Tracking the TSX Index is like getting a front-row seat to the economic pulse of Canada. Whether you’re a seasoned investor or an economic analyst, learning how to interpret the TSX Index can offer valuable insights into market performance. This index is a benchmark that reflects the strength and direction of the Canadian equity market. By understanding its trends, you can make smarter decisions, develop a strategic investment plan, and even identify the best stocks to buy. So, whether you’re researching macroeconomic conditions or crafting financial strategies, knowing how to analyze the TSX Index is a must.

TSX Index Materials or Tools Needed

To effectively evaluate the TSX Index and draw meaningful conclusions about Canadian market trends, a few essential tools and resources can make a big difference. First, reliable internet access is a must. It connects you to real-time data, market reports, and expert analysis. Platforms like TMX Money and Bloomberg are critical for accessing up-to-date TSX Index figures, sector breakdowns, and interactive charts. These sites offer data-driven insights that help you understand market movement over time.

Next, spreadsheet tools such as Excel or Google Sheets are highly recommended. They allow you to track and analyze historical data, calculate moving averages, and build simple models for trend forecasting. Using Google Finance, you can also monitor stock performance and compare it with index trends directly from your spreadsheet.

Understanding economic indicators is key as well. Knowing how inflation rates, GDP growth, and central bank decisions affect the TSX Index can add depth to your analysis. Watching explainer videos like this on YouTube provides visual context and simplifies complex concepts. Lastly, financial news websites keep you informed on breaking developments that influence market behavior. Together, these tools form the backbone of a smart and proactive TSX Index analysis strategy.

| Tool/Resource | Purpose |

|---|---|

| TMX Money or Bloomberg | Real-time TSX Index data |

| Google Finance | Portfolio tracking |

| Excel/Google Sheets | Data analysis and charting |

| YouTube Video | Visual guide to TSX concepts |

| Financial News Sites | Market updates and expert opinions |

TSX Index Instructions

Step 1: Access a Reliable Data Source

Start by visiting authoritative financial platforms such as TMX Money or Bloomberg. These websites provide real-time updates on the TSX Index, including opening and closing figures, daily percentage changes, and interactive charts. The accuracy and timeliness of this data are crucial when analyzing short-term trends or comparing recent activity. Reliable sources also offer filters to explore specific timeframes and company details within the index, ensuring a comprehensive overview.

Step 2: Interpret the Historical Chart

Use the historical chart features to view the TSX Index over various periods such as one day, one month, or several years. Observing long-term performance helps identify patterns like market corrections, recoveries, or prolonged rallies. For instance, a sharp dip could indicate a reaction to global economic news, while gradual growth may reflect strong domestic fundamentals. Historical context is essential when forecasting future movements or assessing current valuations.

Step 3: Compare Sector Performance

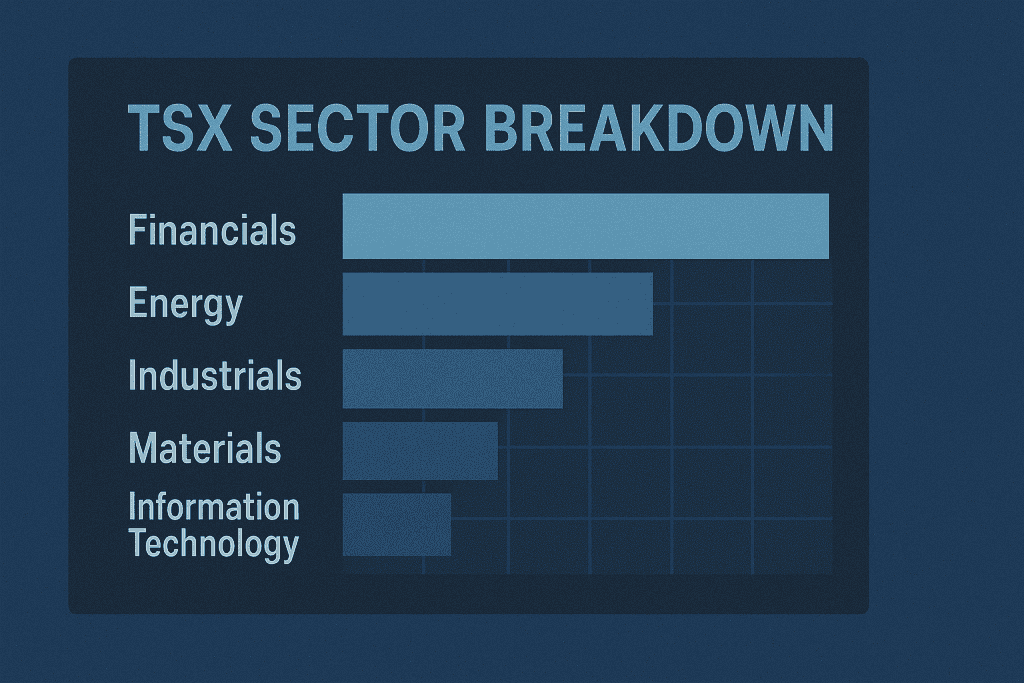

Dive into individual sectors within the TSX Index such as Energy, Financials, Technology, and Healthcare. Evaluate which sectors are leading and which are lagging by reviewing performance metrics and weightings. This insight helps investors allocate funds more effectively based on market momentum. For example, strong growth in the Financials sector might suggest favorable interest rate conditions, prompting further investigation into bank stocks and related assets.

Step 4: Watch Economic Indicators

Keep a close watch on macroeconomic indicators that directly influence the TSX Index. These include interest rates set by the Bank of Canada, inflation levels, unemployment rates, and GDP growth. These factors often trigger shifts in investor sentiment and can lead to sector-specific gains or losses. A rise in interest rates might pressure growth stocks but benefit Financials, while commodity price movements can impact Energy and Materials stocks significantly.

Step 5: Use Technical Tools

Leverage technical analysis tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to spot market trends. These indicators help you identify potential entry or exit points by revealing overbought or oversold conditions. A 50-day moving average crossing above a 200-day average often signals bullish momentum. Such tools add a layer of objectivity and can balance emotions in decision-making.

TSX Index Tips and Warnings

Tips for Success

- Always correlate index movement with major news events

- Diversify your research across sectors

- Use watchlists and alerts to track specific stocks or changes

Warnings to Watch For

- Avoid making decisions based solely on daily fluctuations

- Don’t ignore broader market indicators like the S&P 500 or global trends

- Watch for false breakouts when using technical tools

Conclusion

Understanding the TSX Index is like having a window into Canada’s economic landscape. It reflects the collective performance of major publicly traded companies and serves as a reliable barometer for investors, economists, and policymakers. By studying its trends over time and comparing sector performances, you can gain strategic insights into where the economy is headed and which industries are gaining momentum. From a practical standpoint, this knowledge allows you to build a more informed and balanced investment plan, especially when combined with tools like historical charts, economic indicators, and technical analysis.

The power of a passive index fund that tracks the TSX was recently underscored in a social media post highlighting that it outperformed the Canada Pension Plan for 2024, returning 21 percent with no fees compared to 14.2 percent from the actively managed fund. This stark difference raises essential questions about the value of high-fee management in today’s data-rich, tool-friendly investment landscape. As market accessibility improves, so too does the opportunity for everyday investors to make educated, low-cost decisions using resources that were once exclusive to financial professionals.

FAQ

What is the TSX Index and why is it important in economic analysis?

The TSX Index, officially known as the S&P/TSX Composite Index, represents the performance of the largest companies listed on the Toronto Stock Exchange. In economic analysis, it acts as a barometer of Canada’s financial health. Analysts and investors use it to gauge economic trends and investment opportunities.

How does the TSX Index help in forming an investment plan?

Understanding the TSX Index allows investors to identify high-performing sectors and time their entries or exits in the market. It’s especially useful in long-term financial planning, where sector performance and historical trends guide asset allocation and diversification strategies.

What external factors influence the TSX Index in Canada’s economy?

Several elements impact the TSX Index, including commodity prices (like oil and gold), interest rates, political stability, and global economic developments. These variables can significantly sway market sentiment and valuation of key sectors in the Canadian economy.

Resources

- TMX. TSX Index Overview

- Bloomberg. S&P/TSX Composite Index

- Pique News. Market Movement Analysis

- S&P Global. TSX Composite Overview

- Trading Economics. Canada Stock Market Data

- Burnaby Now. Debt Worry Market Reactions