Moody’s Rating Scale is a standardized system used to assess the creditworthiness of borrowers, including corporations, governments, financial institutions, and debt securities. This scale communicates how likely a borrower is to meet its financial obligations (like paying interest and principal on time), based on a combination of quantitative and qualitative analysis.

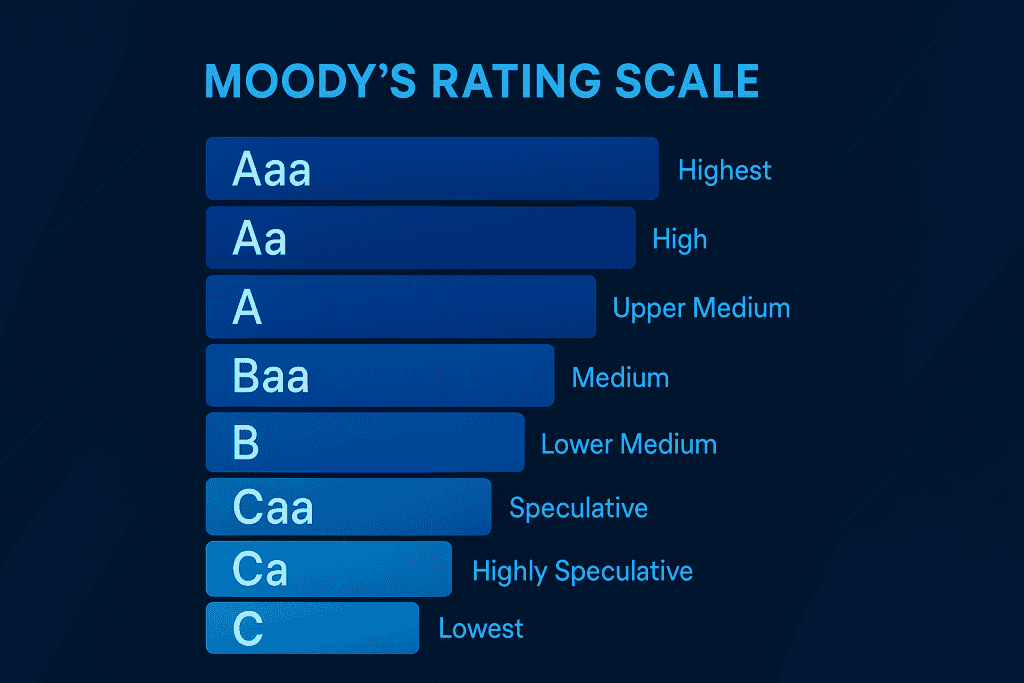

At its core, the scale assigns letter grades — from Aaa (highest credit quality) to C (lowest), with additional modifiers (1, 2, 3) to show finer distinctions between ratings. These ratings help investors and lenders evaluate risk before committing capital.

How Moody’s Rating Scale Works

Moody’s Ratings are determined by committees of analysts who evaluate financial statements, industry trends, economic conditions, and management quality. The result is a credit rating that reflects the probability that the borrower will meet its debt obligations.

The system has two primary categories:

- Long-Term Ratings: Applied to obligations with maturities over 11 months, spanning Aaa (highest quality) to C (lowest quality).

- Short-Term Ratings: For maturities of 13 months or less, using ratings like P-1, P-2, P-3, and NP (Not Prime) to indicate the ability to pay short-term debt.

The higher on the scale an entity sits, the stronger its capacity to repay. Investors use this insight to decide what types of debt are acceptable given their risk tolerance.

What Happened to Moody’s Rating Scale?

Recently, Moody’s made headlines by adjusting the credit ratings of several major economies and corporations. These changes signal shifting financial conditions and can influence everything from interest rates to stock market performance.

Moody’s assigns ratings ranging from Aaa (the best) to C (the worst), helping investors gauge the likelihood of a borrower repaying debt. When Moody’s upgrades a rating, it’s a positive signal—suggesting strong financial health. A downgrade, however, raises red flags, indicating potential financial struggles.

For example, a recent downgrade of a country’s credit rating could mean higher borrowing costs for its government, impacting businesses and everyday citizens.

When and Where?

These rating updates happen regularly as Moody’s assesses financial markets worldwide. Recent adjustments have focused on major economies like the U.S., China, and European nations, along with corporations in tech, banking, and real estate.

The timing of these updates is crucial. A downgrade during economic uncertainty can trigger panic, while an upgrade during recovery can boost investor confidence.

Who is Involved in Moody’s Rating Scale?

Moody’s Investors Service, a division of Moody’s Corporation, is the key player behind these ratings. Established in 1909, it has become a cornerstone of global finance.

Governments, corporations, and financial institutions closely follow Moody’s ratings, as they directly impact borrowing costs, investment decisions, and economic policies. Investors, both big and small, rely on these ratings to guide their financial choices.

Types of Moody’s Rating Scale

Moody’s uses several rating scales tailored to different kinds of debt or credit situations:

1. Global Long-Term Rating Scale

This is the main scale most people think of. It ranges from Aaa (highest credit quality, lowest risk) to C (typically default). Modifiers like 1, 2, and 3 narrow the grades within categories.

2. Short-Term Rating Scale

Designed for obligations with maturities of one year or less. Ratings like P-1 indicate superior short-term creditworthiness, while NP means the issuer doesn’t meet Prime criteria.

3. National Scale Ratings

In specific countries where the global scale may not provide sufficient granularity, Moody’s issues national scale ratings aligned to local market conventions.

4. Sector-Specific and Non-Credit Ratings

Moody’s also publishes sector-specific ratings (like bank financial strength, insurance financial strength, and municipal ratings) and non-credit risk scores unrelated to default risk.

Each type helps different stakeholders understand risk in highly specific contexts, from short-term commercial paper to long-term sovereign debt.

Why Moody’s Rating Scale Matters

Moody’s Rating Scale isn’t just about numbers—it affects real people. A downgrade of a country’s credit rating can lead to higher interest rates on government debt, which often trickles down to businesses and consumers through higher loan rates.

For businesses, a lower rating means they might struggle to secure funding, leading to potential job cuts or slowed growth. On the flip side, an upgrade can boost investor confidence, leading to lower borrowing costs and economic expansion.

For individual investors, these ratings serve as a guide. If you’re investing in bonds, you want to know how safe your investment is. Moody’s helps provide that clarity.

Uses of Moody’s Rating Scale

Moody’s Rating Scale has many practical uses in finance, investment, and economic decision-making. Here are the most important:

1. Assessing Credit Risk

The principal use is to help investors and financial institutions measure the risk that a borrower won’t meet future payments. A higher rating usually means lower perceived risk.

2. Determining Borrowing Costs

Borrowers with strong ratings (e.g., Aaa) typically pay lower interest rates because lenders view them as more reliable. Lower ratings often result in higher interest costs due to greater risk.

3. Portfolio and Risk Management

Institutional investors, such as pension funds and insurance companies, use Moody’s ratings to decide which bonds fit their risk profile and comply with regulatory limits on holdings.

4. Regulatory Frameworks

Banks and financial firms often rely on credit ratings for regulatory capital requirements and stress testing. Many banking rules require certain minimum ratings to qualify for favorable treatment.

5. Influence on Markets and Policy

Changes in credit ratings — especially for sovereigns — can signal economic trends and affect everything from government bond yields to national fiscal policies. Recent sovereign updates have had broad market impacts.

Quotes or Statements about Moody’s Rating Scale

Moody’s recently commented on its rating adjustments, stating:

“Our decisions reflect evolving economic conditions and financial stability risks. While some markets remain resilient, others face growing fiscal pressures.”

Financial analysts also weighed in, with one expert noting:

“A downgrade isn’t just a technical change—it can shake markets and influence policy decisions at the highest levels.”

Conclusion

Moody’s Rating Scale plays a vital role in shaping the financial landscape. Whether you’re a government planning economic policy, a corporation seeking investment, or an individual looking for a safe investment, these ratings matter.

As financial markets evolve, expect more shifts in Moody’s ratings. Staying informed about these changes can help you make smarter financial decisions and navigate the complexities of the global economy.

What do you think? Have you ever made an investment decision based on a credit rating? Let’s discuss in the comments!

Resources

- Financial Edge Training- Moody’s – Definition, How it Works, Credit Ratings Scale

- Moneyland- S&P, Moody’s, Fitch Rating Comparison

- Wolf Street- Corporate Bond Credit Ratings Scales: Moody’s, S&P, Fitch

- Investopedia- Credit Rating: Definition and Importance to Investors

- State of Idaho- Moody’s Rating Symbols & Definitions