If you’ve been exploring stock market indices beyond the commonly known S&P 500, the Russell 2000 Index deserves your attention for several important reasons. This index focuses on 2,000 smaller companies in the United States, many of which are still in their growth stages. These businesses often offer new ideas, fresh products, and innovative services that have the potential to grow quickly. Because of this, the Russell 2000 is seen as a strong reflection of the health and direction of the U.S. economy, especially at the local and regional levels.

Watching how it performs each day, known as Russell 2000 Today, can give early clues about where the market might be headed. For those more active in the market, using Russell 2000 Futures allows for planning and adjusting based on short-term changes. Whether you are building a new investment plan or looking to understand economic trends better, this index offers real-time insight and long-term possibilities. By keeping a close eye on it, you stay better prepared for opportunities and risks alike.

Overview of Russell 2000 Index

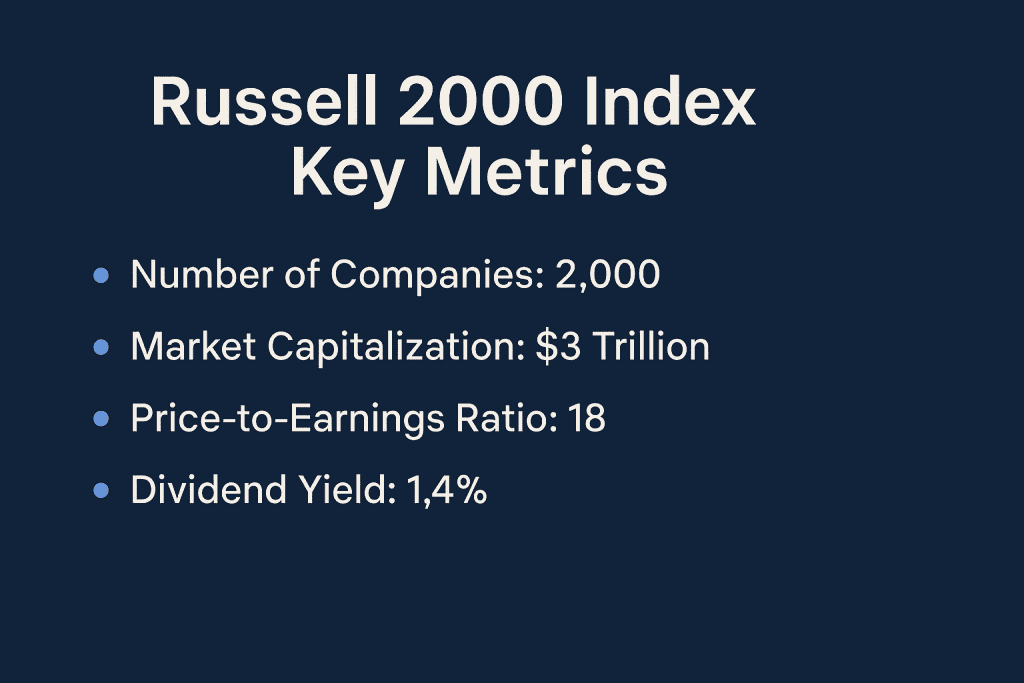

The Russell 2000 Index is a popular market index that tracks the performance of 2,000 small-sized companies based in the United States. These companies are part of the broader Russell 3000 Index, which includes the largest 3,000 publicly traded U.S. firms. While the S&P 500 focuses on big, well-established businesses, the Russell 2000 shines a light on smaller companies that often fly under the radar but hold strong growth potential. Investors and analysts frequently look to this index for signs of how smaller businesses are coping with economic changes, such as rising interest rates or shifts in consumer demand.

Key Features

- Focus on Smaller U.S. Companies: Most of the businesses in this index have market values between 300 million and 2 billion dollars, making them more sensitive to economic conditions.

- Broad Sector Representation: It includes a wide variety of industries, such as healthcare, technology, finance, and consumer goods, giving a full picture of different parts of the economy.

- Domestic Economic Indicator: Since all companies are U.S.-based, the index gives a strong signal of how the national economy is performing at a smaller scale.

- Weighted by Company Size: Larger companies within the index have more impact on its overall performance, but every company contributes.

- Used in Futures Trading: Russell 2000 Futures allow traders to make short-term bets or hedge their portfolios based on expected changes in the small-cap market.

In-Depth Analysis of Russell 2000 Index

To understand how the Russell 2000 Index fits into your economic analysis or investment strategy, we need to dive deeper into its mechanics, performance history, and market perception.

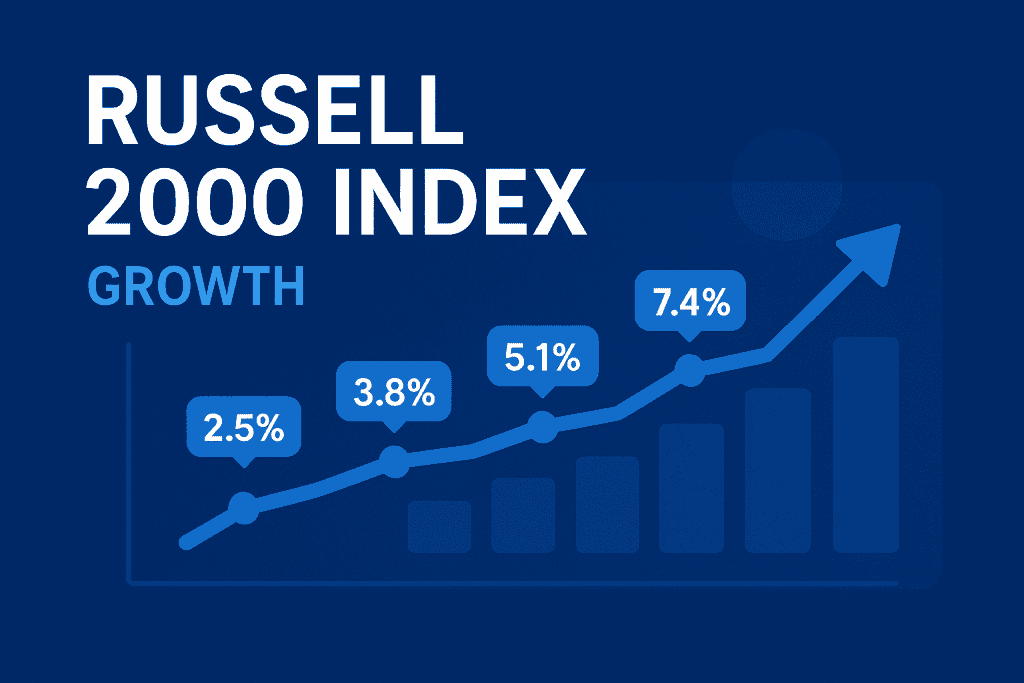

Performance Over Time

Over the past two decades, the Russell 2000 has shown significant volatility. That’s not necessarily bad, it just means opportunity. For example, in economic recovery periods like post-2008 and post-pandemic, small-cap stocks have historically outperformed their large-cap counterparts. In 2021, it saw a staggering 20 percent gain, powered by stimulus support and bullish retail investors.

Volatility and Market Behavior

One thing’s certain: if you’re watching Russell 2000 Today, you’re watching a rollercoaster. The index is highly sensitive to economic data, interest rate shifts, and inflation trends. Compared to the S&P 500, it reacts more quickly to macroeconomic news because small-cap companies are typically more exposed to local economic conditions.

Sector Composition

- Healthcare and financial services make up a large portion of the index

- Industrial and technology companies also play a strong role

- Consumer services and real estate add to its diversity

The Russell 2000 Index includes a wide mix of industries, which helps paint a full picture of how the smaller parts of the U.S. economy are doing. Healthcare companies in the index often focus on local clinics, equipment makers, and biotech startups. Financials include smaller banks and lenders that support local businesses and consumers. The presence of industrial and technology firms shows how manufacturing and innovation are growing among small companies. Consumer-focused sectors, like restaurants and retail, provide insight into spending habits. This variety makes the index a helpful guide for tracking economic trends across multiple areas, not just one.

Use in Investment Strategies

Smart investors use Russell 2000 Futures to speculate or hedge exposure. It’s also common in mutual funds and ETFs targeting growth in emerging enterprises. When building a diversified investment plan, this index can balance out large-cap holdings from indices like the S&P 500.

Russell 2000 Index Comparison

Let’s compare the Russell 2000 Index with similar indices to get a clearer picture of its strengths and limitations.

| Feature | Russell 2000 | S&P 500 | Nasdaq Composite |

|---|---|---|---|

| Company Size | Small-cap | Large-cap | Tech-dominant (mixed) |

| Sector Diversity | High | Moderate | High but tech-heavy |

| Volatility | High | Lower | Very High |

| Economic Sensitivity | Very High | Moderate | High |

| Use in Futures and ETFs | Broad | Very Broad | Broad |

| Investment Focus | Growth potential | Stability | Innovation and growth |

While the S&P 500 gives you stability, the Russell 2000 brings you closer to the heartbeat of entrepreneurial America. As such, it’s excellent for growth-oriented investors.

Russell 2000 Index Pros and Cons

Before diving in, let’s look at the core advantages and disadvantages

| Pros | Cons |

|---|---|

| Strong growth potential | Higher volatility |

| Great for tracking domestic economic health | Sensitive to inflation and rate hikes |

| Excellent diversification for small-cap sector | Less stability compared to large-cap indices |

| Widely available in ETFs and futures | Riskier in uncertain markets |

Conclusion

The Russell 2000 Index represents the smaller, fast-growing companies in the United States. These businesses are often more flexible and responsive to market changes than large corporations. Because of this, the index gives investors a good look at how the broader economy is doing at a local level. When you invest in the Russell 2000, you are supporting up-and-coming companies with the potential for strong growth.

It also helps balance out your investments if you already own larger, more stable stocks. Watching the Russell 2000 Today helps you spot early signs of economic shifts, while Russell 2000 Futures can offer tools to manage risk or take advantage of short-term changes. For anyone looking to add variety and opportunity to their financial plan, the Russell 2000 is a smart option to consider. It brings both challenge and potential reward into a well-rounded investment approach.

Russell 2000 Index Rating

When it comes to gauging future growth and market responsiveness, the Russell 2000 stands tall, especially in recovery phases.

Rating: 4.7 out of 5 stars

FAQ

Why should investors consider the Russell 2000 Index in their economic analysis?

Because it includes smaller U.S. companies, the Russell 2000 Index is more sensitive to local economic shifts, making it an excellent barometer for domestic economic performance.

How do Russell 2000 Futures help in portfolio management?

Russell 2000 Futures allow investors to hedge small-cap exposure, capitalize on market volatility, and speculate short-term with lower capital commitment than buying index ETFs.

What’s the relevance of tracking Russell 2000 Today for individual investors?

Monitoring Russell 2000 Today can help investors identify real-time market sentiment shifts, spot breakout small-cap stocks, and adjust their investment plan accordingly.

Resources

- LSEG. Russell US Indices Overview

- LSEG. Russell 2000 Index Chartbook April 2025

- CME Group. Russell 2000 Futures Specs

- Investopedia. Russell 2000 Index Explained

- MarketWatch. Russell 2000 Index News

- Bankrate. What is the Russell 2000?

- Twitter. DeltaOne’s Market Update

- YouTube. Russell 2000 Index Video Explainer