Ever find yourself swimming in a sea of crypto jargon and bump into the phrase “What is Market Cap”? You’re not alone. Whether you’re casually scrolling through crypto market news or seriously considering your next investment, you’ll notice that market capitalization—or market cap—comes up again and again. It’s one of those financial terms that everyone throws around, but few truly understand, especially outside of traditional stocks.

Think of it like the price tag of a company or a cryptocurrency. It’s what tells investors, “Hey, here’s what the entire project is worth.” Understanding What is Market Cap can completely transform how you assess value in the volatile coin market. It’s the bedrock metric for comparing Bitcoin to other coins, for evaluating growth, and yes, even for spotting potential risks. So buckle up as we journey through this fundamental concept—and make it feel a whole lot more human.

What is Market Cap

Market cap—short for market capitalization—is the total dollar value of a company or cryptocurrency. In the context of blockchain, it’s a quick snapshot of a coin’s size, value, and influence in the crypto economy. It’s calculated by multiplying the current price of the asset by its total circulating supply.

So, if a crypto token is priced at $50 and there are 10 million tokens in circulation, its market cap is $500 million. Simple, right?

But don’t confuse this with actual money sitting in the bank. It’s more like a reflection of market confidence, popularity, and perceived value. You’ll also hear market cap referred to as “market value” or just “cap.”

Breaking Down What is Market Cap

Market cap = Price of one unit × Total circulating supply.

Now, here’s where things get interesting. Market cap acts as a measuring stick. For example, Bitcoin, the biggest name in crypto, has the highest market cap. Why? Because it’s both high in price and widely held. But what about lesser-known coins that are super cheap? If they have enough coins in circulation, their market cap can still be significant—even if their individual token price is just cents.

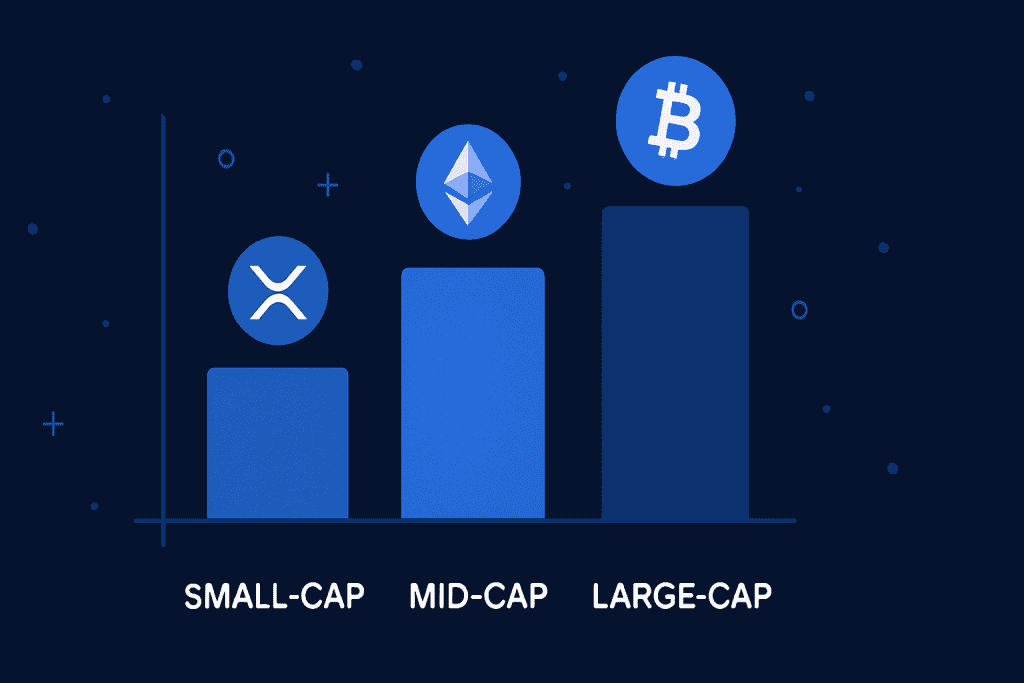

Market cap is split into three broad categories:

- Large-cap: These are heavy hitters like Bitcoin and Ethereum—well-established, less volatile, and considered safer bets.

- Mid-cap: These have strong potential but carry more risk. They’re the up-and-comers.

- Small-cap: High risk, high reward. Think of these like penny stocks with explosive possibilities—or devastating losses.

Here’s a relatable analogy: Imagine the crypto market as a high school. Bitcoin is the popular senior with scholarships (large-cap), while small-cap coins are like freshmen—unknown, full of potential, but still figuring things out.

And one more thing—don’t base your investment choices on price alone. A coin priced at $1 with a billion coins might be more valuable than one priced at $500 with just 10,000 tokens.

History of What is Market Cap

The term “market capitalization” originally came from the traditional stock market, long before crypto was even a twinkle in the digital eye. It’s been used for decades to evaluate the size and risk of companies on exchanges like the NYSE or NASDAQ.

When cryptocurrencies entered the scene in the 2000s and started to gain traction around 2009 (thanks to Bitcoin), investors needed a similar framework to compare one digital asset to another. So, they borrowed this trusty old metric and applied it to the coin market.

Here’s a brief look at its evolution:

| Year | Milestone |

|---|---|

| 1920s | Concept used in evaluating traditional company stocks |

| 2009 | Bitcoin launches; market cap begins to be applied to crypto |

| 2013 | First major crypto boom; market cap becomes crucial |

| 2017 | Explosive altcoin season; market cap becomes mainstream |

| 2021 | Market cap hits trillions in total crypto value |

Types of What is Market Cap

Different cryptocurrencies fall into distinct categories based on their market cap:

Large-Cap Cryptos

These are usually worth over $10 billion. They’re considered stable and less volatile.

Mid-Cap Cryptos

Market cap between $1 billion to $10 billion. They carry moderate risk and offer decent growth potential.

Small-Cap Cryptos

Less than $1 billion. These coins are speculative, risky, and often highly volatile.

| Type | Market Cap Range | Risk Level |

|---|---|---|

| Large-Cap | Over $10 billion | Low |

| Mid-Cap | $1 billion – $10 billion | Medium |

| Small-Cap | Under $1 billion | High |

How does What is Market Cap work?

Imagine a coin priced at $2. If there are 500 million coins in circulation, then its market cap is $1 billion. Now, let’s say the price drops to $1. The market cap drops to $500 million.

This fluctuation helps investors judge whether a coin is gaining or losing momentum. It’s also key in investment strategies where diversification is crucial. Investors often split their portfolios across different cap sizes to balance risk.

Pros & Cons of Market Cap

Before you treat market cap as the holy grail of crypto evaluation, here’s a snapshot of its strengths and weaknesses:

| Pros | Cons |

|---|---|

| Helps gauge size and stability | Doesn’t reflect liquidity or daily volume |

| Useful for comparing different assets | Can be manipulated through price spikes |

| Offers insight into risk and volatility | Doesn’t show real-time sentiment or adoption |

Uses of What is Market Cap

Market cap isn’t just a number—it’s a tool that shapes decisions across the financial world. In practice, it’s used by traders, investors, analysts, and institutions to gauge the relative size, influence, and potential of cryptocurrencies (and stocks) in a crowded market.

In crypto investing, market cap helps investors compare coins without getting distracted by price alone. A coin priced at $0.05 might seem cheap, but if it has 100 billion tokens in circulation, its market cap is $5 billion—hardly a small fish. That’s why seasoned investors often ignore price and focus on cap to determine whether an asset is undervalued, overhyped, or fairly positioned.

In portfolio management, market cap acts as a risk compass. Investors split their holdings across large-cap, mid-cap, and small-cap assets to balance stability with growth. For example, an investor might hold Bitcoin (large-cap) for security, Solana (mid-cap) for growth potential, and a newer coin (small-cap) for high-risk, high-reward speculation.

In industry-specific contexts, such as DeFi or NFT platforms, market cap also reflects project traction. For DeFi protocols, total value locked (TVL) may work alongside market cap to assess platform health. For NFT-based tokens, market cap can help filter out hype-driven pumps from projects with sustained demand.

Even crypto indexes and rankings (like CoinMarketCap and CoinGecko) rely on market cap to determine placement. It’s how Bitcoin stays at the top, and how emerging coins fight their way into visibility.

Bottom line: Market cap is more than a headline figure—it’s a foundational metric that drives how the market perceives value, risk, and opportunity in real time. Understanding how it’s used is key to navigating the crypto world with confidence.

Resources

Here’s where you can dive deeper:

- FINRA. Market Cap Insights

- IG.com. Market Capitalisation Definition

- Investor.gov. Market Capitalizatiopn

- Investopedia. Market Capitalization

- Wealthspire. Market Capitalization