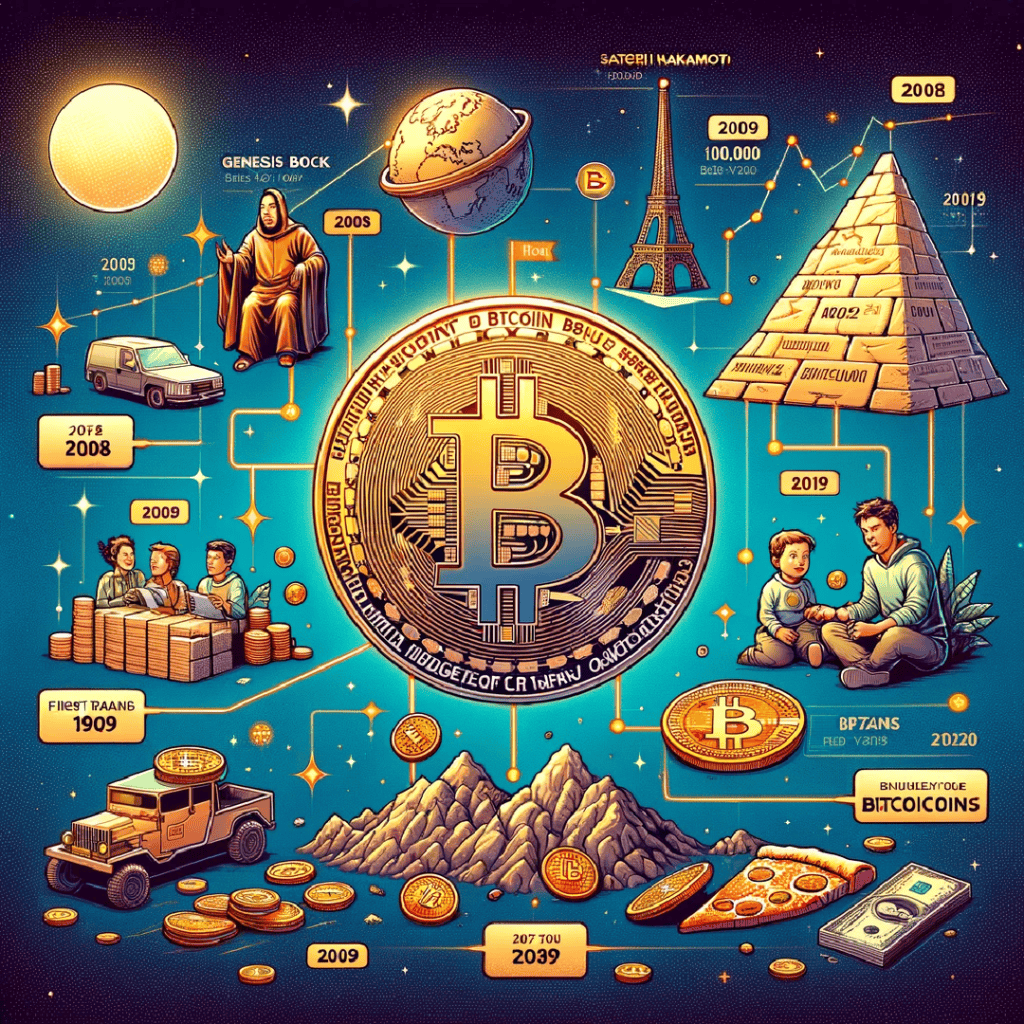

Bitcoin, the first cryptocurrency to utilize blockchain technology, debuted in 2008 when an anonymous developer known as Satoshi Nakamoto introduced it through the white paper “Bitcoin: A Peer-to-Peer Electronic Cash System.” On January 3, 2009, it is officially launched with the mining of the genesis block. This block contained the message, “The Times Jan/03/2009 Chancellor on brink of second bailout for banks,” widely interpreted as a critique of the financial crisis and bank bailouts. This marks a major turning point in the history of digital currencies, revolutionizing the financial system.

Prior to this, there were digital currency systems that operated through centralized servers, but these systems suffered from security and reliability issues due to their centralized nature. This, on the other hand, introduced the blockchain, a distributed ledger technology that records all transactions on a decentralized network, allowing it to be trusted without a central authority. This replaced the role of intermediaries in financial transactions and created an environment where users could conduct transactions directly.

This also acts as a hedge against inflation, with the supply limited to 21 million units, playing an important role in maintaining the scarcity of digital assets. This scarcity has positioned Bitcoin as a store of value.

In conclusion, it was the first cryptocurrency built on blockchain technology, laying the foundation for the new digital economy by decentralizing the financial system and increasing transparency. It challenged the existing financial structure, paved the way for individuals to more securely manage their assets, and spurred interest and research in digital assets around the world.

History by major events and years

2010:

- First transaction: The first real-world transaction took place on May 22, 2010, when Laszlo Hanyecz bought two pizzas with 10,000 bitcoins. The day is since celebrated as “Bitcoin Pizza Day.

- Protocol vulnerability: On August 6, 2010, someone discovered a major vulnerability in the Bitcoin protocol; it was exploited on August 15 but immediately fixed, causing the blockchain to diverge.

2011:

- Price spikes: Bitcoin’s price has been volatile, spiking from $1 to $32 and then plummeting to below $2.

- Other cryptocurrencies emerge: Other cryptocurrencies have begun to emerge based on Bitcoin’s open source code.

2013:

- The first major price increase: Bitcoin’s price rose to $220, then dropped back to $70, before reaching $1,200 in December.

2014:

- Mt. Goxhack: Mt. Gox, the largest bitcoin exchange at the time, was hacked and 850,000 bitcoins were stolen. The incident sent shockwaves through the bitcoin community.

2017:

- All-time high: Bitcoin’s price hits arecord high, reaching $19,783. The year also saw a hard fork called Bitcoin Cash.

2020-2021:

- The surge during the pandemic: During the COVID-19 pandemic, Bitcoin gained traction as a safe haven asset, and its price surged, reaching over $60,000 in April 2021.

Why is Bitcoin important?

Bitcoin is an important technology for many reasons.

- Decentralization: Because this doesn’t rely on a central government or financial institution, no country or organization can control it, which is especially important in countries with political instability.

- Censorship resistance: It has censorship-resistant properties. For example, when protesters in Nigeria protesting government human rights abuses had their bank accounts frozen, they were able to continue raising funds through Bitcoin because it allows for direct transactions without third-party intervention.

- Cross-border remittances: It makes it cheaper and faster to send money internationally. For example, El Salvador has adopted Bitcoin as its official currency, allowing El Salvadorans living in the United States to send money quickly and at a lower cost.

- Inflation hedge: Bitcoin is inflation-resistant due to its fixed supply (21 million). This is in contrast to traditional fiat currencies, where central banks can print currency and cause inflation.

References

- CoinDesk. What is Bitcoin?

- BitBox. Why is Bitcoin Important?

- iHosting Blog. Why is Bitcoin Important: Complete Theory Guide to Bitcoin

- Wikipedia

- Cointelegraph

- History Cooperative

- The Street