If you’ve ever wondered how traders manage to buy and sell stocks, crypto, or even currencies in a single day and actually make a profit, you’re not alone. Many curious investors have searched for the answer to what is day trading, and the buzz around it keeps growing. In the world of fast-moving markets, it represents a unique style of investing that is all about speed, timing, and precision. Unlike long-term investing, where you hold assets for years, this strategy is about opening and closing positions within hours—or even minutes.

Understanding isn’t just for Wall Street pros. It’s increasingly relevant for everyday people, thanks to online platforms, advanced technology, and access to real-time data. Whether you’re simply curious or thinking about trying it yourself, knowing the definition, strategies, and risks of what is day trading can help you navigate this high-stakes arena with a clearer perspective.

What is Day Trading?

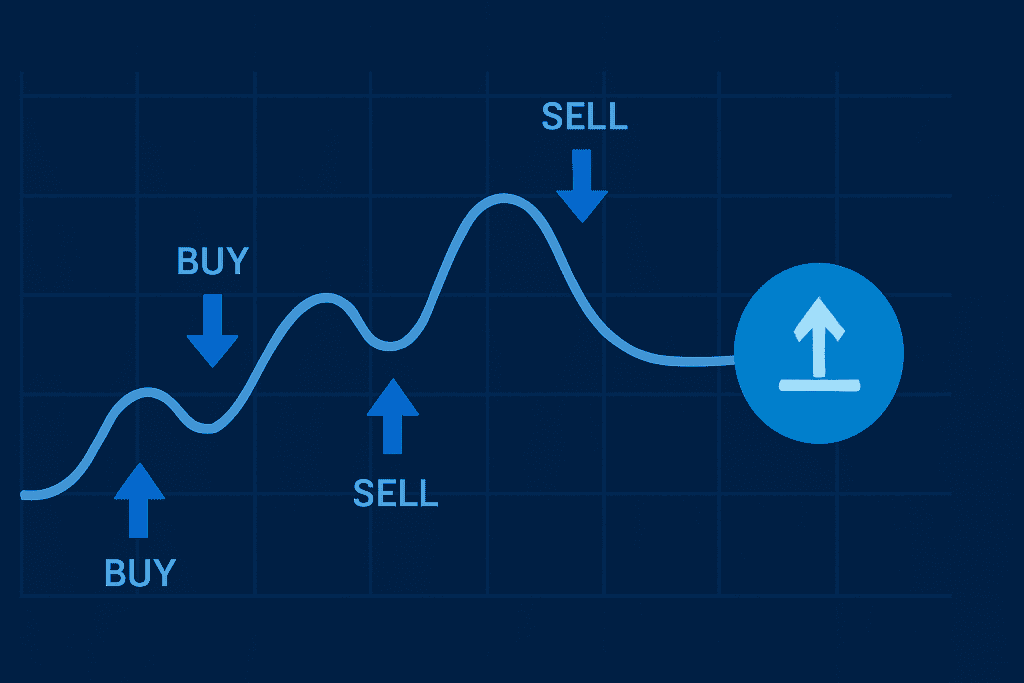

At its simplest, it can be defined as buying and selling financial instruments within the same day, with the goal of profiting from short-term price movements. This means no positions are held overnight—traders close out everything before the market closes to avoid unexpected changes.

In financial circles, you might also hear terms like intraday trading or short-term speculation used as synonyms. All of them point back to the same concept: a style of trading that prioritizes rapid decision-making, technical analysis, and managing risks in real time.

So, what is it really? It’s the practice of riding the market’s smallest waves and turning them into profit opportunities—often multiple times in a single trading session.

Breaking Down Day Trading

Now that we’ve defined what is day trading, let’s break it down into its core parts. At its heart, day trading involves three key components: timing, strategy, and psychology.

Timing

Imagine you’re surfing. To catch the wave, you have to paddle at exactly the right moment. That’s what day traders do with price movements. They use charts, technical indicators, and news events to predict short-term moves and act instantly.

Strategy

Understanding what it is also means knowing there’s more than one way to approach it. Some traders rely on scalping (making tiny profits repeatedly), others on momentum trading (jumping on fast-moving trends), while some prefer range trading (buying low and selling high within a set price band).

Psychology

Here’s a personal anecdote: when I first tried to understand it, I realized the hardest part wasn’t the math—it was keeping my emotions in check. One bad decision fueled by fear or greed can wipe out hours of careful planning. Successful traders often say discipline is more important than strategy.

History of Day Trading

The roots go back to the late 20th century when electronic markets and the internet made real-time trading possible for ordinary people. Before then, intraday trading was largely the domain of professional brokers on exchange floors.

As online platforms grew, individual traders gained access to tools, charts, and data once reserved for institutions, sparking a new wave of retail participation. This democratization of trading not only changed how markets operated but also gave rise to today’s vibrant community of day traders, each leveraging technology to compete in fast-paced financial markets.

| Period | Development in What is day trading |

|---|---|

| Pre-1990s | Limited to institutional traders and brokers |

| 1990s | Online trading platforms emerge, opening access |

| 2000s | Popularity grows with the dot-com boom |

| 2010s–2020s | Mobile apps and crypto expand opportunities globally |

Types of Day trading

Scalping

This is the quickest form, where traders aim for tiny profits multiple times a day. Scalpers rely heavily on speed, precision, and liquidity, often using advanced tools or algorithms to enter and exit positions within minutes—or even seconds.

Momentum Trading

Riding strong price moves, often triggered by news or earnings reports. Momentum traders look for stocks with high volume and strong directional trends, hoping to capture gains before the move fades. It’s high risk, but also potentially high reward.

Range Trading

Buying and selling within predictable highs and lows. Traders identify support and resistance levels, profiting from oscillations between these points. Range trading works well in stable markets where prices move sideways.

News-Based Trading

Capitalizing on sudden market reactions to breaking news. Traders monitor headlines closely, ready to act on surprises like mergers, policy changes, or global events. This strategy demands quick decision-making, as opportunities often vanish as fast as they appear.

How does Day Trading work?

In practice, works by using tools like candlestick charts, moving averages, and trading platforms that allow instant execution. Traders monitor price action throughout the day, looking for entry and exit signals. They often use stop-loss orders to limit risks and may rely on margin accounts to amplify their positions.

Pros & Cons

| Pros | Cons |

|---|---|

| Quick profits from intraday movements | High risk of losses with leverage |

| No overnight risk exposure | Requires constant attention |

| Multiple opportunities per session | Emotionally and mentally draining |

| Accessible via online platforms | High fees and commissions possible |

Uses of day trading

So where is day trading actually used? Across industries and markets, this strategy plays a vital role. Traders apply it in:

Stocks

Fast-moving equities, often driven by earnings reports, breaking news, or technical setups, can deliver quick intraday profits. Traders frequently target high-volume stocks because liquidity makes it easier to enter and exit positions without significant slippage.

Forex

With its 24-hour cycle spanning global sessions in Asia, Europe, and the U.S., it provides nearly constant action. Currency pairs like EUR/USD or GBP/JPY often display sharp intraday movements influenced by macroeconomic news, interest rate announcements, and geopolitical developments.

Crypto

Cryptocurrencies have become one of the most exciting arenas for day traders. High volatility in assets like Bitcoin, Ethereum, and altcoins translates to both high profit potential and elevated risk. Price swings can be triggered by anything from a regulatory update to a single tweet, which means traders must stay alert and nimble.

Regulation and Risk

It’s not just about potential profits—there’s also the very real possibility of losses, sometimes substantial ones, especially for new traders who lack experience. Authorities often remind participants of the importance of proper education, financial planning, and understanding margin requirements before diving in.

Strategy & Tools

Success in day trading doesn’t depend on luck—it requires well-defined strategies and reliable tools. Popular approaches include range trading, momentum trading, and breakout strategies.

Resources

- Investopedia: Day Trading Techniques,

- Corporate Finance Institute: Day Trading Strategies

- MarketWatch: Day Trading Guide

- Investor.gov: Day Trading Insight

- Capital.com: Day Trading Common Mistakes