I still remember the first time Ondo Crypto came up in conversation. It wasn’t during a flashy launch or a viral tweet. It was in a quiet Discord channel where people were talking seriously about risk, yield, and how tiring it can be to constantly chase returns in crypto. That stuck with me. When something gets discussed calmly in a space known for noise, it usually means it’s worth paying attention to.

In the broader cryptocurrency landscape, it represents a shift toward maturity. Instead of pushing everyone toward the same high-risk strategies, it introduces structure and choice. That matters because not everyone wants to gamble their capital. Some people want stability. Others want calculated exposure. Understanding it helps you see how decentralized finance is evolving beyond experimentation and into something that resembles real financial planning. If crypto is going to grow, concepts like this will be part of the foundation.

What is Ondo Crypto

Ondo Crypto is a decentralized finance protocol that offers structured financial products on-chain. In simple terms, it allows users to choose different risk and return profiles when participating in DeFi strategies. These products are created through smart contracts and represented by tokens, making them transparent and programmable.

You may also see Ondo Crypto referred to as Ondo Finance. The terms are often used interchangeably, but Ondo Finance is the organization and ecosystem, while the cryptocurrency usually points to the protocol and its tokenized products.

Breaking Down Ondo Crypto

To really understand, it helps to forget buzzwords for a moment and think about how people actually use money. In traditional finance, investors are rarely treated the same. Some accept low returns in exchange for safety. Others accept higher risk for higher reward. Crypto, for a long time, ignored this reality.

Ondo Crypto changes that by introducing structured products that separate risk into tranches. Each tranche represents a different strategy. Conservative users can choose stability-focused options, while aggressive users can opt for higher potential returns.

What makes this possible is Blockchain technology. Smart contracts handle everything automatically. There’s no human deciding who gets paid first or how funds are allocated. The rules are written into code and visible to everyone. That transparency builds confidence, especially in a system that operates without traditional intermediaries.

Imagine a pool of assets generating yield. Instead of splitting profits evenly, Ondo Crypto divides outcomes based on risk preference. One group receives more predictable returns. Another group absorbs volatility. This structure allows users to participate without constantly monitoring charts or reacting emotionally to market swings.

This design has made Ondo Crypto appealing during unstable periods in the Crypto Market. When prices move fast and sentiment shifts quickly, having predefined outcomes can reduce stress and poor decision-making. It also positions Ondo as a bridge between decentralized innovation and the structured logic of traditional finance.

History of Ondo Crypto

The origins trace back to a simple frustration: decentralized finance was powerful, but chaotic. Early DeFi rewarded those willing to accept extreme risk, leaving cautious users behind.

The team behind Ondo Finance came from traditional finance backgrounds. They understood structured products, risk tranching, and institutional-grade tools. Their goal was to bring those concepts on-chain without compromising decentralization.

Ondo Crypto emerged as DeFi began moving past basic lending protocols and into more complex financial engineering. Its timing mattered. Users were ready for something more thoughtful.

| Year | Development Milestone |

|---|---|

| 2021 | Initial concept and research |

| 2022 | First structured products launched |

| 2023 | Expansion into tokenized real-world assets |

| 2024 | Broader adoption across DeFi platforms |

Types of Ondo Crypto

Ondo Crypto is not a single product. It’s a framework that supports multiple variations, each serving a different purpose.

Fixed Yield Products

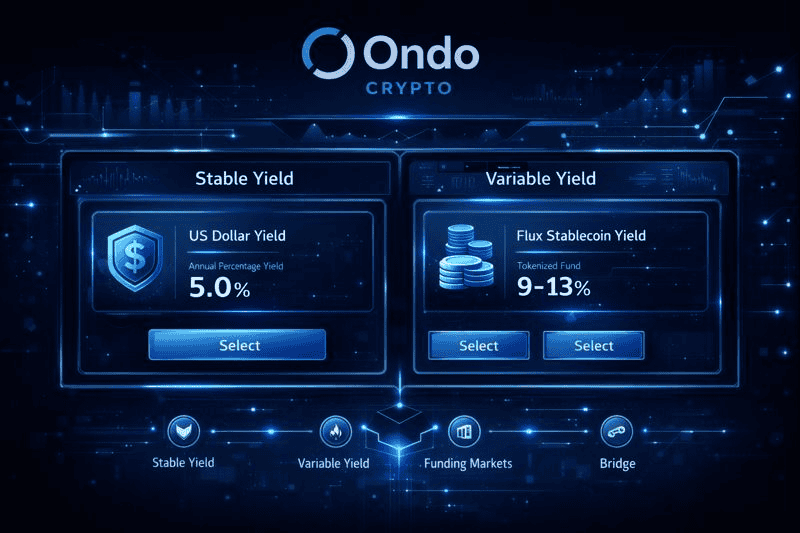

Fixed yield products in Ondo Crypto are designed for users who value predictability over high returns. These products aim to deliver steady outcomes by prioritizing stability within the protocol’s structure. They appeal to conservative participants who want exposure to decentralized finance without constantly worrying about market swings. By limiting volatility, fixed yield options help users plan with greater confidence.

Variable Yield Products

Variable yield products within Ondo Crypto target users who are comfortable taking on more risk for the chance of higher rewards. Returns fluctuate based on market conditions and protocol performance, which can lead to stronger gains during favorable periods. These products suit active participants who understand volatility and are willing to accept uncertainty. For many, this option offers a more dynamic way to engage with decentralized finance.

Tokenized Real-World Asset Products

Tokenized real-world asset products expand Ondo Crypto beyond purely digital markets by linking on-chain strategies to off-chain assets. This approach introduces diversification that is often missing in traditional DeFi setups. Users gain exposure to assets influenced by real economic activity while still benefiting from blockchain transparency. These products are especially attractive to those seeking balance between innovation and familiar financial structures.

| Type | Risk Profile | Ideal User |

|---|---|---|

| Fixed Yield | Low | Risk-averse users |

| Variable Yield | High | Yield-focused users |

| Real-World Assets | Medium | Balanced investors |

How does Ondo Crypto work?

At a technical level, Ondo Crypto works through smart contracts that pool user funds and allocate them based on predefined rules. When users deposit assets, they receive tokens representing their chosen tranche. These tokens reflect both ownership and risk exposure.

Because everything is automated, there’s no manual intervention. Users can enter or exit positions based on protocol rules, often without needing permission. This approach fits seamlessly into the broader DeFi ecosystem and allows integration with other platforms.

Pros & Cons

Before using Ondo Crypto, it’s important to understand both sides of the equation.

| Pros | Cons |

|---|---|

| Structured risk management | Smart contract vulnerabilities |

| Transparent on-chain logic | Requires learning curve |

| Appeals to institutional users | Dependent on market conditions |

Uses of Ondo Crypto

The real value of Ondo Crypto becomes clear when you look at how it’s used in practice. It’s not just theoretical. People rely on it for real financial decisions.

Portfolio Risk Management

Many users turn to Ondo Crypto to smooth out volatility in their portfolios. During turbulent periods driven by assets like Bitcoin, structured exposure can help reduce emotional decision-making.

Yield Strategy Design

Instead of chasing the highest APY, users can design strategies aligned with personal goals. Ondo Crypto allows for yield generation without constant repositioning.

Institutional Testing Ground

Institutions exploring DeFi often prefer familiar structures. Ondo Crypto provides a way to experiment within a framework that mirrors traditional finance logic while remaining decentralized.

Long-Term Capital Planning

For users focused on sustainable growth rather than speculation, Ondo Crypto supports disciplined Investment approaches that prioritize planning over hype.

Resources

- Binance Academy. What Is Ondo (ONDO)?

- Bitstamp. What Is Ondo Finance?

- CoinMarketCap. What Is Ondo Finance?

- CoinRabbit Blog. What Is Ondo Crypto and How to Use It

- OctoBot. What Is Ondo?