In the early days of crypto, owning digital assets usually meant one thing: buy them, hold them, and hope the price goes up. That strategy still exists, but today the ecosystem offers far more options. One of the most talked-about is Yield Farming, a concept that promises to turn idle crypto into a source of ongoing returns.

The first time I encountered it, it sounded almost too good to be true. Friends were earning tokens simply by letting their assets sit inside decentralized platforms. No banks. No paperwork. Just code doing the work. That curiosity led me down a rabbit hole of decentralized finance, smart contracts, and new ways to think about value.

Understanding it matters because it represents a shift in how people interact with money inside the Crypto Market. Instead of relying on traditional institutions, users now participate directly in systems that reward them for providing liquidity and support. Whether you’re exploring crypto for income, experimentation, or long-term strategy, learning how this process works can help you avoid common pitfalls and make better decisions.

What is Yield Farming

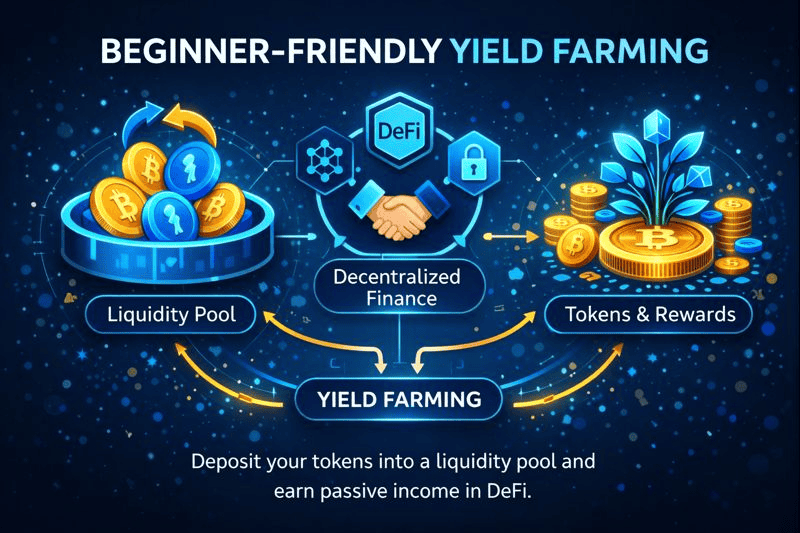

Yield Farming is a decentralized finance method where cryptocurrency holders lend, stake, or lock their assets into smart contracts to earn rewards. These rewards can come from transaction fees, interest paid by borrowers, or newly issued tokens distributed by the platform.

In simpler terms, Yield Farming lets your crypto work for you. Instead of sitting untouched in a wallet, assets are deployed into protocols that need liquidity to function. In return, users are compensated for their participation. It is often compared to earning interest, but the mechanisms and risks are very different from traditional savings accounts.

Breaking Down Yield Farming

To understand, it helps to break the idea into smaller, more familiar pieces. At the foundation is decentralized finance, or DeFi, which removes intermediaries like banks and replaces them with automated code. These systems are built on Blockchain networks that record every transaction publicly and immutably.

The first major component is liquidity. Decentralized exchanges and lending platforms rely on pools of tokens so users can trade or borrow instantly. These pools don’t fill themselves. They depend on users who are willing to deposit assets. When you contribute to a pool, you become a liquidity provider.

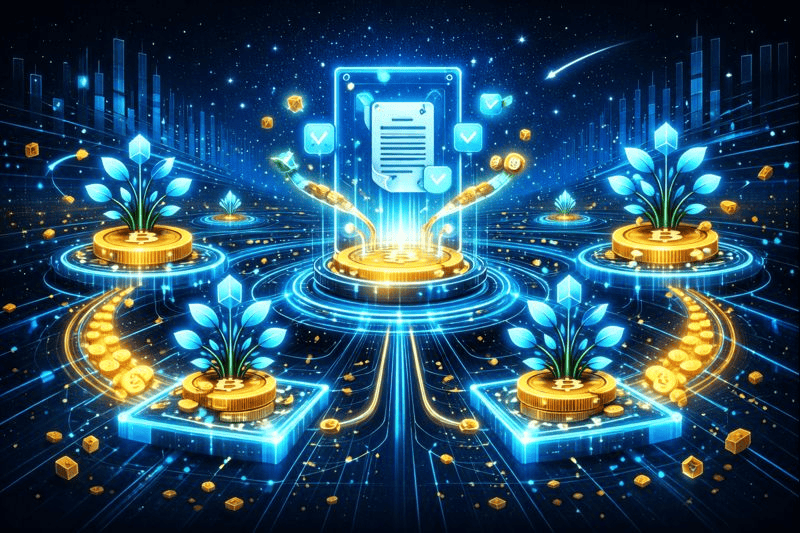

The second component is smart contracts. These are self-executing programs that manage deposits, withdrawals, and reward distribution. Once funds are locked in, the smart contract automatically calculates how much each participant earns. There is no customer service desk or manager approving transactions. The code decides.

Rewards are the third piece. In Yield Farming, returns often come from multiple sources. You might earn a portion of trading fees generated by the pool, interest paid by borrowers, or incentive tokens designed to attract more users. This layered reward system is what makes yields appear so attractive, especially during periods of high activity in the Coin Market.

However, higher rewards usually come with higher risk. Token prices can fluctuate rapidly, and smart contracts can contain bugs. I learned early on that understanding the mechanics of a platform matters more than chasing the highest advertised returns. Yield Farming is not passive in the traditional sense. It rewards attention, research, and risk awareness.

History of Yield Farming

Yield Farming didn’t appear overnight. Its roots trace back to early decentralized lending platforms that allowed users to earn interest on deposited assets. But the strategy truly gained traction around 2020, when protocols began distributing governance tokens as rewards.

These tokens gave holders voting power over platform decisions, adding another layer of value. Users quickly realized they could move funds between protocols to maximize returns, giving rise to complex strategies and automated tools.

| Period | Development |

|---|---|

| 2017–2018 | Early DeFi lending concepts emerge |

| 2019 | Automated market makers gain attention |

| 2020 | Liquidity mining popularizes Yield Farming |

| 2021–Present | Focus shifts to sustainability and risk management |

Types of Yield Farming

Yield Farming isn’t a single activity. It comes in several forms, each with its own mechanics and risk profile.

Liquidity Pool Farming

This is the most common type. Users deposit pairs of tokens into decentralized exchanges. In return, they earn a share of the trading fees generated when others swap assets.

Lending-Based Farming

Here, assets are supplied to lending protocols. Borrowers pay interest, which is distributed to lenders over time. This approach is often considered lower risk compared to liquidity pools.

Staking-Oriented Farming

Some platforms combine staking with yield incentives. Tokens are locked to support network operations while earning additional rewards.

| Type | Main Purpose | Risk Level |

|---|---|---|

| Liquidity Pools | Enable trading | Medium |

| Lending | Provide loans | Low to Medium |

| Staking | Network support | Medium |

How does Yield Farming work?

At a technical level, Yield Farming works through smart contracts that track deposits and calculate rewards in real time. When you deposit assets, the contract issues a receipt token representing your share of the pool. As fees and incentives accumulate, the value of that receipt token increases.

When you withdraw, the smart contract returns your original assets plus earned rewards. The process is transparent, verifiable, and independent of centralized control. This model has attracted users who want alternatives to traditional systems tied to assets like Bitcoin, where returns usually depend on price appreciation alone.

Pros & Cons

Before participating, it’s important to understand both sides of the equation.

| Pros | Cons |

|---|---|

| Opportunity for ongoing returns | Smart contract vulnerabilities |

| No intermediaries | Impermanent loss |

| Transparent reward systems | Rapid market changes |

While the advantages are appealing, the risks are real. Successful participants tend to start small, learn gradually, and diversify rather than placing everything into a single protocol.

Uses of Yield Farming

Yield Farming is used in several practical ways across decentralized finance, depending on the user’s goals and experience level.

Passive Income Generation

Many long-term holders use Yield Farming to earn rewards on assets they plan to keep anyway. Instead of leaving tokens idle, they place them into relatively stable protocols to generate additional returns.

Supporting Market Liquidity

Every decentralized exchange relies on liquidity providers. Without Yield Farming incentives, many platforms would struggle to function efficiently. Farmers play a crucial role in keeping markets liquid and accessible.

Strategic Poratfolio Management

More advanced users actively rotate assets between protocols to balance risk and reward. For them, Yield Farming becomes part of a broader Investment strategy rather than a one-time experiment.

From personal experience, the most sustainable approach is treating Yield Farming like an evolving skill. Markets change, protocols update, and rewards fluctuate. Staying informed matters more than chasing short-term gains.

Resources

- Britannica. Cryptocurrency Yield Farming.

- CoinMarketCap. Yield Farming Glossary.

- Coinbase. What Is Yield Farming and How Does It Work?

- Chainlink. What Is Yield Farming?

- BabyPips. Yield Farming Definition.