Cryptocurrency is changing the way people think about investing. Among the hottest topics in this space is the Ethereum ETF. If you’ve ever felt lost in the world of crypto, you’re not alone. These ETFs are making Ethereum investment easier for everyday people.

Instead of buying and storing Ethereum, an ETF lets investors gain exposure without the hassle of managing digital wallets. This makes it an attractive option for both beginners and experienced traders. As interest in crypto grows, so does the demand for regulated and accessible investment options.

Ethereum ETFs offer a bridge between traditional finance and blockchain technology. But what exactly are they, and how do they work? Let’s break it down.

What is an Ethereum ETF?

An Ethereum ETF (Exchange-Traded Fund) is a financial product that tracks the price of Ethereum. Instead of buying Ethereum directly, investors buy shares in the ETF, which represents Ethereum’s value.

These ETFs trade on traditional stock exchanges, just like regular stocks. Investors can buy and sell shares throughout the day without needing to handle the complexities of crypto wallets.

Some ETFs hold actual Ethereum, while others use futures contracts to track its price. Either way, the goal is to provide investors with exposure to Ethereum without the risks of direct ownership.

Breaking Down Ethereum ETF

Ethereum ETFs take the complexity out of crypto investing. Instead of dealing with private keys and digital wallets, investors can buy shares of an ETF that tracks Ethereum’s price. This makes Ethereum more accessible to everyday traders and large institutions alike.

Key Components

- Underlying Asset: Some ETF hold actual Ethereum, while others track futures contracts that predict its price movements.

- Stock Exchange Trading: Unlike cryptocurrencies, which trade on decentralized exchanges, trade on regulated stock markets like the NYSE or Nasdaq.

- Fund Management: A financial institution manages the ETF, handling asset purchases, security, and compliance with regulations.

Why It’s Important

For years, investing in Ethereum required technical knowledge and a secure way to store crypto. Ethereum ETFs solve this problem. They offer a way to gain exposure to Ethereum without needing to navigate the complexities of blockchain transactions. This is why institutional investors and traditional traders are increasingly drawn to these funds.

Ethereum ETFs also introduce more stability into the investment space. They allow investors to participate in Ethereum’s growth while benefiting from the protections and regulations of traditional financial markets.

History of Ethereum ETF

Ethereum ETFs have been in development for years. While Bitcoin ETFs received attention first, IT followed closely behind.

| Year | Event |

|---|---|

| 2017 | First proposals submitted |

| 2021 | Canada approves first Ethereum ETFs |

| 2023 | U.S. regulators consider multiple applications |

| 2024 | Growing anticipation for Ethereum ETF approval in major markets |

These milestones reflect increasing interest from both retail and institutional investors.

How Does Ethereum ETF Work?

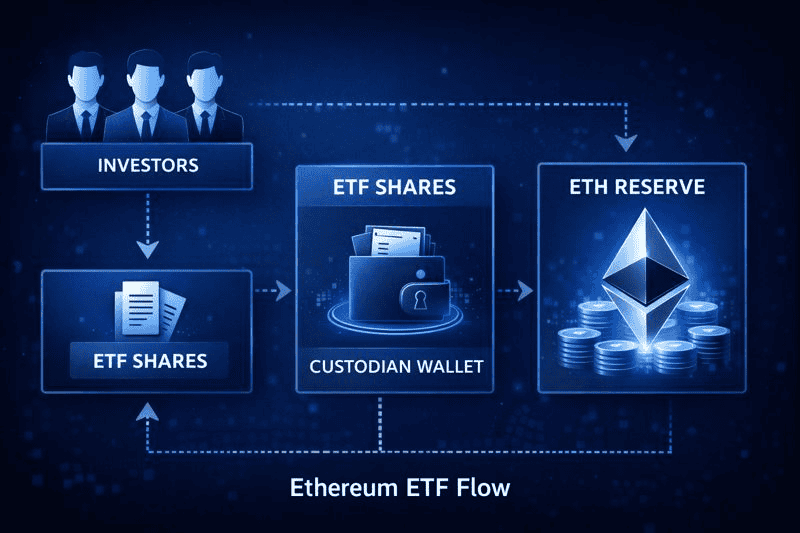

Ethereum ETFs function like traditional exchange-traded funds, allowing investors to buy and sell shares that track Ethereum’s price. These ETFs either hold actual Ethereum or use futures contracts to mirror price movements.

When you invest, you’re not buying Ethereum directly. Instead, the fund manages the assets for you, eliminating the need to store crypto in a digital wallet. Shares of the ETF trade on regulated stock exchanges, making it easy for traditional investors to gain exposure to Ethereum without navigating the complexities of blockchain technology.

For spot ETFs, the fund purchases and holds Ethereum on behalf of investors. With futures ETFs, the fund invests in contracts that speculate on Ethereum’s future price. Regardless of the type, Ethereum ETFs provide a simpler and more accessible way to invest in the growing crypto market.

Types of Ethereum ETF

Not all are the same. Depending on their structure, they can offer different benefits and risks. Here are the main types of Ethereum ETFs and how they work:

Spot Ethereum ETF

This type directly holds Ethereum, meaning the fund buys and stores the asset on behalf of investors. This makes it the most straightforward way to gain exposure to Ethereum’s price movements without having to manage a digital wallet. Since the fund actually owns Ethereum, its price closely follows the market. However, regulatory challenges have made approval for these ETFs difficult in certain regions.

Ethereum Futures ETF

This type, on the other hand, does not hold Ethereum itself but instead tracks the price through futures contracts. These contracts speculate on Ethereum’s future value, allowing investors to gain exposure without directly owning the asset. This ETF type is often more accessible due to lighter regulations, but it can be riskier due to price discrepancies between the futures market and actual Ethereum prices.

Actively Managed Ethereum ETF

This kind is run by professional fund managers who make strategic investment decisions based on market trends. Unlike passive ETFs, which simply follow Ethereum’s price, this type aims to maximize returns by adjusting holdings dynamically. While this offers the potential for higher gains, it also comes with increased fees and the risk of underperformance compared to standards.

Ethereum Staking ETF

An Ethereum Staking ETF includes Ethereum that is actively staked within the blockchain network to earn staking rewards. Investors benefit not only from Ethereum’s price movements but also from passive income generated through staking. However, staking requires assets to be locked up for a period, which could limit flexibility in volatile markets.

| ETF Type | How It Works | Key Advantage | Potential Risk |

|---|---|---|---|

| Spot Ethereum ETF | Holds actual Ethereum | Direct exposure to price | Regulatory hurdles & storage costs |

| Ethereum Futures ETF | Tracks Ethereum futures contracts | No need to store Ethereum | Price discrepancies & volatility |

| Actively Managed ETF | Fund managers buy & sell Ethereum assets | Professional strategy | Higher management fees |

| Ethereum Staking ETF | Holds staked Ethereum to earn rewards | Passive income from staking | Lock-up periods & fluctuating rewards |

Pros & Cons

| Pros | Cons |

|---|---|

| Easy Access: Investors can buy and sell ETFs like stocks. | Management Fees: ETFs charge fees for managing assets. |

| Regulated Investment: ETFs are overseen by financial regulators, reducing fraud risks. | Indirect Ownership: Investors don’t hold Ethereum directly. |

| No Need for Crypto Wallets: Investors avoid security concerns related to digital wallets. | Market Volatility: Ethereum’s price can be unpredictable. |

Uses of Ethereum ETF

Long-Term Investment

Ethereum ETFs help investors hold Ethereum for the long term without managing digital wallets. They offer a regulated way to invest, making them safer than direct crypto purchases. Many investors believe Ethereum will grow in value, making ETFs a smart option. With fewer risks and easier access, they are great for long-term strategies.

Portfolio Diversification

Investors use Ethereum ETFs to add variety to their portfolios. Crypto does not always move with stocks or bonds, which helps balance risk. Since ETFs trade on stock exchanges, they are easier to buy and sell than actual Ethereum. This makes them a simple way to add crypto exposure to an investment mix.

Institutional Investing

Big financial companies use Ethereum ETFs to invest in crypto without holding Ethereum directly. These ETFs follow regulations, making them safer for large investors. They also remove security risks like hacking or lost private keys. Because of this, many institutions prefer ETFs over direct crypto investments.

Resources

- Bankrate. Ethereum ETFs

- The Motley Fool. Ethereum ETFs Explained

- NerdWallet. Guide to Ethereum ETFs

- KuCoin. Ethereum ETF: Everything You Need to Know

- ETF.com. Investing in Ethereum ETFs