A few years ago, I noticed something strange. My usual grocery run felt lighter, but my receipt was heavier. Same items. Same brands. Higher total. That quiet shift is something we all experience at some point, and it’s one of the clearest signs of Inflation at work.

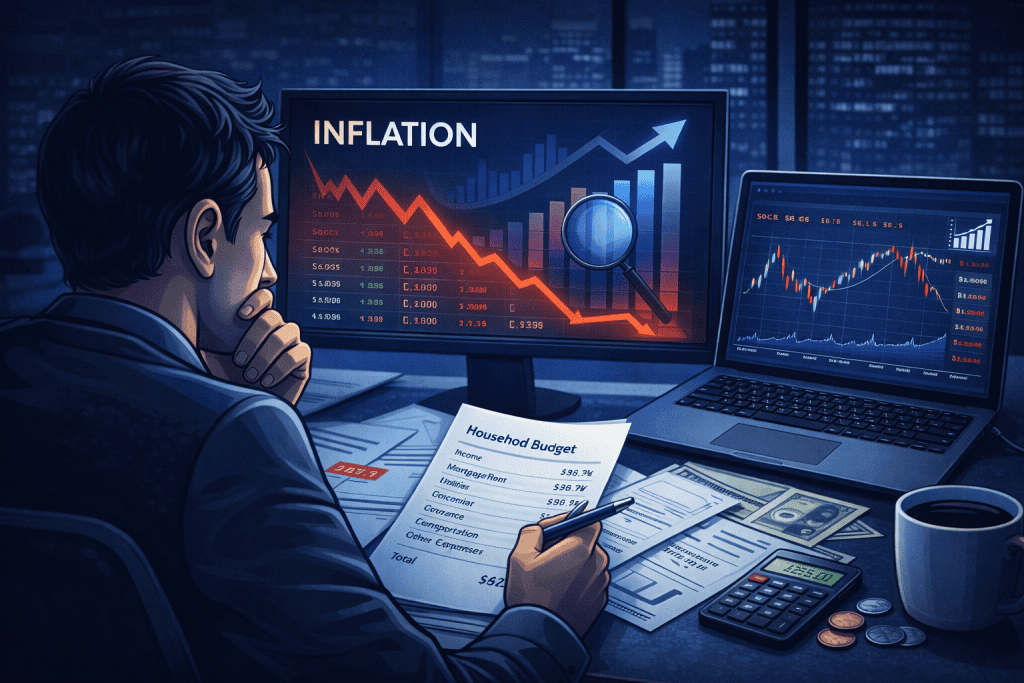

In the world of Economic Analysis, few forces matter more than Inflation. It influences interest rates, wages, investment returns, business strategy, and household budgets. Yet for something so powerful, it’s often misunderstood or ignored until it becomes uncomfortable.

Understanding how rising prices move through the economy isn’t just for analysts or finance professionals. It’s practical knowledge. Whether you manage a company, build portfolios, or simply want your paycheck to stretch further, learning how to interpret price trends gives you clarity and confidence.

This guide walks you through a clear, step-by-step approach. No complicated jargon. No dramatic predictions. Just grounded insights you can apply to your financial decisions starting today.

Tools Needed

You don’t need advanced software or a background in economics to understand what’s happening. A few simple tools are enough to start making sense of the data and applying it to your life.

You’ll want access to reliable financial information, a way to track numbers, and a snapshot of your own financial situation. The goal is to connect national trends to your personal reality.

| Tool/Material | Purpose |

|---|---|

| Government economic reports | Track official Inflation rates |

| Financial news websites | Monitor current trends |

| Spreadsheet or notebook | Record and compare data |

| Personal budget records | See real-life impact |

| Basic calculator | Calculate percentage changes |

These simple tools are enough to start understanding Inflation in a practical way.

Inflation Instructions

Step 1: Learn What Rising Prices Actually Mean

Before reacting to headlines, understand the basics. When we talk about general price increases, we’re describing a sustained rise in the cost of goods and services over time. As prices climb, purchasing power falls.

Think of it this way: if your income stays the same but everyday essentials cost more, your money does less. That gap matters.

Spend time reviewing terms like consumer price index and purchasing power. This foundation helps you interpret news reports and policy decisions more clearly. Once you understand the mechanics, the conversation becomes less intimidating.

Step 2: Follow the Data, Not the Drama

Headlines often amplify fear. Instead of reacting emotionally, look at official numbers. Compare current rates with those from the past few years.

Are price increases accelerating or slowing? Are certain categories rising faster than others?

Tracking this data over time helps you avoid making impulsive moves, especially during volatile periods or after events like a market crash. Economic trends unfold gradually. Seeing the bigger picture keeps you grounded.

Make it a habit to review updates quarterly rather than obsessing daily. Patterns matter more than single-month spikes.

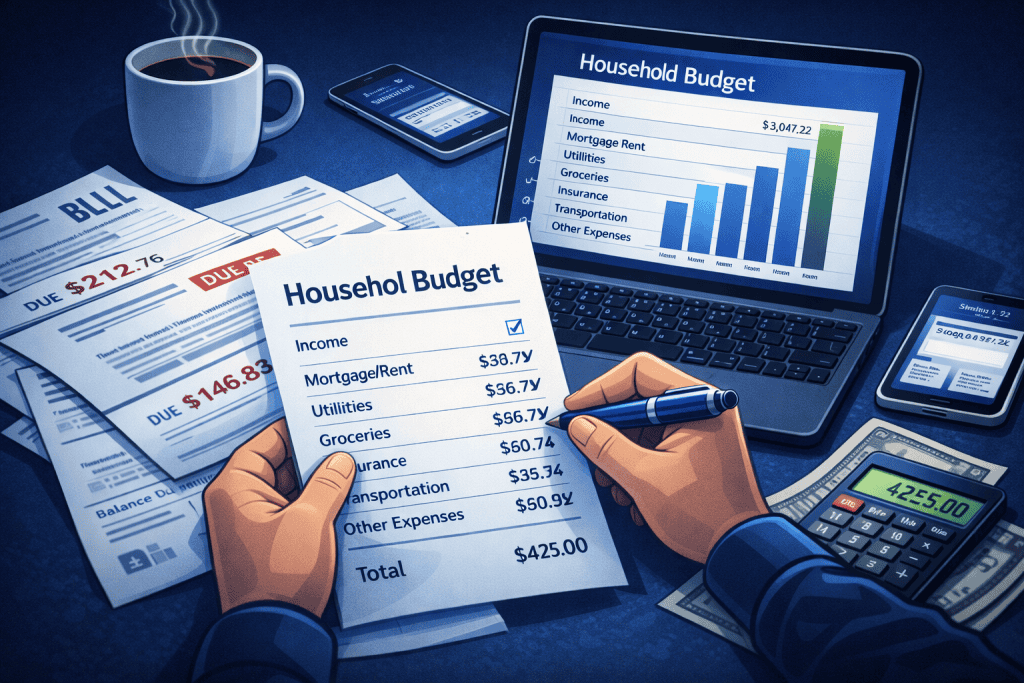

Step 3: Connect National Trends to Your Budget

This is where analysis becomes personal. Pull up your expenses from two or three years ago. Compare them with today.

Groceries. Rent. Utilities. Insurance. Transportation.

You may notice steady increases in certain categories while others remain stable. That’s how macroeconomic changes filter into daily life.

This step also helps refine your investment plan. If living costs rise faster than expected, long-term financial projections need adjustment. Small percentage changes can compound significantly over time.

Seeing the connection between national data and your own bank account makes everything more concrete.

Step 4: Evaluate Savings and Asset Performance

Cash sitting in a low-interest account can quietly lose value when prices rise faster than returns. That’s why reviewing savings strategy matters.

Compare your returns against recent price growth. If your savings earn 2 percent but costs rise 4 percent, the gap reduces real value.

Investors often revisit asset allocation during these periods. Some sectors historically perform better in rising-cost environments. Researching the Best stocks to buy under current conditions may support portfolio resilience.

This is also where updated trading strategies come into play. Short-term adjustments may differ from long-term positioning. The key is aligning decisions with evidence, not fear.

Step 5: Understand the Broader System

Price changes don’t happen in isolation. They connect to interest rates, employment levels, production costs, and global supply chains. All of these interact within the larger Economic System.

When central banks adjust interest rates, they’re often responding to sustained price pressure. Businesses respond by adjusting pricing or investment plans. Consumers change spending behavior.

By observing these interconnected movements, you begin anticipating shifts rather than reacting to them. That’s the difference between passive awareness and informed strategy.

Step 6: Adjust Gradually and Monitor Consistently

The final step isn’t dramatic. It’s steady.

Review your financial assumptions annually. Revisit savings goals. Adjust contributions if necessary. Rebalance portfolios thoughtfully.

Avoid extreme decisions based on temporary spikes. Economic cycles move in phases. Stability often returns, even after turbulent periods.

Consistency wins. Awareness reduces anxiety. Small, deliberate changes protect long-term stability.

Inflation Tips and Warnings

One of the biggest mistakes people make is overreacting. Sudden changes in prices can trigger fear-based decisions, especially in investment markets. Selling long-term assets too quickly often locks in losses.

Another common issue is ignoring gradual increases. When price growth is moderate, it’s easy to assume it’s harmless. But even modest annual increases compound significantly over time.

Diversification remains one of the most effective safeguards. Spreading risk across asset types reduces exposure to unexpected shocks.

It’s also important to compare multiple data sources. Relying on a single article or headline can distort perspective. Sound Economic Analysis depends on broader context.

Here’s a quick guide:

| Tip | Why It Helps |

|---|---|

| Avoid emotional decisions | Markets often recover |

| Review financial plans yearly | Keeps goals realistic |

| Diversify holdings | Reduces concentrated risk |

| Monitor interest rate trends | Signals policy direction |

| Think long term | Economic cycles are natural |

Finally, separate temporary disruptions from long-term structural changes. Supply chain issues, seasonal shifts, or geopolitical events can cause short-term spikes that don’t reflect lasting patterns.

Conclusion

Inflation isn’t just an economic buzzword. It’s a quiet force shaping your daily life, your savings, and your future plans. By understanding these step by step, you move from reacting emotionally to thinking strategically.

Start with the basics. Track the data. Connect it to your own finances. Study its impact on investments. Then adjust thoughtfully.

Economic Analysis doesn’t have to feel overwhelming. With consistent observation and small adjustments, you can protect your purchasing power and make smarter financial choices.

Don’t wait for headlines to tell you what’s happening. Look at the numbers yourself. Inflation is happening whether we pay attention or not. The difference is whether we choose to understand it.

FAQ

How does Inflation influence long-term financial planning in Economic Analysis?

Long-term financial planning requires estimating future costs and expected returns. When prices rise steadily, future expenses may be higher than originally projected. In Economic Analysis, adjusting forecasts to account for sustained price growth ensures retirement plans, business budgets, and savings targets remain realistic and achievable.

What is the best way to protect savings during periods of Inflation in Economic Analysis?

Protecting savings involves ensuring returns outpace rising costs. This may include diversified investments, adjusting asset allocation, or exploring instruments designed to hedge against price growth. Regular portfolio reviews are essential within Economic Analysis to maintain purchasing power over time.

Why is Inflation important in understanding the broader Economic System?

Price stability affects employment, lending rates, production costs, and consumer confidence. Policymakers respond to sustained increases with interest rate adjustments and other measures. Understanding this relationship helps individuals and professionals interpret shifts within the broader Economic System more accurately.

Resources

- WallStreetMojo. Inflation

- Investopedia. How Inflation Affects Your Cash Savings

- Bankrate. What Is Inflation?

- Pru Life UK. High Inflation Hurts Your Finances More Than You Think

- MarketWatch. What Is Inflation?