The first time I heard someone casually say “just buy it on a CEX,” I remember thinking I had missed a memo. Everyone else seemed fluent in crypto slang, while I was still figuring out wallets and blockchains. If that sounds familiar, you’re not alone. The crypto world moves fast, and terms often get thrown around without much explanation.

In cryptocurrency, a CEX plays a major role in how most people enter the market. It’s often the first place users buy Bitcoin, trade tokens, or check prices. Understanding how it works isn’t just helpful, it’s essential. It affects how your money is stored, who controls it, and what risks you’re taking on. Whether you’re brand new or already trading, knowing this concept can help you make smarter decisions and avoid costly mistakes.

What is CEX?

A CEX is short for centralized exchange. It refers to a cryptocurrency trading platform operated by a company that manages transactions, user accounts, and asset custody. Instead of trading directly with another person, users trade through the platform, which acts as an intermediary.

Common variations of the term include “centralized crypto exchange” or simply “crypto exchange,” though not all exchanges are centralized by default.

Breaking Down CEX

To really understand a CEX, it helps to compare it to something familiar. Think of an online stock brokerage. You create an account, deposit money, place orders, and rely on the company to execute trades and keep records. A centralized crypto exchange works in much the same way.

When you sign up, the platform creates an internal wallet for you. This wallet holds your funds, but the private keys are controlled by the exchange. That’s a key difference from self-custody wallets. For beginners, this setup feels intuitive. You log in with a username and password, reset credentials if needed, and contact support if something goes wrong.

Liquidity is another defining feature. Because large numbers of users trade on these platforms, buy and sell orders are matched quickly. This makes pricing more stable and reduces slippage during volatile market conditions. It’s one reason traders often prefer a CEX for frequent transactions.

Centralized exchanges also handle compliance. Identity verification, transaction monitoring, and reporting are part of their responsibility. While this reduces anonymity, it also introduces accountability and consumer protections that many users appreciate.

However, centralization creates a single point of failure. If systems are compromised, users may be exposed to Hacking attempts or broader Cyber Threats. This is why security practices, cold storage, and transparency matter so much when choosing a platform.

Despite the trade-offs, these exchanges remain the most widely used gateway into cryptocurrency because they prioritize usability, speed, and familiarity.

History of CEX

The concept of a CEX developed out of necessity. Early crypto users traded peer-to-peer on forums, which was risky and inefficient. As interest grew, centralized platforms emerged to organize trading and improve trust.

| Year | Development |

|---|---|

| 2010 | First Bitcoin exchanges launched |

| 2013 | Global adoption expands |

| 2017 | Retail trading boom |

| 2020–Present | Increased regulation and security |

Types of CEX

Not every CEX serves the same purpose. Different types exist to meet different user needs.

Fiat-to-Crypto Exchanges

Fiat-to-crypto exchanges are often the entry point into cryptocurrency. These platforms allow users to buy digital assets using traditional money such as dollars, euros, or pounds. Bank transfers, debit cards, and sometimes even payment apps are supported, making the process feel familiar to anyone who has used online banking before.

This type of CEX focuses heavily on ease of use. Interfaces are clean, instructions are guided, and educational prompts are common. Identity verification is usually required, which can feel like a hassle, but it also provides a sense of legitimacy and accountability. For beginners, this trade-off is often worth it because it reduces confusion and errors during early transactions.

Crypto-to-Crypto Exchanges

Crypto-to-crypto exchanges are designed for users who already own digital assets and want to trade between them. Instead of converting fiat money, users deposit crypto and exchange it for other tokens. These platforms typically offer a much wider selection of assets and trading pairs.

A CEX in this category often appeals to more active traders. Advanced charting tools, order types like stop-loss and limit orders, and faster execution speeds are common features. While they may look intimidating at first, they offer greater flexibility for users who want more control over their trading strategies.

Hybrid Centralized Exchanges

Hybrid exchanges aim to combine the best elements of centralized convenience with features inspired by decentralized systems. These platforms still operate as a CEX, but they may offer enhanced transparency, partial user control over assets, or improved security structures.

For users who want ease of use without fully giving up control, hybrid exchanges can feel like a middle ground. They’re especially attractive to those who have grown comfortable with crypto but still value customer support, compliance, and reliability.

| Type | Key Feature | Best For |

|---|---|---|

| Fiat-to-Crypto | Easy onboarding | Beginners |

| Crypto-to-Crypto | Many trading pairs | Active traders |

| Hybrid | Mixed features | Intermediate users |

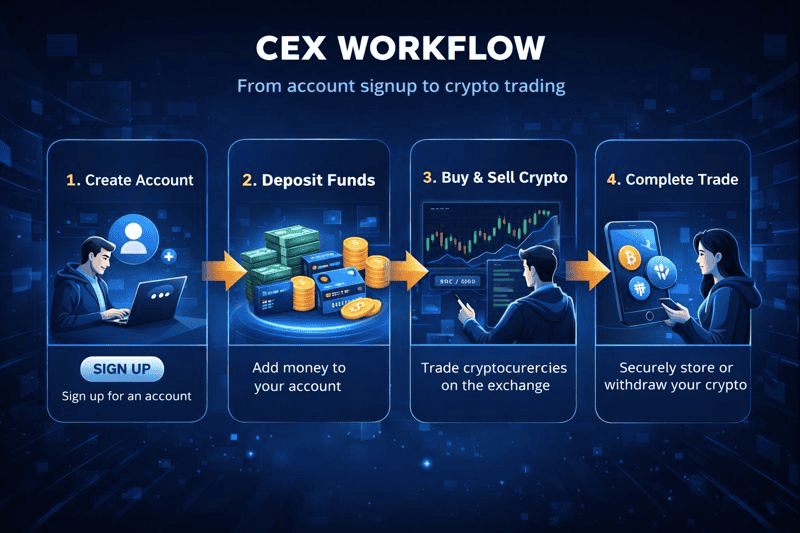

How does CEX work?

A CEX uses an internal order book system. Users place buy or sell orders, and when prices match, the trade executes automatically. The platform manages fees, confirmations, and custody while users interact through apps or web dashboards.

Pros & Cons

Before using a CEX, it’s worth understanding both sides.

| Pros | Cons |

|---|---|

| User-friendly interface | Custody risk |

| High liquidity | Identity checks |

| Customer support | Platform dependency |

Uses of CEX

A CEX is more than just a trading venue. It plays several practical roles in the crypto ecosystem.

Buying and Selling Digital Assets

This is the most common use. Users convert fiat into crypto or cash out profits with relative ease.

Trading and Investment Strategies

From long-term holding to short-term speculation, traders rely on charts, indicators, and order types available on centralized platforms.

Portfolio Tracking

Many exchanges offer built-in analytics, helping users track performance and balances across assets.

Education and Market Awareness

Established exchanges also act as trust anchors when misinformation spreads through Deepfakes or fake promotions. Still, users should remain cautious, especially after a Windows Update or when accessing accounts on public networks, even while using tools like Express VPN.

Resources

- Corporate Finance Institute. Cryptocurrency Exchanges.

- Britannica. Centralized vs Decentralized Crypto.

- Google Play Store. CEX.IO App Overview.

- CoinMarketCap Academy. Centralized Exchange (CEX).

- Bitcoin.com. What Is a CEX?.