Imagine having the power to invest in hundreds of companies at once without spending endless hours researching each one. That’s what an Index Fund offers—a simple, powerful way to grow wealth while minimizing risk. In the world of Economic Analysis, this investment vehicle plays a crucial role in balancing market efficiency and investor confidence.

Instead of chasing the next big stock or worrying about short-term market swings, an Index Fund allows you to mirror the performance of major market indices like the S&P 500. It’s an approach that embraces consistency and long-term vision—perfect for anyone crafting a sustainable investment plan within an ever-changing Economic System.

What is Index Fund?

It is a type of mutual fund or exchange-traded fund (ETF) designed to track the performance of a specific market index, such as the Dow Jones or NASDAQ. Instead of trying to beat the market, it aims to match it. By doing so, investors gain exposure to a broad range of assets without the constant need for active management.

This strategy offers diversification and stability, making it one of the most cost-effective and accessible ways for people to participate in the financial markets. Whether you’re a seasoned investor or just starting your journey, understanding how an Index Fund works can transform how you approach long-term financial goals.

Breaking Down Index Fund

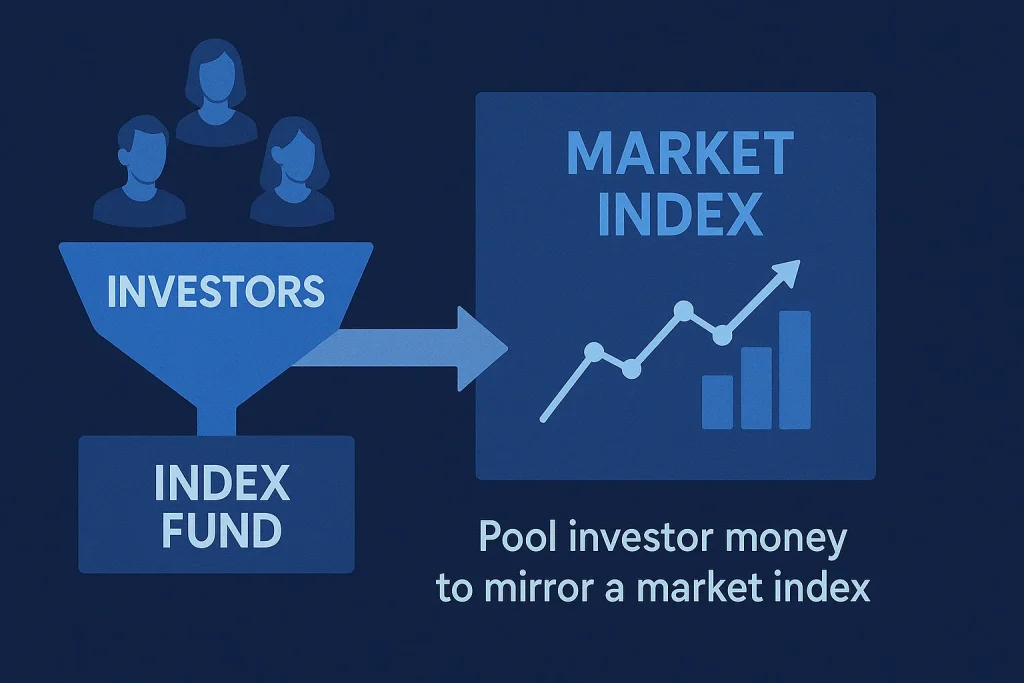

Let’s break down how an Index Fund operates. Picture it as a mirror reflecting the market’s overall movement. It pools money from numerous investors to purchase all (or a representative sample) of the securities in a given index. For example, an S&P 500 fund invests in 500 of the largest U.S. companies, giving investors instant diversification.

The main components include:

- Underlying Index – The benchmark that the fund replicates, such as the NASDAQ 100.

- Fund Manager – Oversees the tracking of the index but does not actively pick stocks.

- Expense Ratio – A small fee covering the cost of managing the fund.

By eliminating the guesswork of picking the Best stocks to buy, an Index Fund allows investors to ride the overall wave of the market rather than gamble on individual winners or losers.

History of Index Fund

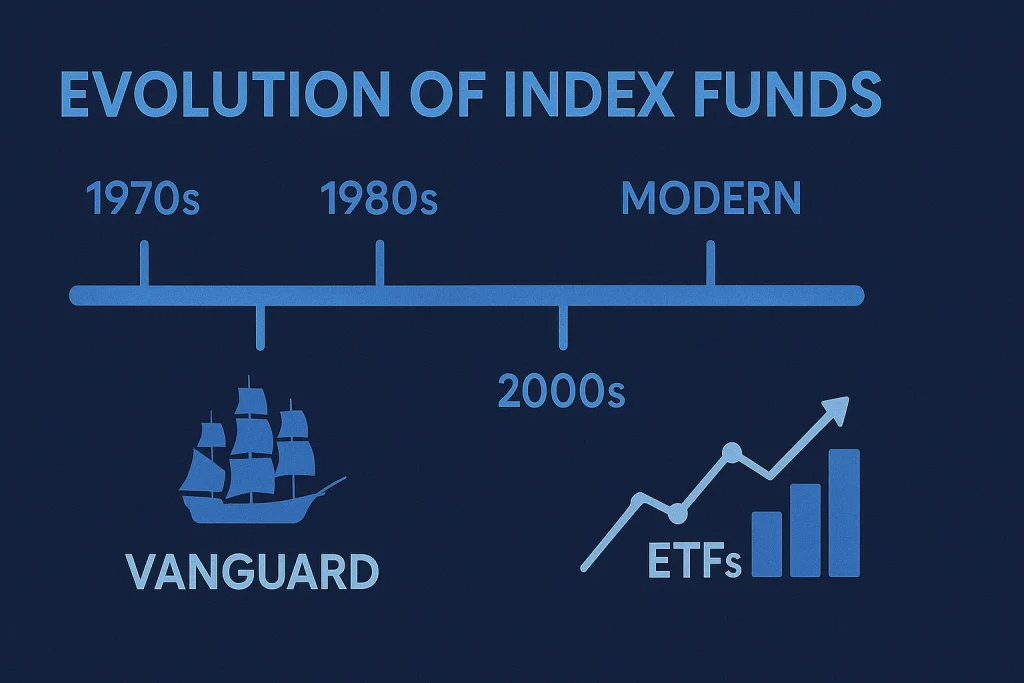

The concept of the fund began in the 1970s when economist John Bogle launched the first retail fund through Vanguard. His revolutionary idea was that most actively managed funds underperformed the market after accounting for fees. By tracking the market instead, investors could achieve better long-term returns.

| Era | Key Development | Impact on Investment |

|---|---|---|

| 1970s | First retail Index Fund by Vanguard | Popularized passive investing |

| 1980s | Growth of institutional index funds | Pension funds adopted the strategy |

| 1990s | Rise of ETFs | Offered flexibility and real-time trading |

| 2000s–Present | Global adoption | Became a standard part of diversified portfolios |

The simplicity and low costs made index investing increasingly attractive, especially after major events like the 2008 market crash. Investors sought safety, transparency, and consistency—all of which Index Funds delivered.

Types of Index Fund

Stock Index Fund

This is the most common type, tracking equity markets such as the S&P 500 or Russell 2000. It gives exposure to a broad range of companies and industries, spreading risk while maximizing growth potential.

Bond Index Fund

These track government or corporate bond markets, providing stability and income through interest payments. Ideal for conservative investors seeking steady returns.

International Index Fund

By tracking global markets, these funds help investors diversify beyond domestic boundaries, reducing dependence on one country’s economy.

Sector Index Fund

Focused on specific industries like technology, healthcare, or energy. Great for investors who want targeted exposure without picking individual stocks.

Each type offers unique advantages, depending on one’s financial goals and risk tolerance. Together, they form the backbone of a balanced, long-term portfolio.

How Does Index Fund Work?

The process begins when an investor buys shares of an Index Fund. That money is pooled with other investors’ contributions, which the fund uses to purchase securities within a chosen index.

- Selection of Index – The fund chooses an index to track, such as the NASDAQ or S&P 500.

- Portfolio Construction – It invests in all or a representative sample of the securities in that index.

- Rebalancing – Over time, the fund adjusts holdings to stay aligned with the index composition.

- Returns Distribution – Investors earn returns through dividends and capital appreciation.

This step-by-step mechanism ensures that performance remains as close as possible to the index itself. It’s a passive but powerful strategy that captures market trends over time, making it one of the simplest ways to build long-term wealth using smart trading strategies.

Pros & Cons

Understanding the pros and cons of an Index Fund is essential before investing. While it offers simplicity and diversification, it’s not immune to market fluctuations.

Investors often appreciate the transparency and predictability of this approach. There’s no need to worry about sudden managerial shifts or hidden strategies. However, one must accept that when markets decline, it follow suit—they don’t try to outperform during downturns.

| Pros | Cons |

|---|---|

| Low management fees | Limited flexibility during market shifts |

| Broad diversification | Cannot outperform the index it tracks |

| Easy to understand and manage | Returns can drop during market downturns |

| Consistent long-term growth | Lack of active management decisions |

Uses of Index Fund

It serves multiple purposes, from building retirement wealth to providing institutional stability.

Retirement Planning

Investors often choose index-based investments for retirement accounts due to their long-term reliability and low costs.

Institutional Portfolios

Pension funds and insurance companies use them to achieve stable, predictable performance aligned with broader market trends.

Educational and Family Savings

Parents often invest in these funds for college or family savings goals, as they provide consistent growth over time.

These funds act as the cornerstone for diversified portfolios, balancing risk and return through passive participation in the global economy.

Resources

- Vanguard – The Pioneer of Index Fund Investing.

- Morningstar – Best Index Funds

- Fidelity – ETF vs. index fund

- Investopedia – What are Index Funds? How do they work?

- Charles Schwab – Looking for quality mutual funds and ETFs?