If you’ve ever watched headlines swing wildly over digital coins and wondered what’s really going on behind the scenes, you’re not alone. Learning how to evaluate Virtual Currency within the category of Economic Analysis isn’t just for tech geeks or Wall Street pros anymore. It’s becoming a practical skill for investors, analysts, and anyone curious about where money is heading next.

I remember the first time I tried to understand the sudden surge in a well-known coin’s price. I stared at charts for hours, thinking I needed complex formulas. In reality, what I needed was a simple framework. Once I understood how Virtual Currency interacts with supply, demand, regulation, and the broader Economic System, the chaos started to make sense.

Analyzing Virtual Currency helps you avoid blind speculation. It strengthens your investment plan, sharpens your awareness of risk, and helps you spot patterns before they hit mainstream headlines. Whether you’re an aspiring analyst or simply crypto-curious, this guide will walk you through the process step by step.

Tools Needed

Before diving into Virtual Currency analysis, you need a few essentials. The good news is that you don’t need expensive software or a finance degree. Most tools are accessible online.

You’ll need a reliable internet connection, access to reputable financial news sites, a portfolio tracking app, and basic spreadsheet software. It also helps to understand fundamental economic indicators like inflation rates and monetary policy updates.

Here’s a quick overview:

| Tool/Material | Purpose | Why It Matters |

|---|---|---|

| Financial News Platforms | Track market updates | Understand real-time movements |

| Cryptocurrency Data Sites | Monitor price and volume | Analyze trends in Virtual Currency |

| Spreadsheet Software | Record and compare data | Identify long-term patterns |

| Economic Reports | Study policy impacts | See how Virtual Currency fits into the broader Economic System |

| Portfolio Tracker | Manage holdings | Support your long-term investment plan |

These tools give structure to what can otherwise feel like digital noise.

Virtual Currency Instructions

Step 1: Understand the Purpose Behind the Virtual Currency

Start by asking a simple question: why does this Virtual Currency exist? Some coins aim to speed up cross-border payments. Others focus on privacy or smart contracts. Without understanding its purpose, analyzing price movements is like judging a book by a single sentence.

Look at the whitepaper. Read the project’s official site. Explore how it claims to fit into the larger Economic Analysis landscape. When I first did this, I realized many coins were solving very different problems. That clarity changed how I viewed their potential value.

Include screenshots of official project roadmaps or supply models if you’re documenting your research.

Step 2: Study Supply and Demand Dynamics

Virtual Currency prices are heavily influenced by supply mechanics. Is the coin capped like Bitcoin? Is it inflationary? Are new tokens released regularly?

Now look at demand. Who is actually using it? Retail investors? Institutions? Developers?

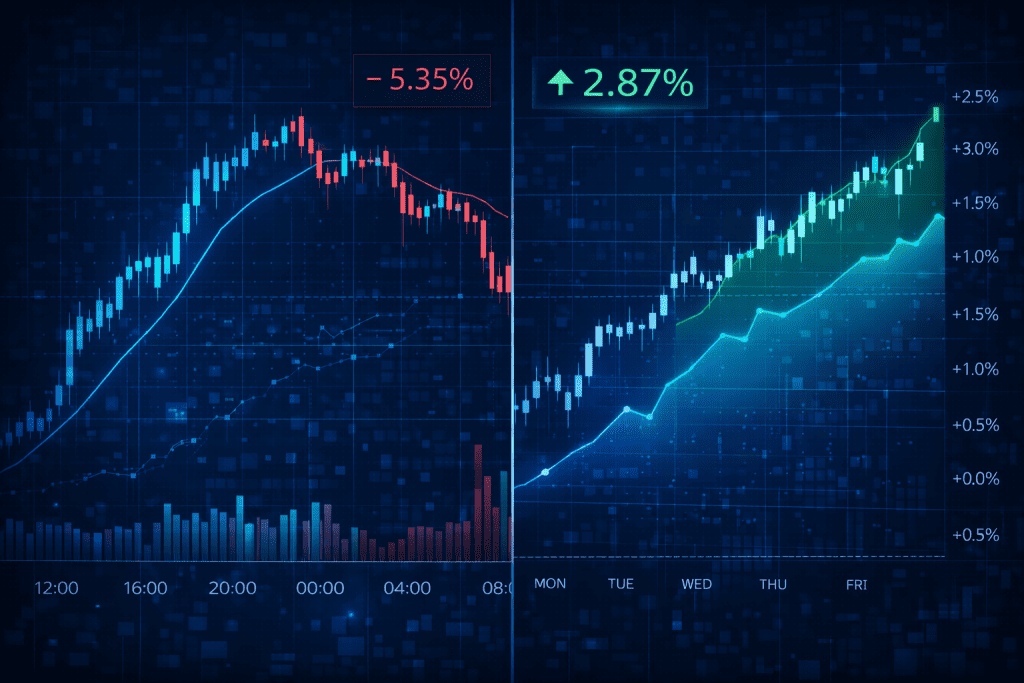

Supply shocks can trigger rapid price swings. During a sudden market crash, currencies with weak demand foundations often drop hardest. Understanding this balance is essential for sound Economic Analysis and smarter decision-making.

Step 3: Analyze Market Sentiment and News

News can move Virtual Currency prices faster than traditional assets. Regulatory announcements, exchange hacks, or government bans can all create volatility.

Track social sentiment but don’t rely on hype. When headlines promise overnight riches, pause. Compare that noise with real economic indicators. Over time, you’ll notice patterns. Sentiment spikes often precede corrections.

This is where disciplined trading strategies become important. Emotional reactions rarely end well.

Step 4: Compare with Traditional Assets

One useful method in Economic Analysis is comparison. How does Virtual Currency behave compared to gold, bonds, or the Best stocks to buy during similar economic events?

During inflationary periods, some investors treat Virtual Currency as a hedge. In uncertain times, correlations shift. Watching these relationships gives you insight into how digital assets fit into the global Economic System.

When I started comparing charts side by side, I stopped seeing crypto as isolated. It became part of a bigger financial story.

Step 5: Evaluate Long-Term Viability

Finally, zoom out. Short-term spikes are exciting, but sustainability matters more. Does the development team continue building? Are partnerships forming? Is adoption increasing?

This is where patience pays off. A strong Virtual Currency project shows growth in usage, not just price. Solid fundamentals often outlast hype cycles.

Economic Analysis is about patterns over time, not daily noise.

Virtual Currency Tips and Warnings

Analyzing Virtual Currency can feel thrilling. The 24/7 market never sleeps, and dramatic price swings can tempt you into impulsive decisions. But steady discipline wins more often than emotional excitement.

First, always verify your sources. Not every online article is credible. Stick to established financial platforms and research-based sites.

Second, separate long-term analysis from short-term speculation. A clear investment plan protects you from reacting to every dip or rally.

Third, prepare for volatility. Even strong projects can experience sharp downturns during a market crash. This doesn’t always signal failure. Sometimes it reflects broader economic pressure within the Economic System.

Here’s a quick reference:

| Tip | Why It Helps | Common Mistake to Avoid |

|---|---|---|

| Diversify holdings | Reduces risk exposure | Putting all funds into one Virtual Currency |

| Set entry and exit points | Supports structured trading strategies | Emotional buying during hype |

| Monitor regulation updates | Impacts market stability | Ignoring government policy shifts |

| Track adoption metrics | Signals long-term value | Focusing only on daily price changes |

| Review quarterly | Keeps your Economic Analysis fresh | Reacting to every rumor |

One personal lesson: early on, I chased a trending coin without researching its use case. Within weeks, interest faded. That experience taught me patience. Virtual Currency rewards thoughtful analysis, not speed.

Conclusion

Learning how to analyze Virtual Currency through Economic Analysis may seem complex at first, but it becomes manageable once you follow a clear framework. Start by understanding the purpose behind the currency. Study supply and demand. Watch sentiment and regulation. Compare performance against traditional assets. Then zoom out and evaluate long-term sustainability.

With the right tools and a disciplined mindset, Virtual Currency analysis shifts from overwhelming to empowering. You don’t need to predict every movement. You just need to make informed decisions based on evidence and structure.

Take your time. Start small. Practice analyzing one currency thoroughly before expanding. The more you observe patterns, the more confident you’ll feel navigating this evolving financial space.

FAQ

How does Virtual Currency impact the Economic System in long-term economic analysis?

Virtual Currency can influence the Economic System by introducing decentralized transaction methods, altering cross-border payment efficiency, and challenging traditional banking models. In long-term Economic Analysis, experts examine adoption rates, regulatory integration, and whether Virtual Currency functions as a store of value or speculative asset. Its true impact depends on scalability and institutional acceptance.

What is the best way to include Virtual Currency in a diversified investment plan within Economic Analysis?

To include Virtual Currency in a diversified investment plan, allocate only a portion of your portfolio based on risk tolerance. Economic Analysis suggests balancing digital assets with equities, bonds, or even the Best stocks to buy during stable cycles. Diversification reduces exposure to volatility while allowing potential upside from innovation.

How do market crash scenarios affect Virtual Currency trading strategies in Economic Analysis?

During a market crash, Virtual Currency often experiences intensified volatility. Effective trading strategies involve setting stop-loss levels, maintaining liquidity, and analyzing macroeconomic indicators. In Economic Analysis, crash periods also reveal which projects have strong fundamentals versus those driven by speculation.

Resources

- Forbes Advisor. What Is Digital Currency?

- DIGI Watch. Cryptocurrencies Overview

- N5 Now Blog. Dinero Virtual Explained

- Investopedia. Virtual Currency Definition

- Vantage Markets Academy. Digital Currency Guide