Have you ever wondered who controls the rhythm of an economy—the invisible hand that keeps inflation in check, encourages spending, or slows it down when needed? That’s the role of Monetary Policy. In the world of economic analysis, this concept stands as one of the most influential tools that governments and central banks use to steer national prosperity.

Think of it as a thermostat for the Economic System. When inflation heats up, central banks adjust interest rates to cool things down. When growth slows, they lower rates to spark spending and investment. Understanding Monetary Policy is essential for anyone who wants to grasp how economies evolve, survive recessions, and thrive after crises.

What is Monetary Policy?

At its core, Monetary Policy refers to the process by which a country’s central bank controls the supply of money and interest rates to achieve economic objectives like price stability and employment. It’s essentially the art of balancing growth and stability.

In simple terms, when an economy grows too quickly, prices rise. To prevent this, the central bank might increase interest rates, making borrowing costlier. Conversely, when an economy slows, the bank can cut rates to encourage spending and investment plans.

Breaking Down Monetary Policy

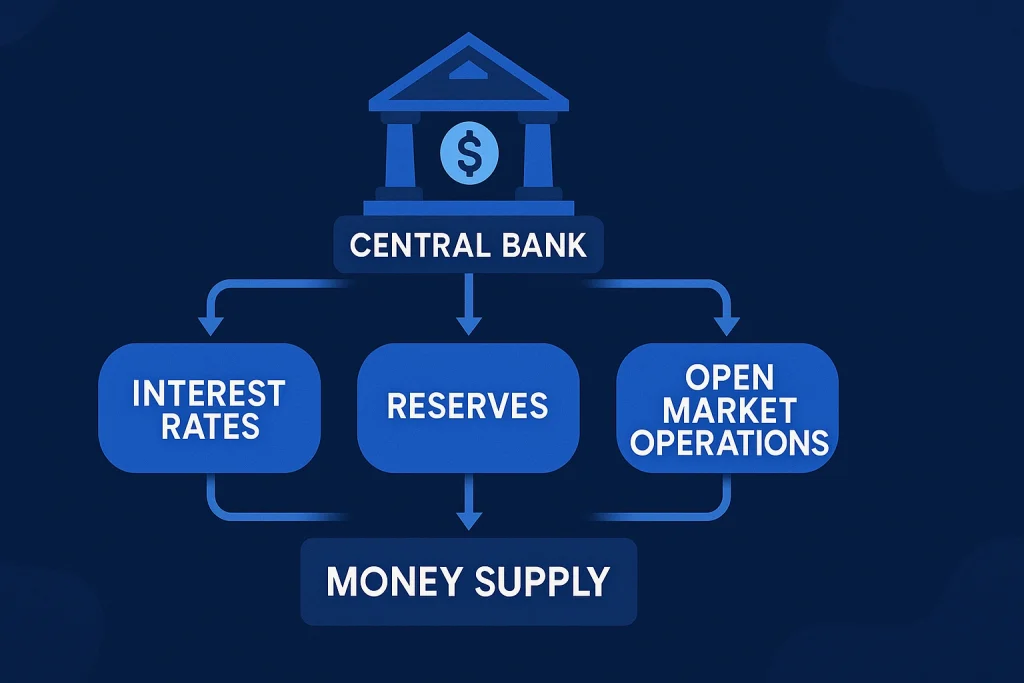

To better understand Monetary Policy, let’s break it into its main components. There are three primary levers: the interest rate, reserve requirements, and open market operations.

- Interest Rate Adjustments – This is the most common tool. By raising or lowering interest rates, central banks influence borrowing and saving behavior.

- Reserve Requirements – Banks are required to hold a portion of deposits as reserves. Changing this amount directly impacts how much money banks can lend.

- Open Market Operations – Central banks buy or sell government securities to influence liquidity in the financial system.

Imagine you’re planning your trading strategies or wondering about the Best stocks to buy. Each move the central bank makes affects your portfolio’s value. Whether rates rise or fall determines how much investors risk or save.

History of Monetary Policy

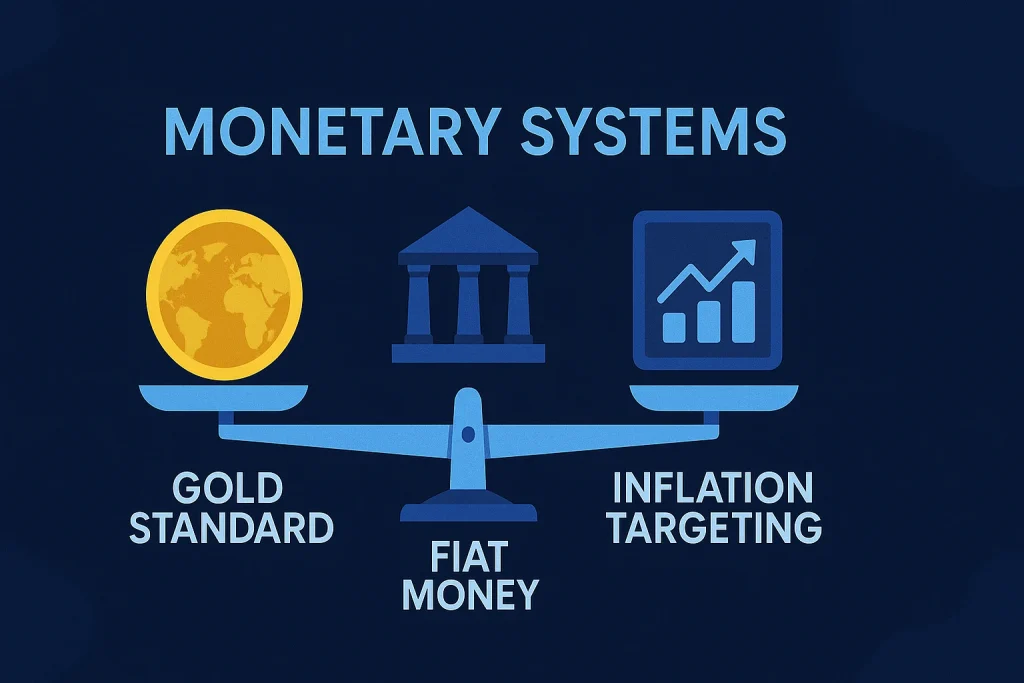

The story of Monetary Policy begins centuries ago. It evolved alongside the growth of banking systems and government institutions. In early economies, gold and silver defined currency value. However, the 20th century transformed this system with the establishment of modern central banks.

| Era | Key Development | Impact on Policy |

|---|---|---|

| 1600s–1800s | Gold Standard Era | Money value tied to gold; limited flexibility |

| Early 1900s | Creation of Central Banks | Enabled government control over money supply |

| 1940s–1970s | Bretton Woods System | Linked currencies to the U.S. dollar |

| 1980s–Present | Inflation Targeting | Central banks prioritize price stability |

The 2008 global market crash redefined how central banks respond to crises. It pushed policymakers to innovate—introducing measures like quantitative easing and forward guidance.

Types of Monetary Policy

Expansionary Monetary Policy

This type of Monetary Policy increases the money supply and lowers interest rates to boost economic activity. It’s commonly used during recessions to encourage borrowing, investment, and spending. For instance, after the 2020 global downturn, many central banks adopted this approach to reignite growth.

Contractionary Monetary Policy

The opposite strategy, contractionary policy, reduces the money supply and raises interest rates. It’s a measure used to control inflation or cool down an overheating economy. While it slows spending, it protects long-term stability.

Neutral Monetary Policy

Sometimes, central banks keep rates steady, maintaining equilibrium in the economy. This approach is common when growth and inflation are both within target ranges.

Each of these policies carries unique implications, shaping everything from job markets to currency values.

How Does Monetary Policy Work?

The process starts when a central bank—like the Federal Reserve or the European Central Bank—assesses economic indicators such as inflation, employment, and GDP growth. Once data suggests the economy needs adjustment, policymakers act.

- Assessment: Economists analyze trends in consumer prices, unemployment rates, and credit activity.

- Decision: Based on findings, the central bank decides to either stimulate or slow down the economy.

- Implementation: Interest rates are adjusted, or securities are bought or sold to influence liquidity.

- Transmission: These decisions impact commercial banks, businesses, and households.

- Outcome: Spending, investment, and inflation respond accordingly, often within months.

Through this mechanism, Monetary Policy acts like a pulse that regulates the flow of money through the economy, ensuring steady and sustainable growth.

Pros & Cons

Before diving deeper, it’s vital to understand both sides of Monetary Policy—its benefits and its drawbacks. Every economic decision made by a central bank carries consequences that ripple through businesses, consumers, and governments alike. When implemented wisely, monetary adjustments can stabilize markets, encourage spending, and sustain long-term growth. However, even a small misstep—such as tightening policy too early or keeping rates too low for too long—can trigger unintended effects, from inflation to reduced consumer confidence.

The beauty and challenge of Monetary Policy lie in its timing. Central banks must constantly analyze changing data, global events, and market psychology to strike the perfect balance. Too much stimulus, and inflation surges. Too little, and economies may stagnate. It’s like steering a massive ship—subtle changes take time to show results, and once the tide turns, reversing course isn’t easy. Understanding these pros and cons helps policymakers, investors, and everyday citizens appreciate why each monetary move is carefully calculated.

| Pros | Cons |

|---|---|

| Controls inflation effectively | May cause unemployment if over-tightened |

| Stimulates growth during recessions | Reduced savings due to low interest rates |

| Stabilizes currency value | Can lead to asset bubbles if prolonged |

| Enhances investor confidence | Loses impact when interest rates near zero |

Uses of Monetary Policy

The versatility of Monetary Policy makes it crucial across industries. It influences everything from consumer spending to corporate investments.

Banking and Finance

Banks depend on central bank policies to decide lending rates and manage liquidity. For example, lower rates encourage banks to extend more loans, stimulating economic activity.

Real Estate

Housing markets thrive under expansionary policy as low borrowing costs attract homebuyers and developers. However, this can sometimes inflate property prices.

Manufacturing and Exports

A stable Monetary Policy supports manufacturers by maintaining predictable interest rates and exchange rates, helping exporters remain competitive.

Stock Markets

Investors closely follow policy announcements. A hint of rate cuts can send markets soaring as confidence builds around cheaper borrowing.

Through all these sectors, Monetary Policy keeps economies flexible, adapting to shifting global conditions.

Resources

- Federal Reserve – Understanding the Federal Reserve’s Monetary Policy Tools.

- International Monetary Fund – How the IMF Supports Global Monetary Stability.

- European Central Bank – Insights on Eurozone Monetary Policy.

- Investopedia – Monetary Policy: Meaning, Types, and Tools

- World Bank – Global Financial Development Report 2019 / 2020