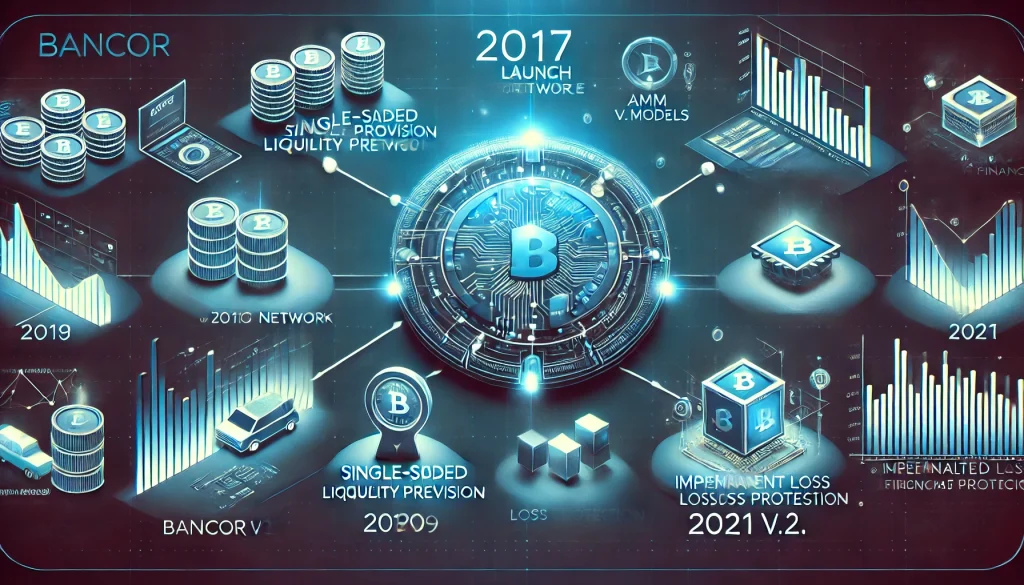

Bancor is a well-known name in the world of cryptocurrency and decentralized finance (DeFi). This is one of the first decentralized liquidity protocols. It allows users to swap different cryptocurrencies directly from their wallets without using a traditional exchange. Launched in 2017, the Bancor Network introduced smart contracts and liquidity pools to the DeFi space. This innovation changed how crypto assets are traded and managed.

What is Bancor?

Bancor is a decentralized liquidity protocol built on blockchain technology. It allows users to trade different cryptocurrencies without a counterparty, unlike traditional trading. The Bancor protocol uses smart contracts to manage automated market makers (AMMs). This enables quick and seamless conversions between tokens. The Bancor Network Token (BNT) is central to this system. It acts as an intermediary, allowing users to swap any token within the network.

Unlike centralized exchanges that match buyers and sellers, Bancor relies on liquidity pools. These are pools of various tokens that anyone can add to or withdraw from. The system always ensures liquidity, so trades happen immediately without the risk of price slippage. This approach has made it a key player in the DeFi ecosystem, especially for trading lesser-known or low-volume tokens.

Background of Bancor

The Bancor Network was created to solve a big problem in cryptocurrency: the lack of liquidity for many tokens. Liquidity means how easily an asset can be bought or sold without changing its price. Traditional exchanges often struggle to provide enough liquidity, especially for less-traded tokens.

Bancor’s solution is its use of automated market makers (AMMs). AMMs set token prices based on the ratio of assets in a pool. When a user swaps one token for another, the AMM adjusts the price based on supply and demand. This allows swaps without needing a direct buyer or seller. The BNT token is important here. It acts as a bridge between different liquidity pools and makes it easier to swap tokens without direct trading pairs.

This model model is simple and efficient. It removes middlemen and uses smart contracts. This creates a more decentralized financial system. Any user can add liquidity and earn fees, making finance more accessible and providing more opportunities globally.

It also introduced single-sided liquidity. This lets users provide liquidity with just one token, not pairs. It reduces complexity and risk for providers. It also offers impermanent loss protection. This feature helps providers avoid losses when token prices change—a long-standing issue in DeFi.

History of Bancor

| Period | Event |

|---|---|

| 2017 | Bancor Network launched as one of the first decentralized liquidity protocols in the DeFi space. |

| 2018-2020 | Rapid growth in DeFi adoption as Bancor introduces new features like single-sided liquidity provision and impermanent loss protection. |

| 2021 | Bancor v2.1 is launched, further enhancing its AMM model and reducing risks for liquidity providers. |

The Bancor Network launched in 2017 and became a pioneer in DeFi. It quickly gained attention for using smart contracts to create liquidity pools. Many other DeFi projects have since copied and improved this model. Bancor’s team has continued to evolve the protocol to address issues like impermanent loss. They introduced impermanent loss protection to solve this common AMM risk.

Bancor’s launch coincided with the growth of decentralized finance (DeFi). DeFi aims to create an open, permissionless financial system on blockchain technology. Since then, this has led in developing technologies that make DeFi more accessible and secure for users.

Types of Bancor Implementations

| Type | Description |

|---|---|

| Bancor v1 | The original version launched in 2017, featuring a simple AMM model with liquidity pools using the BNT token as an intermediary. |

| Bancor v2.1 | An upgraded version launched in 2021, offering single-sided liquidity provision and impermanent loss protection for liquidity providers. |

Bancor v1 was revolutionary for its time. It introduced a new way to approach trading and liquidity in the crypto space. Bancor v2.1 improved on early AMM limitations. It addressed high gas fees and impermanent loss, both major barriers for users. The version offered impermanent loss protection and single-sided liquidity provision. These features lowered risks for liquidity providers and attracted more DeFi users.

How does Bancor Work?

Bancor works through a system of smart contracts that manage liquidity pools and facilitate token swaps. Here’s how it works:

- Automated Market Makers (AMMs): It uses AMMs instead of a traditional order book. They automatically set token prices based on supply and demand in liquidity pools.

- Liquidity Pools: Users deposit token pairs into these pools. When someone trades one token for another, the smart contract adjusts the token ratio, setting a new price.

- BNT Token: The Bancor Network Token (BNT) connects different pools. It allows easy swapping between any tokens in the network and avoids managing multiple trading pairs.

- Impermanent Loss Protection: It protects against impermanent loss, where liquidity providers lose value if token prices change. It compensates for these losses, making it safer for providers.

Pros & Cons

| Pros | Cons |

|---|---|

| Enables decentralized trading without the need for order books or centralized exchanges. | Liquidity providers face potential impermanent loss if the price of tokens changes drastically. |

| Offers impermanent loss protection to reduce risks for liquidity providers. | High gas fees on Ethereum can make small trades expensive. |

| Supports single-sided liquidity, allowing users to provide liquidity with just one token. | Still faces competition from newer DeFi protocols offering similar or enhanced features. |

| Provides a user-friendly platform for swapping tokens directly from crypto wallets. | Complexity in understanding AMM models and liquidity pool dynamics for new users. |

Companies Involved in Bancor

Bancor Foundation

The primary organization behind the development and governance of the Bancor protocol.

DeFi Projects

Various DeFi projects and platforms integrate with Bancor to provide liquidity solutions for their tokens.

Blockchain Ecosystem Partners

Collaborates with other DeFi protocols to enhance liquidity and trading capabilities across the ecosystem.

Applications or Uses

- Decentralized Exchanges (DEXs): Bancor’s protocol is a key layer for many DEXs. It allows users to swap tokens without a central party.

- Liquidity Mining and Yield Farming: Users can add liquidity to Bancor’s pools and earn fees or rewards. This is a popular way to earn passive income in DeFi.

- DeFi Innovations: Bancor’s development has led to features like impermanent loss protection and single-sided liquidity. These set new standards for DeFi innovation.

- Cross-Platform Integration: Bancor’s technology is used in various wallets, DEXs, and DeFi platforms. This makes it vital to the broader DeFi ecosystem.

Resources

- Moralis Academy. DeFi Deep Dive: What is Bancor?

- The Motley Fool. Bancor

- Investopedia. Bancor (BNT)

- The Tie. Bancor: A History

- SuperMoney. Bancor