption and investment. Unlike Western economies, Japan’s growth remains fragile. Policymakers focus on nurturing recovery and achieving stable wage growth before altering the interest rate course. This response shows a nuanced understanding of local market dynamics, avoiding hasty actions that could reverse fragile economic gains.

Impact on Economic System

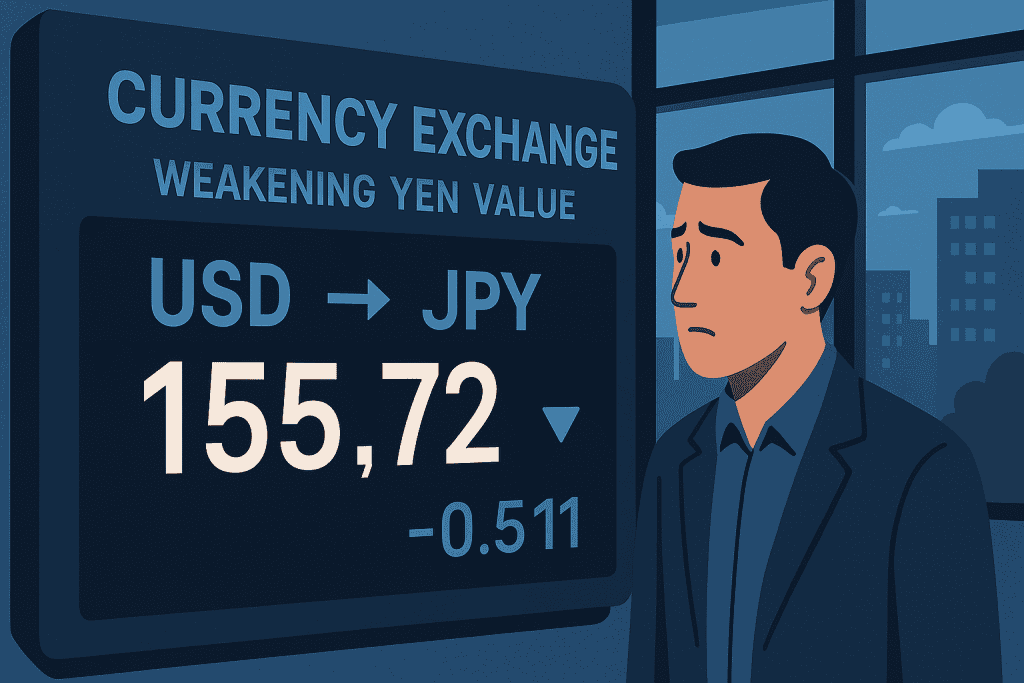

The Bank of Japan Interest Rate profoundly influences Japan’s economic engine. It determines how expensive it is to borrow for buying homes, expanding businesses, or funding infrastructure. Lower rates boost spending but weaken the yen, making imports costly. This helps export-led sectors thrive but puts pressure on households facing higher prices for essentials like food and fuel. The rate policy also affects asset prices, investor confidence, and long-term fiscal planning. As Japan navigates its demographic challenges and seeks sustained growth, the interest rate remains a balancing tool, constantly adjusted to meet changing internal and external demands.

Bank of Japan Interest Rate Comparison

Here’s how the BOJ stacks up against global peers:

| Feature | Bank of Japan | U.S. Federal Reserve | European Central Bank |

|---|---|---|---|

| Rate Level | ~0% | ~5.25% | ~4.5% |

| Inflation Target | 2% | 2% | 2% |

| Strategy | Yield Curve Control | Rate hikes | Balance sheet tapering |

| Market Focus | Yen stability | Employment and inflation | Eurozone stability |

Bank of Japan Interest Rate Pros and Cons

Understanding the impact requires examining both sides.

| Pros | Cons |

|---|---|

| Stimulates economic activity and investment | Weakens the yen, raising import costs |

| Keeps borrowing costs low for government and households | Reduces savings interest for consumers |

| Supports inflation targets in a deflationary context | Limits monetary policy flexibility in future downturns |

Conclusion

The Bank of Japan Interest Rate continues to reflect a deliberate and highly cautious monetary philosophy that prioritizes economic stability over abrupt reactions. While other central banks race to hike rates to curb inflation, Japan carefully assesses its domestic conditions before making any move. This strategy is rooted in years of dealing with deflation, demographic challenges, and subdued wage growth. The central bank understands that a hasty rate increase could stall fragile progress or trigger financial instability. Instead of making dramatic shifts, it fine-tunes its approach to align with evolving market signals and inflation data.

As external factors like oil prices and global tariffs add complexity, Japan’s steady hand offers a stabilizing influence in an unpredictable economic climate. The road ahead will require a nuanced balance between fostering growth and keeping inflation within manageable limits, but Japan’s current stance shows a clear commitment to long-term resilience and policy consistency.

Bank of Japan Interest Rate Rating

Japan’s economic policy remains cautiously strategic.

Japan’s core inflation surged to 3.5% in April, exceeding expectations and marking the highest in over two years. Driven by rising food and oil prices, this trend puts mounting pressure on the Bank of Japan to consider a rate hike by year-end despite lingering economic uncertainty.

Rating: 3.2 out of 5 stars

FAQs

What is the current Bank of Japan Interest Rate strategy?

The Bank of Japan Interest Rate strategy relies on Yield Curve Control to maintain low long-term interest rates. This helps promote growth and maintain inflation around the target level.

How does the Bank of Japan Interest Rate affect global markets?

Because of Japan’s economic influence and its large reserve holdings, any change in the Bank of Japan Interest Rate can shift global capital flows, currency exchange rates, and investor sentiment.

Why hasn’t the Bank of Japan increased interest rates aggressively like other countries?

The Bank of Japan Interest Rate policy stays low to support a fragile economic system and avoid sparking a market crash. Japan faces unique demographic and structural economic challenges.

Resources

- Nikkei Asia. Japan’s core inflation hits more than 2-year high

- Trading Economics. Japan Interest Rate

- Reuters. BOJ under pressure amid inflation

- Wall Street Journal. BOJ’s rate hike window narrowing

- Equals Money. BOJ Interest Rate Decision

- Investing.com. Interest Rate Decision Calendar