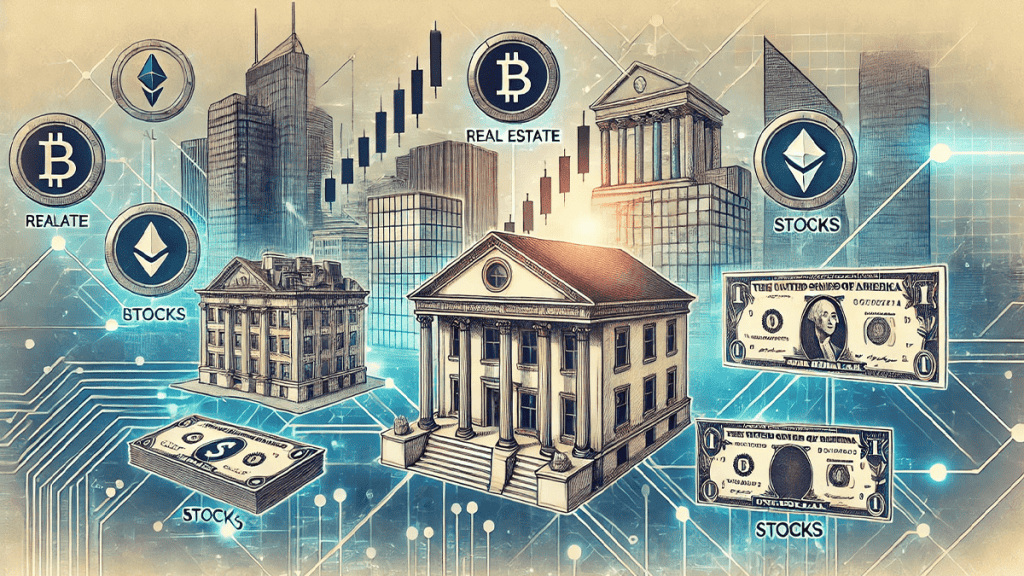

The advent of blockchain technology has paved the way for numerous innovations in the financial sector, one of which is security tokens. It represent ownership of an asset, such as real estate, stocks, or bonds, but digitized and recorded on a blockchain. This guide aims to provide an in-depth understanding of this, their implications, and their potential to reshape the financial landscape.

Security tokens, for example, bridge the gap between traditional financial instruments and the burgeoning cryptocurrency world. They offer the flexibility and efficiency of digital assets while providing the security and regulation of traditional investments. Through the tokenization of assets, it allow fractional ownership, increased liquidity, and access to global markets. These innovations are especially important in today’s fast-paced financial environment, where investors are seeking more transparent, efficient, and accessible investment opportunities.

Moreover, they are an important component of the growing digital economy, offering new avenues for investment and capital formation. As blockchain technology continues to evolve, the role of security tokens is expected to expand, making them an essential topic for investors, regulators, and financial professionals alike. As such, this guide covers what this are, their benefits, how they work, and their applications in various sectors.

What is a security token?

A security token’s digital representation of ownership of a real-world asset that is collateralized and managed on a blockchain. Unlike utility tokens, which provide access to a specific product or service, this are subject to federal securities regulation. They can represent a company’s stock, real estate, bonds, or other financial assets.

Characteristics of security tokens

These assets have a few key characteristics that distinguish them from other types of digital assets:

- Regulatory compliance: This must comply with securities regulations that ensure investor protection and market integrity.

- Ownership: Security token holders have ownership rights, including dividends, profit sharing, and voting rights.

- Asset-backed: Each token is backed by a tangible or intangible asset to provide unique value.

- Blockchain-based: Security tokens utilize blockchain technology for transparency, security, and efficiency of transactions.

Benefits of security tokens

It offer many advantages over traditional financial instruments and other types of digital assets.

Enhance liquidity

One of the most important benefits of security tokens is enhanced liquidity. For example, traditional assets such as real estate or private equity are often illiquid, meaning they cannot be sold quickly or exchanged for cash. However, it improve liquidity by tokenizing these assets, enabling fractional ownership and making them easier to trade on secondary markets.

Improving accessibility

Security tokens democratize investment opportunities by allowing small, fractional investments. This accessibility opens up the opportunity for more investors to participate in markets that were previously inaccessible due to high barriers to entry.

Reduce costs and improve efficiency

Blockchain technology lowers transaction costs by reducing the need for intermediaries such as brokers and clearinghouses. Process automation through smart contracts further increases efficiency, reducing the time and costs associated with traditional financial transactions.

How do security tokens work?

It’s created through a process called tokenization, which divides assets into digital tokens on the blockchain. This process involves several steps

- Identify assets: Determine which assets you want to tokenize, such as real estate, equity, or debt.

- Compliance: Ensure that your tokenization process is compliant with applicable securities laws and regulations.

- Create a token: Develop a digital token that represents ownership of an asset.

- Distribution: Distribute tokens to investors through a security token offering.

- Trading: Enable secondary market trading of your token to increase liquidity and market access.

Security Token Offerings

It offers a funding method that issues security tokens to investors in exchange for capital. Security token offerings are strictly regulated, unlike traditional coin offerings, which are primarily for utility tokens. This compliance provides greater security and trust for investors.

Examples of successful security token offerings

Bakkt, an issuance and management platform, successfully launched a security token offering for the St. Regis Aspen Resort, which allowed investors to purchase fractional ownership of the luxury resort, demonstrating the potential for real estate.

Security tokens in traditional finance

Traditional financial markets can also benefit from the introduction of this. Tokenizing stocks, bonds, and other financial instruments can increase liquidity, reduce costs, and improve transparency.

Security tokens vs. traditional securities

| Features | Security tokens | Traditional securities |

|---|---|---|

| Compliance | Securities compliance | Comply with existing regulations |

| Ownership | Provide ownership | Provide ownership |

| Liquidity | High, due to partial ownership | Lower and often less liquid |

| Transaction costs | Reduced thanks to blockchain | Parent, due to intermediary |

| Transparency | High due to blockchain technology | Low-level reliance on centralized records |

| Accessibility | High, partial investment is possible | Low, often high barriers to entry |

Conclusion

These assets represent a breakthrough in the interaction between traditional finance and blockchain technology. They increase liquidity, improve accessibility, and reduce costs, making them an attractive option for investors and issuers alike. As regulatory frameworks continue to evolve, the adoption of security tokens is expected to increase, paving the way for a more efficient and inclusive financial system.

This is not just a technological innovation, but a financial revolution that promises to democratize access to investment opportunities and reshape the global financial landscape. To capitalize on the potential of this, investors, regulators, and financial professionals need to stay informed about these developments.

FAQ

What is a security token?

A security token is a digital asset that represents ownership of a real-world asset, such as real estate, stocks, or bonds, and is secured on the blockchain.

How are security tokens different from utility tokens?

Security tokens represent ownership and are regulated as securities, while utility tokens provide access to a product or service and are generally not regulated as securities.

What are the advantages of security tokens?

Security tokens offer improved liquidity, greater accessibility, cost savings, and efficiency compared to traditional financial instruments.

Resources

- Investopedia. security token.

- TechTarget. Security token definition.

- Scorechain. Security tokens.

- Polymesh. Security token.

- Wallam. What is a security token in cryptocurrency?