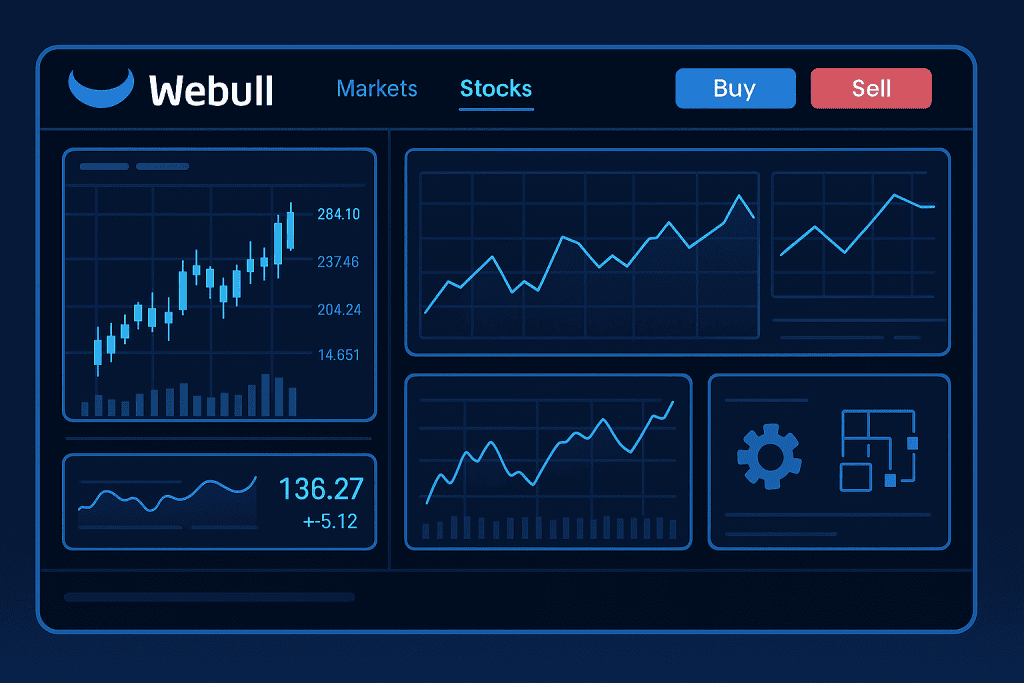

Diving into the dynamic world of Webull Stock within economic analysis is not just for Wall Street insiders. It’s an exciting, accessible way for individual investors and enthusiasts to sharpen their trading strategies and take control of their financial futures. Whether you’re a seasoned trader or a curious beginner, learning how to analyze and trade equities on Webull opens up new possibilities. With its sleek interface and robust tools, Webull Stock offers opportunities to craft winning strategies and make informed decisions.

Moreover, this platform democratizes access to trading by providing high-level tools without the hefty price tag often seen elsewhere. You’re no longer dependent on financial advisors or big institutions; you can explore your own investment plan and make decisions that match your goals. The best part? With some practice and patience, you can feel just as confident navigating markets as seasoned traders.

Webull Stock Materials or Tools Needed

To confidently navigate Webull Stock, you need some key essentials. Below is a brief overview of what you’ll want at your fingertips.

| Tools/Materials | Purpose |

|---|---|

| Webull App/Desktop Platform | Main interface for trading and analysis |

| Reliable Internet Connection | Ensures smooth real-time data updates |

| Trading Account with Webull | Allows access to market features |

| Watchlist Setup | Helps monitor chosen equities efficiently |

| Economic News Sources | Keeps you informed on market-moving events |

Without these, even the best trading strategies can fall flat. Make sure your setup is reliable, especially your internet, as delayed data can mean missed opportunities! Having a robust system also reduces stress, allowing you to focus on refining your trading strategies and understanding the market pulse.

Webull Stock Instructions

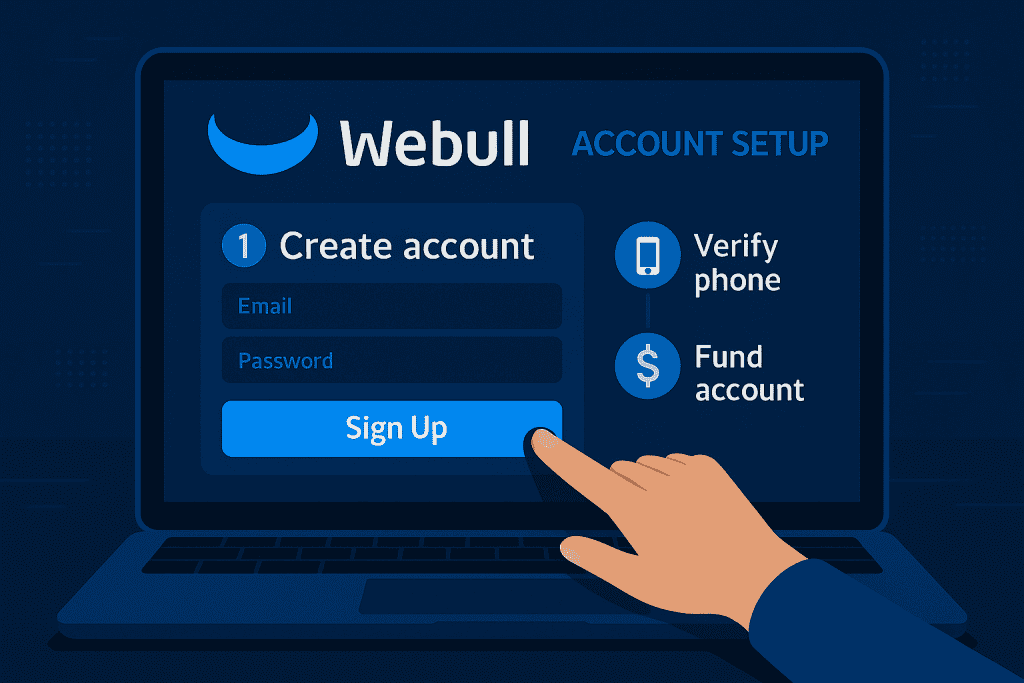

Step 1: Set Up Your Webull Account

Start by downloading the Webull app or accessing its desktop version. Registration is straightforward, but you’ll need to verify your identity, which usually takes just a few minutes. Once set up, explore the dashboard, familiarize yourself with the menus, and personalize your watchlists. This is your command center, and knowing your way around matters.

Take a few minutes to explore the demo videos or tutorials Webull offers. They can provide insights into lesser-known features and shortcuts. By investing time upfront, you set yourself up for a smoother trading experience down the line.

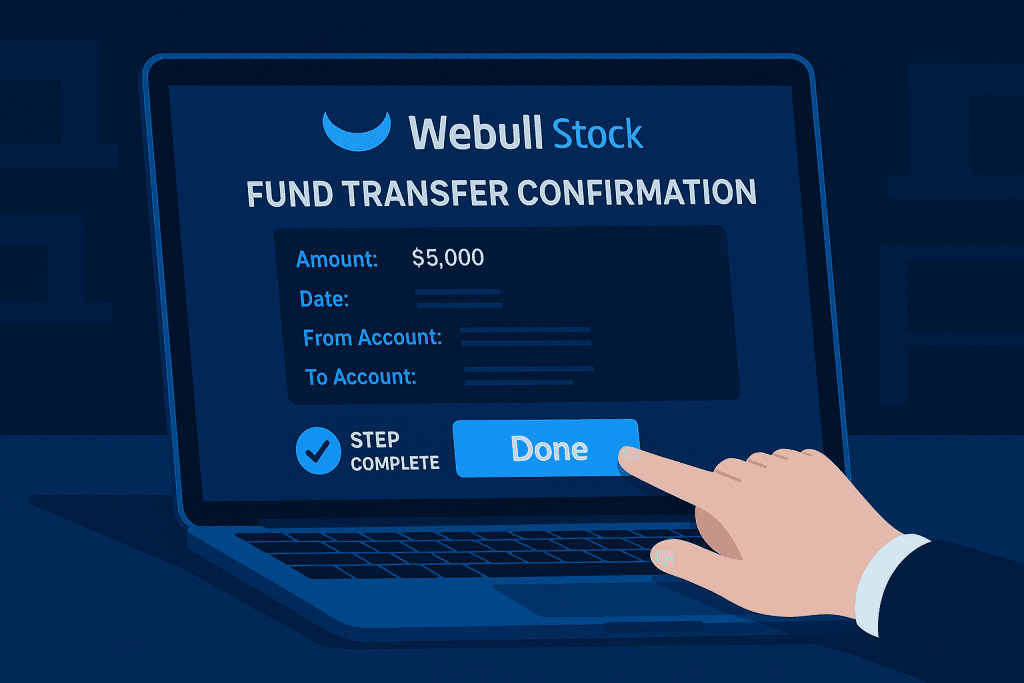

Step 2: Fund Your Trading Account

Before you can trade, you need funds. Link your bank account securely within Webull’s platform and transfer your initial deposit. Webull often offers free stock bonuses for initial deposits—an exciting little perk! Once funded, you can test out paper trading (simulated trading) to practice without risking real cash.

Remember, patience pays here. While it’s tempting to jump into real trades, practicing on the paper trading platform lets you experiment with strategies and understand the platform’s nuances without financial risk.

Step 3: Research and Select Equities

Here’s where your economic analysis skills shine. Use Webull’s built-in screeners, advanced charts, and news feeds to analyze companies. Pay attention to metrics like P/E ratios, EPS, and dividend yields. Look for companies with solid fundamentals or emerging trends.

You might also explore sectors aligned with your interests. Are you passionate about green energy, or intrigued by tech startups? Aligning investments with your interests often keeps you more engaged and motivated to learn. This is where terms like Best Stocks to Buy and Investment Plan naturally enter the conversation—align your picks with these ideas.

Step 4: Place Your First Trade

Exciting, right? To buy or sell, navigate to your chosen stock’s page, tap ‘Trade,’ and input your desired share quantity and price. You can choose between market orders, limit orders, or stop-loss setups. Double-check everything before hitting confirm—you want precision here.

Also, consider starting small. Begin with fractional shares if you’re hesitant to commit larger amounts. This way, you gain practical experience and insights without overexposing your portfolio to risk.

Step 5: Monitor and Adjust Positions

After executing your trade, the journey isn’t over. Use Webull’s real-time tracking tools to watch your positions. Set up alerts for price changes or news events that could impact your stock. Consider applying Trading Strategies such as trailing stops or scaling into positions as you gain confidence.

It’s smart to keep a trading journal where you log the reasoning behind each trade. Over time, this record becomes a treasure trove of personal insights, helping you recognize patterns and avoid repeating past mistakes.

Step 6: Review Performance

Consistent review is key. Dive into your portfolio’s performance reports, assess gains and losses, and identify patterns. Did certain strategies work better? Were there missed opportunities? Reflection sharpens your edge.

Additionally, revisit your original investment plan regularly. Are your goals still the same? Has your risk tolerance changed? Adapting as your experience grows ensures your trading approach evolves effectively.

Step 7: Keep Learning and Evolving

The market is always shifting, and so should you. Explore Webull’s learning center, webinars, and community forums. Stay updated with the latest economic news and adjust your strategies to remain competitive.

Engage with other traders online. Reading shared experiences, strategies, and even failures can give you valuable perspectives. Learning is a lifelong journey in trading, and staying curious is your best asset.

Webull Stock Tips and Warnings

Here’s where seasoned traders whisper their best advice:

| Tips | Warnings |

|---|---|

| Start with paper trading to gain confidence | Don’t trade based on hype or rumors |

| Diversify your portfolio to manage risk | Avoid over-leveraging or chasing losses |

| Use stop-loss orders to protect investments | Beware of emotional decision-making |

Another tip? Set realistic expectations. While some days will bring wins, others may bring losses. Understanding that the journey is long-term helps you stay level-headed and avoid knee-jerk reactions that could derail your portfolio.

Conclusion

Mastering Webull Stock is a journey filled with discovery, growth, and occasional surprises. With the right tools, a thoughtful approach, and a willingness to learn, you can navigate the trading world confidently. So, why wait? Dive in, test your strategies, and embrace the thrill of economic analysis in action!

Remember, no one becomes an expert overnight. The key is to remain consistent, stay informed, and never stop refining your approach. Over time, your confidence will grow, and so will your trading acumen.

FAQs

What makes Webull Stock a good platform for economic analysis?

Webull Stock shines with its advanced charting tools, real-time data, and deep analytic features, making it ideal for both new and seasoned investors in economic analysis. Its user-friendly interface lowers the entry barrier for beginners while providing sophisticated tools for pros.

How can I create a successful investment plan on Webull Stock?

Start by defining your financial goals, selecting equities that align with those goals, and applying tested trading strategies. Regularly reviewing performance helps fine-tune your investment plan. Make sure your plan includes diversification and clear risk management strategies.

Are there specific trading strategies recommended for Webull Stock users?

Yes! Strategies like dollar-cost averaging, swing trading, and setting stop-loss orders work well. Customize these to your risk tolerance and market insights for the best results. Always keep learning from your results and stay adaptable to changing market conditions.

Resources

- Webull Help Center. How to Buy Stocks on Webull

- Webull. Official Site

- BrokerChooser. Webull Stocks Review

- YouTube. Webull Stocks Trading Tutorial

- Twitter. Webull Global Update