What is Short Selling? At first glance, the term sounds like financial jargon reserved for Wall Street insiders. Yet, it plays a major role in the world of Economic Analysis and financial decision-making. It is not just a clever trick used by hedge funds; it’s a strategy that influences stock prices, shapes market trends, and sparks heated debates among investors. Understanding it matters because it teaches us how markets really work—both in times of calm and crisis.

Imagine betting against a company you believe is overvalued, only to watch events prove you right—or wrong. That tension, risk, and reward define the essence of short selling. By grasping its mechanics, we gain insight into market psychology, risk-taking, and the thin line between bold strategy and reckless gamble.

What is Short Selling?

The concept is an investment strategy where a trader borrows shares of a company, sells them at the current price, and later buys them back—ideally at a lower price. The difference between the selling and buying price becomes the profit. Put simply, it’s the opposite of the “buy low, sell high” mantra. Here, the logic flips: sell high first, then buy low later. Some call it “shorting” or “going short.” For investors, it’s a way to profit when they expect a stock to fall.

Breaking Down Short Selling

To really understand it, let’s strip it down to its bones.

Imagine borrowing your neighbor’s lawn mower. You lend it to someone else for cash, expecting that you’ll soon find a cheaper mower in a thrift shop to replace it. If you succeed, you return the mower and pocket the difference. But if the price of mowers skyrockets, you’re stuck paying more to replace it than you earned in the first place.

That’s the essence of short selling:

Borrowing Shares – A trader borrows stock from a broker.

Selling Them Immediately – Those shares are sold at the current market price.

Returning the Shares – The trader gives the borrowed shares back to the broker and keeps the profit.

Let’s use an example. Suppose you short 100 shares of a company at $50 each. The stock then drops to $30. You buy them back for $3,000, return them to the broker, and pocket $2,000. But if the stock climbs to $70 instead, you lose $2,000. The risk is theoretically unlimited because stock prices can keep climbing.

This strategy is powerful but dangerous. Unlike traditional investing, where the worst case is losing your initial investment, short sellers can lose much more than they put in. That’s why economic analysts often warn beginners to tread carefully.

History of Short Selling

It dates back to the 1600s in Amsterdam, where traders speculated on the Dutch East India Company. Since then, it has been both praised as a tool for market efficiency and blamed for worsening financial crashes.

| Year | Event | Impact |

|---|---|---|

| 1609 | First recorded short sale in Amsterdam | Birth of short selling |

| 1929 | U.S. stock market crash | Short sellers accused of fueling panic |

| 2008 | Global financial crisis | Regulators briefly banned shorting bank stocks |

| 2021 | GameStop saga | Retail traders challenged hedge funds with massive short squeezes |

Types of Short Selling

It isn’t one-size-fits-all. Investors use variations depending on risk and creativity.

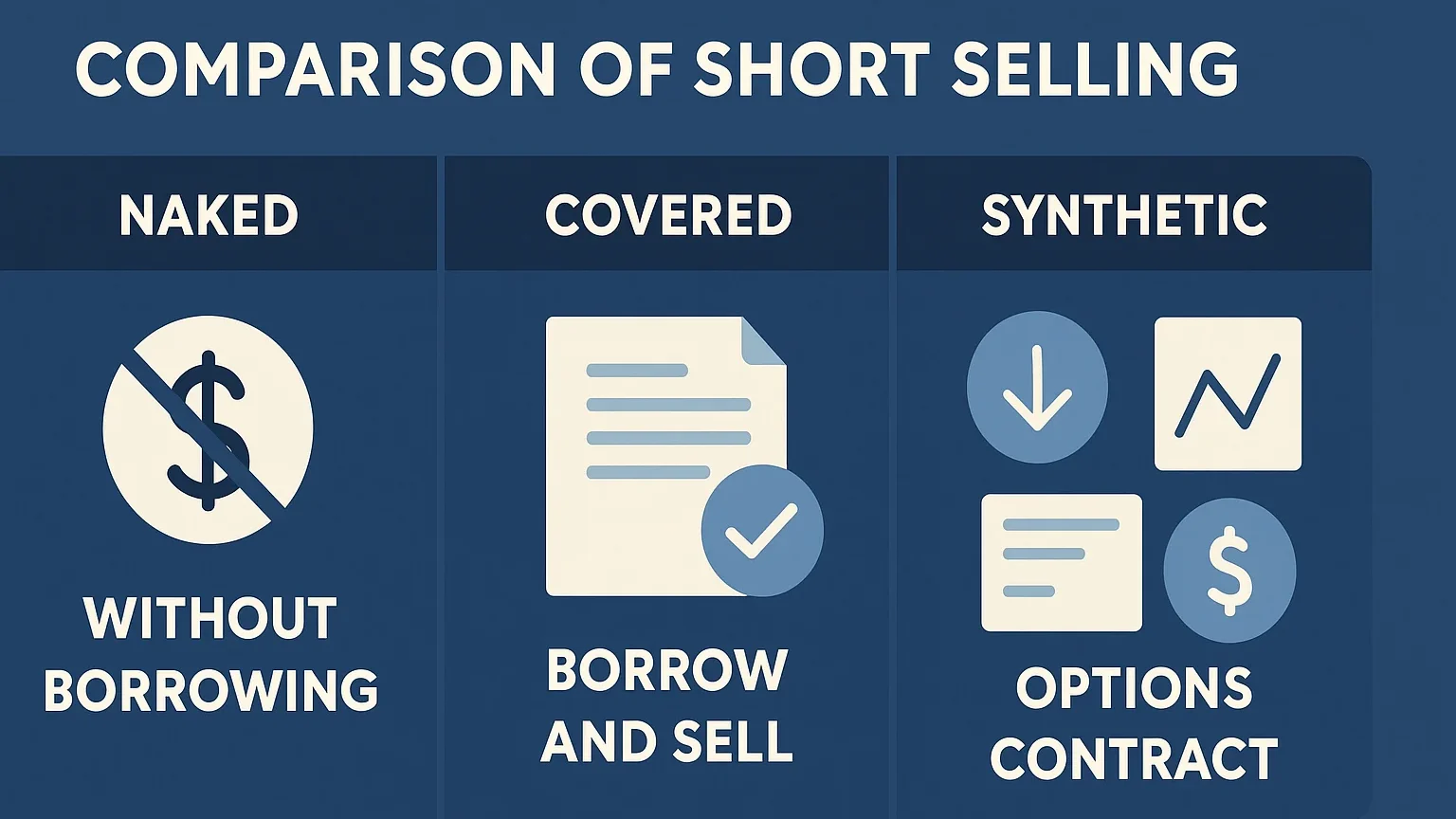

Naked Short Selling

This controversial type involves selling shares without even borrowing them first. It’s banned in most countries because it can manipulate markets.

Covered Short Selling

The standard form, where the trader borrows shares before selling. This is legal and widely practiced.

Synthetic Short Selling

Here, traders use derivatives such as options to mimic the effects of short selling without borrowing shares directly.

| Type | Description | Legality |

|---|---|---|

| Naked Short | Selling shares without borrowing | Mostly illegal |

| Covered Short | Borrowing before selling | Legal |

| Synthetic Short | Using derivatives to replicate | Legal |

How does Short Selling work?

Short selling works by exploiting falling prices. Traders predict that a stock is overvalued or set for decline. They borrow, sell, and repurchase later. The broker facilitates the borrowing, often charging fees or interest. Timing is everything—sell too early, and the rebound may ruin your bet; sell too late, and profits shrink.

Pros & Cons

Before diving in, it’s vital to weigh both sides of the coin.

| Pros | Cons |

|---|---|

| Profits from falling markets | Unlimited loss potential |

| Exposes overvalued companies | Requires margin and borrowing costs |

| Adds liquidity to markets | Risk of short squeezes |

| Sharpens market efficiency | Often criticized as manipulative |

Uses of Short Selling

Short selling is not just about making a quick profit; it serves bigger purposes in economic analysis. It exposes weak companies, reveals overhyped stocks, and adds depth to financial markets.

Hedging Strategies

Investors use short selling to protect portfolios. For example, if someone owns tech stocks, they may short-sell similar ones to offset risks.

Market Correction

By betting against overvalued firms, short sellers help bring prices closer to reality. This creates balance and prevents bubbles.

Identifying Fraud

History shows that some of the biggest corporate scandals—like Enron—were exposed by short sellers who dug into shady practices.

Speculative Gains

Of course, speculation is a big driver. Traders sometimes use short selling simply to chase high-risk, high-reward opportunities.

Think of the 2021 GameStop event. Hedge funds betting on declines faced armies of retail traders pushing the stock price up. The result? A dramatic short squeeze that cost billions. This event also drew attention to how technology, Windows Update, and platforms like Reddit shape financial outcomes.

Short selling even connects with digital risks. Economic systems today face cyber threats such as trading hacks or data leaks. Just like hacking destabilizes networks, reckless shorting can destabilize markets. That’s why regulators monitor these activities closely. And just as tools like Express VPN protect online privacy, financial safeguards exist to prevent abusive shorting practices. In fact, some critics compare fraudulent naked shorts to shady software like Deepfakes, designed to exploit loopholes.

Conclusion

Short selling is one of the most controversial yet powerful strategies in financial markets, offering the chance to profit from falling prices, expose overvalued companies, and even uncover fraud, but it also carries enormous risks, including unlimited potential losses. By understanding how it works—along with its history, types, and real-world impacts—investors can better weigh its benefits and dangers. Whether seen as a tool for market efficiency or a reckless gamble, short selling undeniably shapes market movements and challenges us to look deeper at what truly drives value.

Resources

- Investopedia – Short Selling Explained

- IG – What Is Short Selling and How It Works

- SEC (U.S. Securities and Exchange Commission) – Key Points About Regulation SHO

- Desjardins – What is Short Selling?

- Bloomberg – Latest News on Short Selling