Price Action Trading is one of the most popular approaches in economic analysis, trusted by traders who want clarity without the clutter of dozens of indicators. At its heart, it focuses only on the movement of price itself—clean, raw, and straightforward. This method helps traders make decisions based on patterns, levels, and candlesticks rather than overwhelming data. For industry professionals, it provides discipline and structure, while beginners find it easier to grasp compared to overly technical systems.

I remember when I first started trading, I felt lost in endless charts full of signals. Discovering Price Action Trading simplified everything, and suddenly I understood the story markets were telling. With this strategy, you learn to read price like a language, and that can mean the difference between confusion and clarity in your trading journey.

Price Action Trading Materials or Tools Needed

To practice Price Action Trading effectively, you don’t need complicated tools. A reliable trading platform, a stable internet connection, and charts are enough. The real tools are your eyes, patience, and ability to interpret candlesticks. Some traders also use journal software to track trades and refine decisions.

| Material/Tool | Purpose |

|---|---|

| Trading Platform | Executes trades and shows price charts |

| Internet Connection | Keeps data and charts updated in real time |

| Charting Software | Displays candlestick and line patterns |

| Trading Journal | Records trades and lessons learned |

Price Action Trading Instructions

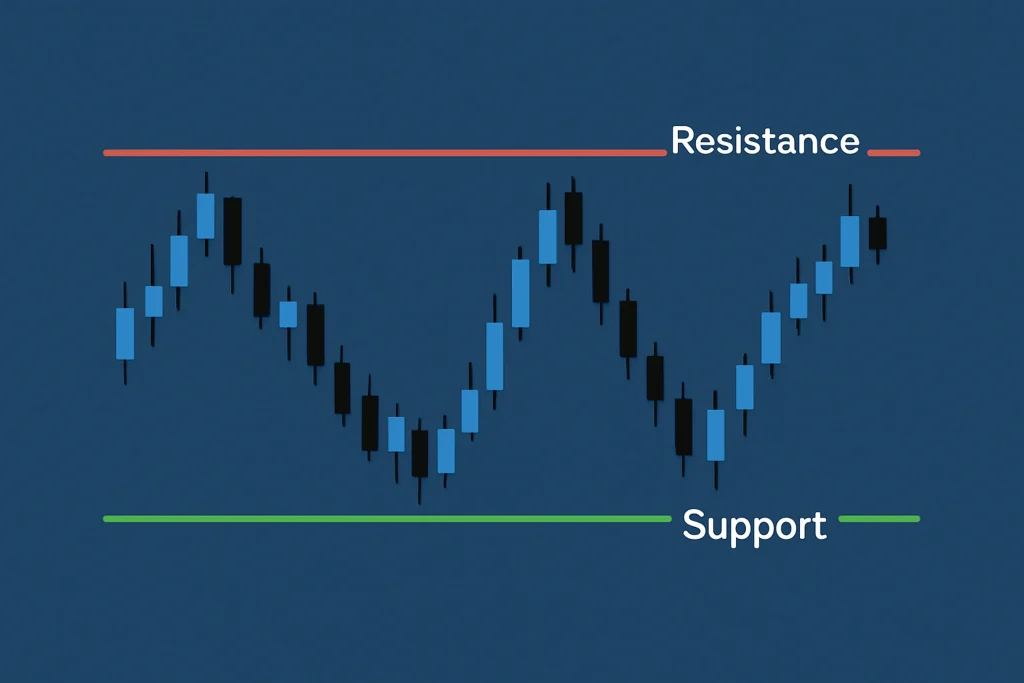

1. Step 1: Identify Key Levels

Start by marking support and resistance zones on your chart. These levels act like the floor and ceiling of price movement. Traders use them to decide where to enter or exit a position. By analyzing recent highs and lows, you can spot where the market might bounce or break. Don’t overcomplicate it; focus on clear and obvious levels.

2. Step 2: Watch for Candlestick Patterns

Candlestick patterns are the heart of Price Action Trading. Look for dojis, engulfing candles, and pin bars. These shapes reveal the market’s mood—whether buyers or sellers are in control. When combined with key levels, candlesticks tell a powerful story. For example, a pin bar forming at strong resistance can signal an upcoming reversal.

3. Step 3: Confirm with Trend Direction

Never trade blindly against the trend. Use trend lines or moving averages for confirmation. In an uptrend, focus on buying opportunities when price retraces. In a downtrend, search for selling setups after pullbacks. Trading with the trend increases your chances of success and reduces risk.

4. Step 4: Set Take Profit and Stop Loss

A true Price Action Trading plan always includes risk management. Decide where to exit before entering. Place your stop loss beyond support or resistance levels to protect your account. At the same time, set a take profit target based on logical price levels. This discipline helps avoid emotional mistakes.

5. Step 5: Manage the Trade

Once the trade is live, stick to your plan. Avoid staring at the chart every second; trust your analysis. Some traders trail their stop loss to lock in gains. Others scale out of positions. The key is consistency. Just like a Windows Update runs automatically, your plan should work without constant interference.

Price Action Trading Tips and Warnings

Price Action Trading is powerful, but it requires discipline and patience. Traders often fail because they chase every candle without waiting for strong setups. Always journal your trades—it sharpens your skill over time.

| Tips | Warnings |

|---|---|

| Trade with the trend | Don’t ignore risk management |

| Wait for clear candlestick signals | Avoid overtrading on small moves |

| Use support and resistance levels | Don’t mix too many indicators with price action |

| Keep a trading journal | Don’t trade emotionally after losses |

One mistake I made early was ignoring risk. I’d enter trades with no stop loss, and one bad move wiped out several wins. That experience taught me the value of protection. In a world full of cyber threats and even financial market hacking, protecting your capital is just as vital as locking down your digital security with tools like Express VPN.

Conclusion

Price Action Trading is more than just reading charts—it’s learning a language markets speak. By identifying levels, reading candlesticks, and respecting trends, you create a clear strategy. With discipline and risk management, this method helps you cut through noise and trade with confidence. Start small, practice consistently, and let the market show you its rhythm.

FAQ

How does Price Action Trading benefit economic analysis?

Price Action Trading benefits economic analysis by focusing on raw price movement instead of lagging indicators. It reveals real-time supply and demand dynamics, helping traders and analysts interpret market psychology more effectively.

Can beginners succeed with Price Action Trading in economic analysis?

Yes, beginners can succeed with Price Action Trading because it strips away unnecessary tools. By focusing only on price charts and candlestick patterns, new traders quickly learn how economic analysis connects with market behavior.

What risks should I watch out for in Price Action Trading?

The biggest risks are overtrading, ignoring stop losses, and misreading patterns. In economic analysis, misinterpretation can distort decisions. Traders should manage risk carefully and avoid distractions, just as companies guard against threats like Deoptakes malware.

Resources

- Investopedia – Price Action Trading Explained

- TradingView – Price Action Trading Ideas

- Price Action – What Is Price Action

- The Balance – Guide to Price Action Trading

- DailyFX – Price Action Trading Strategies