The crypto world can feel overwhelming. New tokens appear every day, each claiming to solve a big problem. Somewhere between the noise and the hype, RXS Crypto has been gaining attention for a different reason. Instead of promising quick wins, it focuses on something more grounded: connecting digital tokens to real-world value.

I remember speaking with a colleague who had followed crypto for years but felt disconnected from most projects. “I understand the tech,” he said, “but I want to know what actually backs it.” That question sits at the heart of RXS Crypto. It’s not about speculation alone. It’s about ownership, access, and trust.

Understanding this concept matters because the industry is shifting. As cryptocurrency matures, projects that bridge digital systems with tangible assets are becoming more relevant. This guide explains RXS Crypto in plain language, without the confusion.

What is RXS Crypto

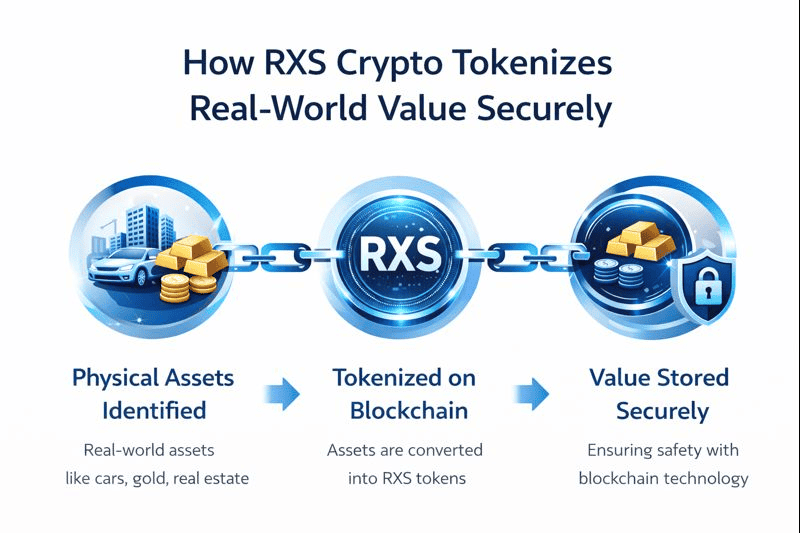

RXS Crypto is a digital asset designed to represent real-world assets on the Blockchain. Instead of existing purely as a virtual currency, it connects tokens to tangible or financial value, such as property, commodities, or structured financial instruments. You may also see it described as a real-world asset token or a tokenized value protocol, depending on its application.

Breaking Down RXS Crypto

To really understand, it helps to look at why it exists. Traditional finance relies on layers of intermediaries. Ownership records are kept in private databases, transfers take time, and access is often limited to those with capital or connections.

RXS Crypto takes a different approach. It uses tokenization to convert real-world assets into digital tokens. Each token represents a share of an underlying asset and is recorded on a decentralized ledger. This makes ownership easier to verify and transfer.

Imagine a large commercial property. Normally, investing in it requires legal contracts, brokers, and a significant upfront cost. With RXS, that same property can be divided into smaller digital units. Investors can buy a fraction instead of the whole thing. Ownership becomes flexible, and participation opens up.

Transparency is another important element. Transactions are visible and verifiable, which helps reduce disputes and fraud. In the broader Crypto Market, trust is a constant challenge, and public records play a major role in building confidence.

Efficiency also improves. Transfers that once took days or weeks can happen in minutes. Costs are lower, and settlement is faster. Rather than competing with every token in the Coin Market, RXS Crypto focuses on real utility and measurable value.

History of RXS Crypto

The ideas behind RXS Crypto developed as the crypto industry moved beyond experimentation. After early decentralized currencies like Bitcoin demonstrated that blockchain technology worked, attention shifted toward practical applications.

| Year | Key Development |

|---|---|

| 2021 | Interest in real-world asset tokenization increases |

| 2022 | Infrastructure and protocol concepts emerge |

| 2023 | Public visibility and exchange listings |

| 2024 | Expansion of use cases and ecosystem growth |

Types of RXS Crypto

Different forms of RXS Crypto exist to serve different purposes within digital asset ecosystems. Each type reflects how the token is structured and how value is delivered to users. Understanding these variations helps clarify where and how the token may be applied.

Asset-Backed RXS Crypto

Asset-backed RXS Crypto is directly tied to physical or financial assets such as real estate, commodities, or structured investments. Each token represents a verifiable share of an underlying asset, providing a clearer sense of intrinsic value. This structure often appeals to users seeking stability and real-world grounding.

Utility-Based RXS Crypto

Utility-based RXS focuses on functionality rather than asset ownership. These tokens are commonly used to access services, participate in governance, or pay for platform-related activities. Their value is driven by demand for the ecosystem rather than the assets themselves.

Hybrid RXS Crypto

Hybrid RXS Crypto combines elements of both asset-backed and utility-based models. It allows tokens to represent real-world value while also enabling platform interaction and services. This flexible structure supports long-term ecosystem growth and user engagement.

| Type | Core Purpose | Typical Use |

|---|---|---|

| Asset-Backed | Ownership | Investing |

| Utility-Based | Access | Platform use |

| Hybrid | Mixed | Long-term ecosystems |

How does RXS Crypto work?

RXS operates through smart contracts. These automated agreements execute predefined rules without manual oversight. When conditions are met, transfers occur automatically. This reduces reliance on intermediaries and increases efficiency, especially for global transactions.

Pros & Cons

Before engaging, it’s important to understand both its strengths and its limitations.

| Pros | Cons |

|---|---|

| Real-world value linkage | Regulatory uncertainty |

| Transparent ownership | Requires technical understanding |

| Fractional access | Market volatility |

Uses of RXS Crypto

The practical value of RXS Crypto becomes clearer when you look at how it’s applied in real-world scenarios. Rather than existing only as a tradable token, it is designed to support meaningful economic activity. Its use cases focus on accessibility, efficiency, and transparency across different sectors. These applications show how crypto can move beyond speculation and into everyday financial systems.

Real Estate Participation

One of the most talked-about its uses is in real estate tokenization. Properties can be divided into digital shares, allowing people to invest without purchasing an entire building. This lowers the barrier to entry and opens real estate markets to a much wider audience. It also improves liquidity, since tokenized property shares can be transferred more easily than traditional ownership stakes.

Cross-Border Transactions

International transactions are often slow, expensive, and dependent on multiple intermediaries. RXS Crypto helps streamline this process by enabling direct, peer-to-peer value transfers across borders. Transactions can settle faster and with fewer fees compared to traditional systems. This is especially useful for businesses and individuals operating in multiple countries.

Portfolio Diversification

Some users incorporate RXS Crypto into their portfolios as a way to balance digital assets with real-world value. Because the token is tied to tangible or structured assets, it may behave differently from purely speculative cryptocurrencies. This can help reduce overexposure to market swings in certain conditions. For long-term strategies, it offers an alternative approach to diversification.

Institutional Finance

Financial institutions are increasingly exploring tokenized assets to modernize their operations. RXS Crypto can be used to simplify settlement processes and reduce administrative overhead. Automated smart contracts help minimize errors and speed up transactions. Over time, this approach could reshape how institutions handle ownership, compliance, and asset management.