Cryptocurrency has revolutionized the financial world, offering a decentralized way to store and transfer value. However, with great power comes great responsibility. Ensuring the security of your crypto assets is paramount, as the digital nature of cryptocurrencies makes them susceptible to hacking, fraud, and other malicious activities. This guide will walk you through the essential steps and strategies to secure your crypto assets effectively.

Understanding the Importance of Securing Your Crypto Assets

Cryptocurrencies, such as Bitcoin and Ethereum, have gained immense popularity due to their decentralized nature and potential for high returns. However, this popularity has also attracted cybercriminals looking to exploit vulnerabilities in crypto storage and transactions. Therefore, understanding how to secure your crypto assets is crucial for any investor.

To begin with, it’s important to recognize the unique challenges posed by cryptocurrencies. Unlike traditional financial assets, cryptocurrencies are digital and often stored in wallets that can be accessed online. This digital aspect makes them convenient but also vulnerable to cyberattacks. Furthermore, the irreversible nature of crypto transactions means that once your assets are stolen, they are likely gone forever.

The first step in securing your crypto assets is choosing the right wallet. Wallets come in various forms, including hardware wallets, software wallets, and paper wallets. Each type has its own advantages and disadvantages, which we will explore in detail. Next, we will discuss the importance of strong passwords and two-factor authentication (2FA) in protecting your crypto assets. Additionally, we will delve into the significance of keeping your private keys secure and the role of backup strategies.

Moreover, we will cover advanced security measures such as using cold storage and multisig wallets, as well as best practices for trading and transacting in cryptocurrencies. By following the guidelines outlined in this guide, you can significantly reduce the risk of losing your crypto assets to theft or fraud.

Strong Passwords and Two-Factor Authentication

- Creating Strong Passwords

- Using strong, unique passwords for your crypto assets is essential. A strong password should be at least 12 characters long and include a mix of letters, numbers, and special characters. Avoid using easily guessable information, such as birthdays or common words.

- Implementing Two-Factor Authentication

- Two-factor authentication (2FA) adds an extra layer of security by requiring a second form of verification in addition to your password. This could be a code sent to your mobile device or generated by an authentication app like Google Authenticator. Enabling 2FA on your crypto assets can significantly reduce the risk of unauthorized access.

Securing Your Private Keys

- Importance of Private Keys

- Your private keys are the most critical piece of information in your crypto assets. They are used to sign transactions and prove ownership of your crypto assets. If someone gains access to your private keys, they can steal your cryptocurrencies.

- Best Practices for Private Key Security

- Never share your private keys with anyone and avoid storing them digitally on devices connected to the internet. Consider using a hardware wallet or writing them down and storing them in a secure place, such as a safe.

Backup Strategies

- Regular Backups

- Regularly backing up your wallet ensures that you can recover your crypto assets in case of device failure or loss. Make sure to backup your wallet’s private keys and other important information.

- Secure Storage of Backups

- Store your backups in multiple secure locations to prevent loss due to theft, fire, or other disasters. Consider using encrypted USB drives or secure cloud storage services.

Advanced Security Measures

- Cold Storage

- Cold storage involves keeping your cryptocurrencies in an offline environment, such as a hardware wallet or paper wallet. This method is highly secure as it eliminates the risk of online attacks. Cold storage is ideal for long-term storage of large amounts of cryptocurrency.

- Multisig Wallets

- Multisig (multi-signature) wallets require multiple private keys to authorize a transaction. This adds an extra layer of security, as a single compromised key will not be sufficient to steal your crypto assets. Multisig wallets are particularly useful for institutional investors or individuals with significant crypto holdings.

Best Practices for Trading and Transacting

- Use Reputable Exchanges

- When trading cryptocurrencies, use reputable exchanges with strong security measures and a good track record. Research the exchange’s security protocols and user reviews before entrusting them with your crypto assets.

- Be Cautious with Public Wi-Fi

- Avoid accessing your crypto assets over public Wi-Fi networks, as they are often less secure and can be easily intercepted by hackers. Use a virtual private network (VPN) if you need to access your accounts while on public networks.

- Double-Check Transaction Details

- Always double-check the recipient’s address and transaction details before sending any crypto assets. A small mistake in the address can result in the loss of your crypto assets, as transactions are irreversible.

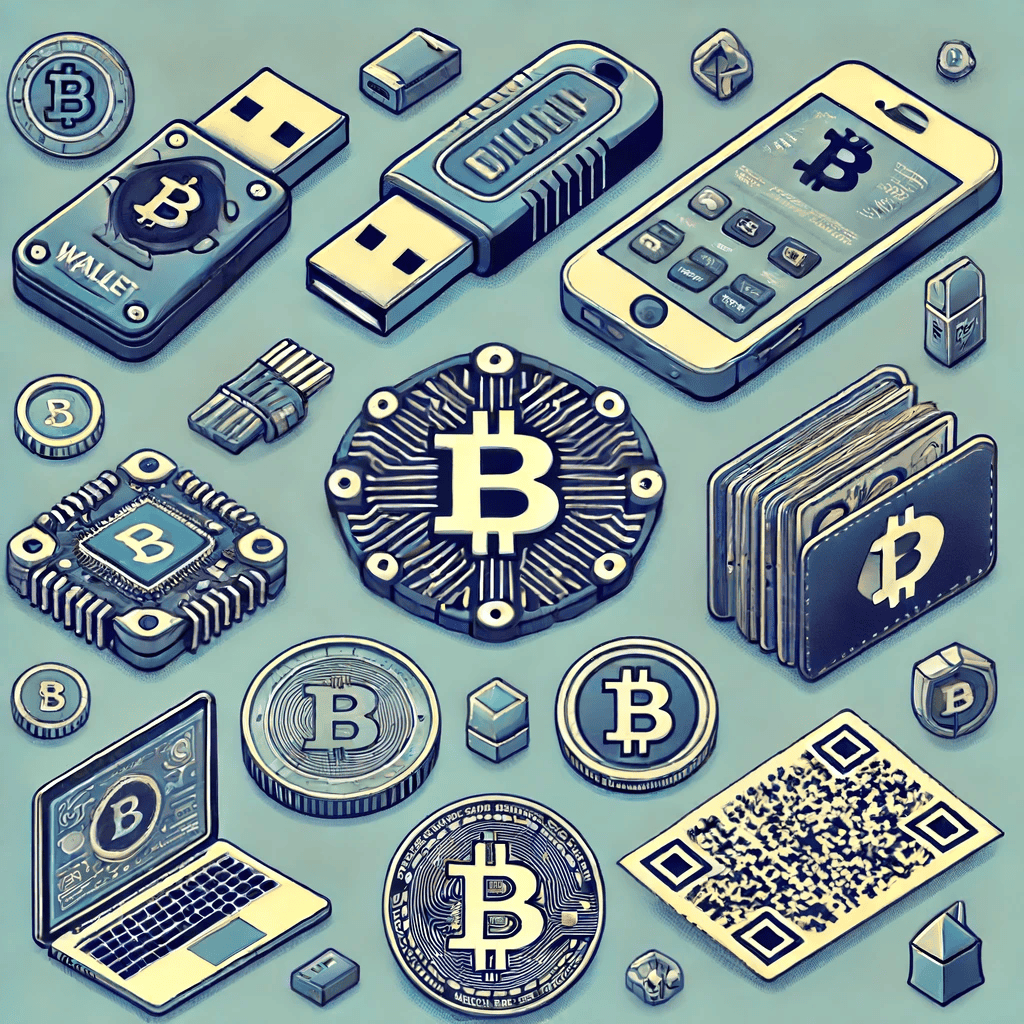

Choosing the Right Wallet

Hardware Wallets

Hardware wallets are physical devices that store your private keys offline, making them immune to online attacks. These wallets are considered one of the most secure options for storing assets. Popular hardware wallets include Ledger Nano S and Trezor. The main advantage of hardware wallets is their resistance to hacking attempts, as the private keys never leave the device. However, they come with a cost and require careful handling to avoid loss or damage.

Software Wallets

Software wallets are applications or programs that store your private keys on your computer or mobile device. They are convenient and often free, but their security depends on the security of the device they are installed on. Examples include Exodus and Electrum. While software wallets are easier to use for frequent transactions, they are more vulnerable to malware and hacking compared to hardware wallets.

Paper Wallets

Paper wallets involve printing your private and public keys on a piece of paper and storing it in a secure location. This method keeps your keys completely offline, but the physical nature of paper wallets makes them susceptible to damage, loss, or theft. Paper wallets are best used for long-term storage of significant amounts of crypto assets.

Comparison of Wallet Types

| Wallet Type | Security Level | Ease of Use | Cost | Ideal For |

|---|---|---|---|---|

| Hardware Wallet | High | Moderate | High | Long-term storage |

| Software Wallet | Moderate | High | Low/Free | Frequent transactions |

| Paper Wallet | High | Low | Low | Long-term storage |

Conclusion

Securing your crypto assets requires a combination of the right tools and best practices. By choosing the appropriate wallet, using strong passwords and two-factor authentication, safeguarding your private keys, and implementing regular backups, you can protect your investments from theft and loss. Advanced security measures such as cold storage and multi-signature wallets offer additional protection for those with significant holdings.

As the cryptocurrency landscape continues to evolve, staying informed about the latest security threats and practices is crucial. Regularly updating your knowledge and adapting to new security measures will help ensure the safety of your crypto assets. Remember, the security of your crypto assets is ultimately in your hands, and taking proactive steps today can save you from potential losses in the future.

FAQ

What is the most secure way to store cryptocurrencies?

The most secure way to store cryptocurrencies is using a hardware wallet or cold storage, which keeps your private keys offline and safe from online attacks.

How can I protect my crypto wallet from hackers?

Use strong passwords, enable two-factor authentication, and keep your private keys secure. Regularly update your security measures and avoid accessing your wallet over public Wi-Fi.

What should I do if I lose my private keys?

If you lose your private keys, you may lose access to your cryptocurrencies permanently. It’s crucial to have regular backups and store them in secure locations.