Investing in the stock market often feels unpredictable. The wide range of choices can make it hard to decide where to place your money, especially if you seek long-term growth and stability. Moody’s Corporation (MCO) frequently appears on lists of top investment picks. But is it a smart choice for your portfolio, or just another name driven by current trends? To answer that, you need to understand how the stock performs and whether it matches your financial goals and risk tolerance.

Whether you are a seasoned investor or just starting out, evaluating a company like Moody’s requires careful analysis. You need to consider its financial health, business model, industry position, and growth outlook. By reviewing these factors, you can decide if MCO fits your investment strategy. In this article, we will explore those elements to help you make a clear, informed decision.

Materials or Tools Needed

Before diving into stock analysis, you’ll need the right tools to track MCO’s performance effectively.

| Tool/Resource | Purpose |

|---|---|

| Stock Market Apps (e.g., Yahoo Finance, Bloomberg) | Track real-time prices, news, and historical trends |

| Company Reports (Moody’s 10-K, 10-Q filings) | Analyze revenue, earnings, and financial health |

| Investment Research Platforms (Morningstar, Seeking Alpha) | Get expert insights and ratings on MCO stock |

| Technical Indicators (Moving Averages, RSI) | Evaluate market trends and momentum |

Having access to these tools can help you make data-driven decisions when analyzing MCO stock.

Step-by-Step Instructions to Analyze MCO Stock

Step 1: Review Moody’s Business Model & Revenue Streams

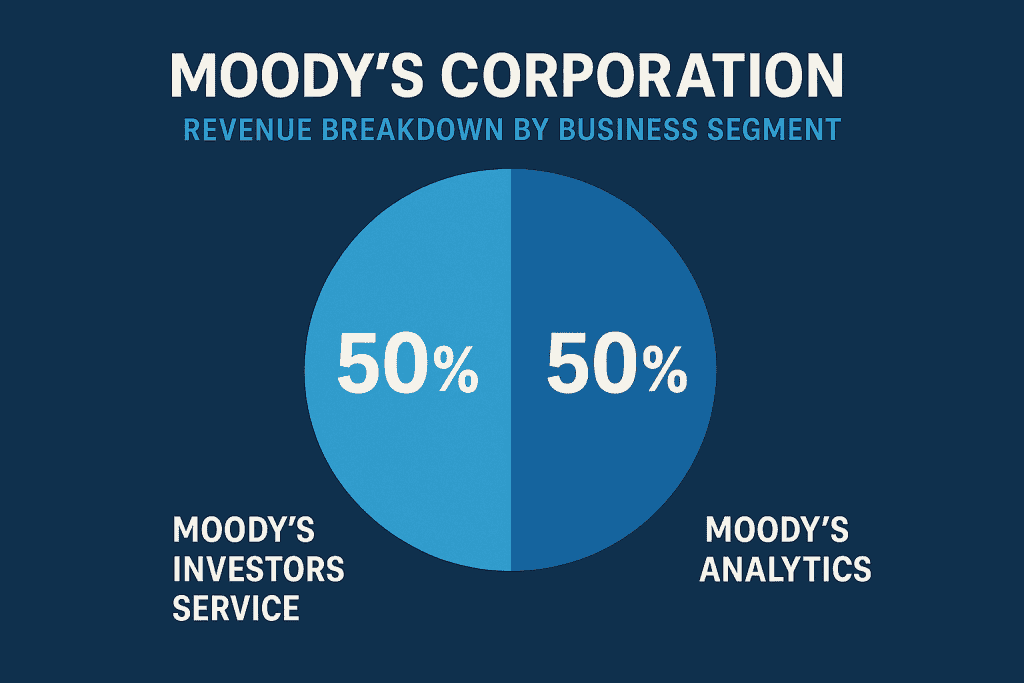

Moody’s Corporation is a leading entity in the fields of credit ratings, risk management, and financial analytics. Gaining a clear understanding of its revenue sources is essential for evaluating its long-term growth potential.

- Moody’s Investors Service (MIS): Provides credit ratings for bonds and companies, earning fees from issuers.

- Moody’s Analytics (MA): Offers risk management software, financial data, and advisory services to businesses.

Since credit ratings are essential for global finance, Moody’s enjoys a stable revenue stream even during economic downturns.

Step 2: Examine MCO’s Financial Performance

A company’s strength depends not only on a sound business model but also on its financial performance. The following overview highlights how Moody’s has performed in recent periods.

Key Financial Metrics (Latest Data)

| Metric | Value | Why It Matters |

|---|---|---|

| Revenue Growth | ~10% YoY | Consistent revenue growth shows business expansion |

| Earnings Per Share (EPS) | ~$11.50 | Higher EPS indicates strong profitability |

| Profit Margin | ~30% | A high margin suggests strong pricing power and efficiency |

| Debt-to-Equity Ratio | ~2.5 | High debt could be risky, but Moody’s cash flow offsets concerns |

Moody’s strong earnings and steady growth make it a compelling choice for long-term investors.

Step 3: Analyze MCO Stock’s Price Trends & Volatility

Stock price trends offer valuable insight into how the market views a company. Moody’s historical performance reflects consistent long-term growth, though it has experienced periodic declines.

- 52-Week Range: ~$280 – $390

- All-Time High: ~$400

- Beta: ~0.9 (lower volatility than the market)

Moody’s stock tends to outperform during economic stability but can face temporary setbacks when interest rates rise.

Step 4: Compare MCO to Competitors

To truly know if MCO stock is among the best stocks to buy, compare it to similar companies:

| Company | Market Cap | P/E Ratio | Growth Rate |

|---|---|---|---|

| Moody’s (MCO) | ~$70B | ~32x | ~10% YoY |

| S&P Global (SPGI) | ~$120B | ~33x | ~11% YoY |

| MSCI Inc. (MSCI) | ~$50B | ~38x | ~13% YoY |

Moody’s offers strong profitability, but MSCI and S&P Global also show competitive growth rates.

Step 5: Assess Market Trends & Economic Impact

Moody’s stock performance depends on interest rates, corporate debt issuance, and global financial stability.

- Bullish Scenario: If interest rates stabilize and corporate lending increases, MCO’s revenue from credit ratings will rise.

- Bearish Scenario: If recession fears grow, companies may issue fewer bonds, reducing Moody’s earnings.

Keeping an eye on Federal Reserve policies and bond markets is crucial for predicting MCO’s future.

Tips and Warnings

Investment Tips

- Diversify your portfolio: Avoid overexposure by spreading investments across various assets.

- Focus on the long term:

- Moody’s strong track record supports a buy-and-hold strategy.

- Stay updated on earnings: Quarterly reports offer key insights into financial health and growth trends.

Potential Risks

- Regulatory impact: Changes in government oversight may affect Moody’s operations and profitability.

- Economic downturns: Reduced credit activity during recessions can lower revenue.

- Valuation risk: A high P/E ratio suggests potential for price correction if growth slows.

Conclusion

Moody’s Corporation remains a solid choice for long-term investors. Its consistent earnings, strong profit margins, and central role in credit ratings make it a dependable performer. Moody’s helps investors and institutions assess financial risk, which ensures demand for its services across economic cycles. This dependable business model supports steady revenue, even during downturns. While the stock may face short-term volatility, its ability to generate income and adapt to changing markets adds long-term value.

If you’re looking to add a stable, blue-chip stock to your portfolio, MCO stock deserves serious attention. Its long track record of growth and market leadership speaks volumes. Moody’s continues to innovate in data analytics and financial technology, expanding well beyond traditional credit ratings. This forward-thinking approach, combined with its financial strength, makes MCO a smart and resilient investment option.

FAQ

Is MCO stock a good long-term investment?

Yes, Moody’s has shown consistent revenue growth, a high-profit margin, and strong market demand for its services. It’s a solid long-term hold for investors.

How does Moody’s make money?

Moody’s earns revenue through credit ratings, financial analytics, and risk management services, making it a diversified financial powerhouse.

Is MCO stock risky?

While Moody’s has strong financials, risks include regulatory changes, market downturns, and rising interest rates that could impact its earnings.

Resources:

- Yahoo Finance: Checkout Moody’s Corporation (MCO) Stock Price, News, Quote

- Market Watch: Learn more about Moody’s Corp. Stock Quote (U.S.: NYSE) – MCO

- Trading View: Discover MCO Stock Price and Chart – Moody’s Corporation