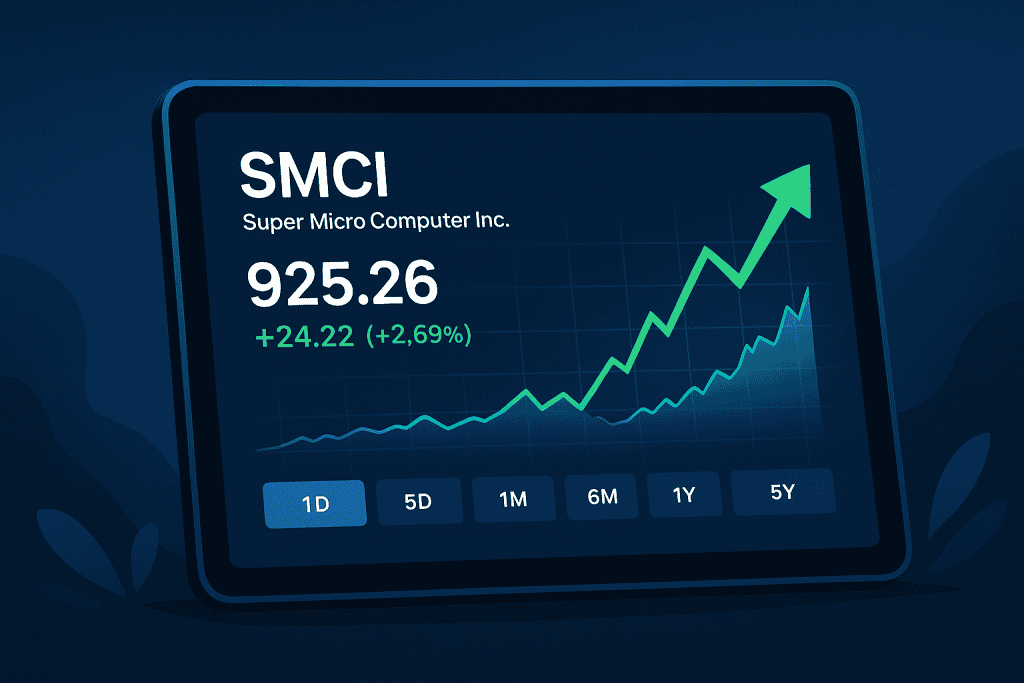

SMCI stock price of Super Micro Computer, Inc. (SMCI) has been experiencing significant volatility, drawing the attention of both seasoned investors and newcomers eager to capitalize on its rapid fluctuations. This heightened level of activity reflects the growing interest in SMCI as a key player in the high-performance computing sector. With substantial price swings occurring in a relatively short period, traders and long-term investors alike are closely monitoring its movements, evaluating potential opportunities and risks. The stock’s unpredictable nature has led to increased discussions on financial forums, as market participants debate whether the recent momentum will continue or if a correction is on the horizon.

As a leading provider of high-performance computing solutions, SMCI has demonstrated remarkable growth, positioning itself as a prominent force in the technology sector. The company’s stock surge has ignited widespread discussions about its long-term potential, prompting investors to analyze its fundamentals, revenue growth, and market expansion strategies. Many are now considering whether SMCI is among the best stocks to buy, given its strong presence in the rapidly evolving computing industry. As demand for AI-driven and cloud-based technologies rises, the company’s innovative solutions could play a crucial role in sustaining its upward trajectory. However, with the stock’s rapid appreciation, some investors are also questioning whether its valuation remains justified or if a pullback is inevitable.

What Happened?

SMCI’s stock price has soared due to increased demand for AI-powered data centers. The company’s innovative servers are in high demand.

With AI, cloud computing, and edge computing gaining traction, SMCI’s cutting-edge infrastructure is becoming essential. Investors are closely monitoring its future growth.

Recently, the company announced record-breaking earnings, exceeding analysts’ expectations. This fueled a major SMCI stock price rally, attracting significant market attention.

Its revenue surge is driven by booming AI infrastructure demand. Tech giants are aggressively expanding data centers, boosting SMCI’s stock price.

Additionally, SMCI secured key partnerships with leading cloud service providers. These deals strengthen its position in the competitive AI-driven computing industry.

However, market volatility persists. Some analysts believe SMCI’s rapid growth could lead to potential overvaluation and price corrections.

When and Where?

The surge in SMCI stock price gained momentum in early 2024, shortly after the company released its latest earnings report. The announcement came during a scheduled investor call from its headquarters in San Jose, California, a location already closely watched due to its central role in the tech and semiconductor ecosystem.

What stood out was not just the earnings themselves, but the forward-looking commentary shared by management. Guidance related to demand, capacity expansion, and partnerships caught the attention of analysts almost immediately. Within hours, major financial news outlets began covering the update, while investment platforms flagged the SMCI stock price for unusual price movement.

At the same time, discussions picked up across social media channels, trading forums, and market newsletters. Retail investors and institutional players alike began reacting, adding to trading volume and price volatility. This combination of strong corporate messaging, rapid media coverage, and heightened online chatter helped push SMCI into the spotlight and sustained interest well beyond the initial announcement.

As a result, the SMCI Stock Price’s movement was not confined to a single trading session. Instead, it unfolded over several days, reinforcing the idea that the surge was driven by broader market reassessment rather than a short-lived reaction.

Who is Involved?

Several key players are driving SMCI’s stock movement:

- Charles Liang, CEO and founder of Super Micro Computer, has been vocal about the company’s aggressive expansion in AI server technology.

- Institutional investors, including major hedge funds and mutual funds, have increased their stake in SMCI, signaling confidence in the company’s long-term prospects.

- AI and cloud computing companies are directly influencing demand for SMCI’s servers, as firms like NVIDIA, Microsoft, and Amazon Web Services rely on high-performance computing solutions.

Why SMCI Stock Price Matters

The rapid rise in SMCI stock price is more than just another market trend—it reflects the growing importance of AI and high-performance computing in today’s economy. Super Micro is positioning itself as a key enabler of AI infrastructure, making SMCI Stock Price an attractive bet for investors who believe in the future of AI-driven technology.

Additionally, SMCI’s strong financials suggest it could sustain this momentum. The company has shown impressive revenue growth, improved profitability, and a commitment to expanding its manufacturing capabilities. For investors looking at the best stocks to buy, SMCI offers a compelling case.

However, with great reward comes great risk. The SMCI Stock Price’s rapid appreciation raises concerns about potential overvaluation. Some analysts warn that the current hype could lead to sharp corrections if growth expectations are not met. For risk-tolerant investors, SMCI presents an exciting opportunity, but it’s crucial to keep an eye on market fluctuations.

Quotes or Statements

CEO Charles Liang shared his thoughts on the company’s recent performance:

“We are committed to driving the future of AI infrastructure with our innovative, energy-efficient server solutions. Our strong partnerships and technology leadership position us for sustained growth in this evolving market.”

Meanwhile, financial analyst John Thompson from MarketWatch noted:

“SMCI’s stock price surge reflects the broader AI boom. Investors should watch for continued revenue growth and operational efficiency before making long-term commitments.”

Conclusion

The SMCI stock price has seen remarkable growth, largely driven by the AI revolution and increasing demand for high-performance computing. While the stock presents exciting opportunities, it also comes with inherent risks due to market volatility. Whether it’s one of the best stocks to buy depends on your investment strategy—are you ready to ride the AI wave, or will you wait for a potential pullback? One thing is certain: SMCI Stock Price will remain to be watched in the coming months. As the company continues to expand its product offerings and strengthen its market position, investor sentiment will likely play a crucial role in shaping its stock trajectory.

With the AI boom fueling demand for advanced computing infrastructure, SMCI stands to benefit from sustained industry growth. However, competition in the sector is fierce, with major tech giants also vying for dominance in the high-performance computing space. Investors must carefully assess factors such as revenue growth, profitability, and future scalability to determine if SMCI aligns with their portfolio goals. Analysts remain divided on whether the stock’s current valuation reflects its long-term potential or if a correction is overdue. Regardless of short-term fluctuations, SMCI’s role in powering next-generation computing solutions ensures it will remain a key player in the evolving tech landscape.

Resources

- MarketWatch: Learn about Super Micro Computer Inc. Stock Quote

- tradingview.com: Discover NASDAQ:SMCI – Super Micro Computer, Inc. – TradingView

- Investing.com: check out the Super Micro Computer Stock Price – SMCI