Many homebuyers and investors are asking: when will mortgage rates go down? Over the past few years, rates have been higher than usual, making it harder to afford a home. Some experts believe rates could start to drop by late 2025, but this depends on several things.

The biggest factor is fed rate cuts. If the Federal Reserve lowers interest rates, mortgage rates will likely follow. Inflation also plays a role—if prices stay high, rates may not drop as quickly as people hope. The overall economy, job market, and housing demand will also affect of it.

This review breaks down what to expect, what experts are predicting, and what buyers should watch for in the coming months. Whether you’re planning to buy a home or invest, staying informed can help you make smarter decisions.

Mortgage Rate Trends and Predictions

This have fluctuated in recent years due to economic uncertainty and changing policies. Understanding these trends helps buyers and investors make informed decisions.

Key Highlights:

- Fed rate cuts impact mortgage rates significantly.

- Inflation, job markets, and GDP growth influence rate changes.

- Predictions vary, but experts suggest a possible decline in late 2025.

- Homebuyers should watch for shifts in investment plans and trading strategies.

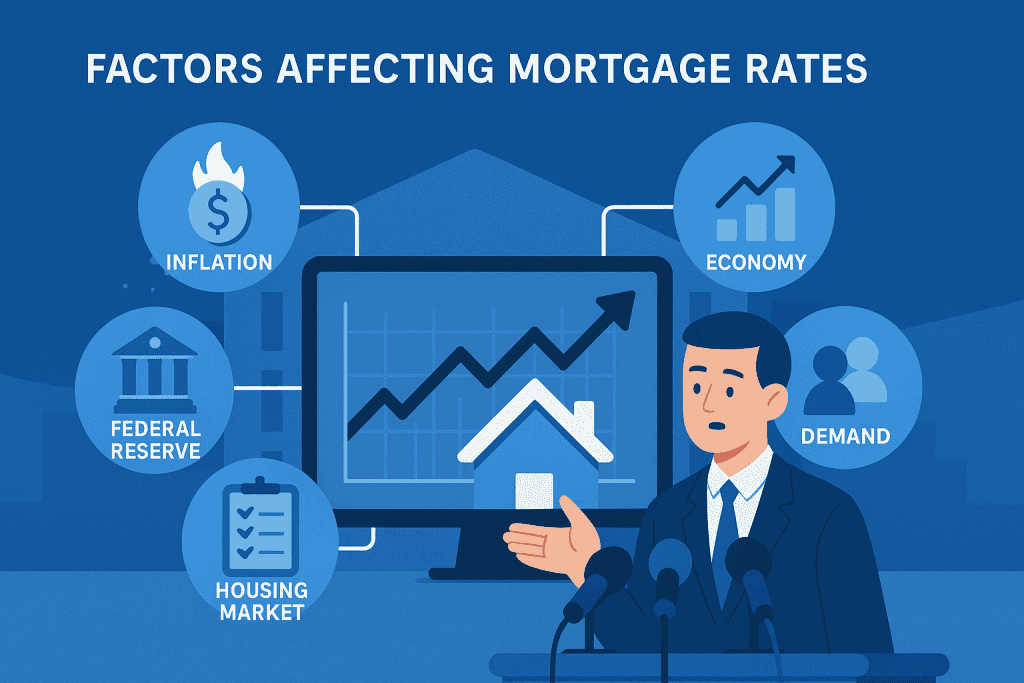

Key Factors Influencing Mortgage Rates in 2025

This don’t change randomly. Several key factors determine whether they go up or down. If you’re wondering when will mortgage rates go down, here are the biggest things to watch.

Fed Rate Cuts

The Federal Reserve controls interest rates, which directly impact mortgage rates. If the Fed lowers rates, borrowing money becomes cheaper, and mortgage rates usually follow. However, if inflation remains high, the Fed might keep rates steady or even raise them.

Inflation and the Economy

Inflation has a huge effect on mortgage rates. When inflation is high, lenders increase interest rates to protect their profits. If inflation slows down, rates may start to drop. The overall economic system also matters—when the job market is strong and the economy is growing, rates tend to stay higher. If there’s a slowdown or market crash, rates could decrease to encourage borrowing.

Housing Market Demand

The number of people buying homes affects mortgage rates. If demand is high, lenders keep rates up because buyers are willing to pay more. If fewer people are buying homes, rates might drop to attract new borrowers.

Global and Political Events

Events like economic downturns, stock market shifts, or even political decisions can impact mortgage rates. If there’s uncertainty, investors may move their money to safer options, which can cause mortgage rates to rise or fall depending on the situation.

Keeping an eye on these factors will help you understand when will mortgage rates go down and what to expect in the housing market.

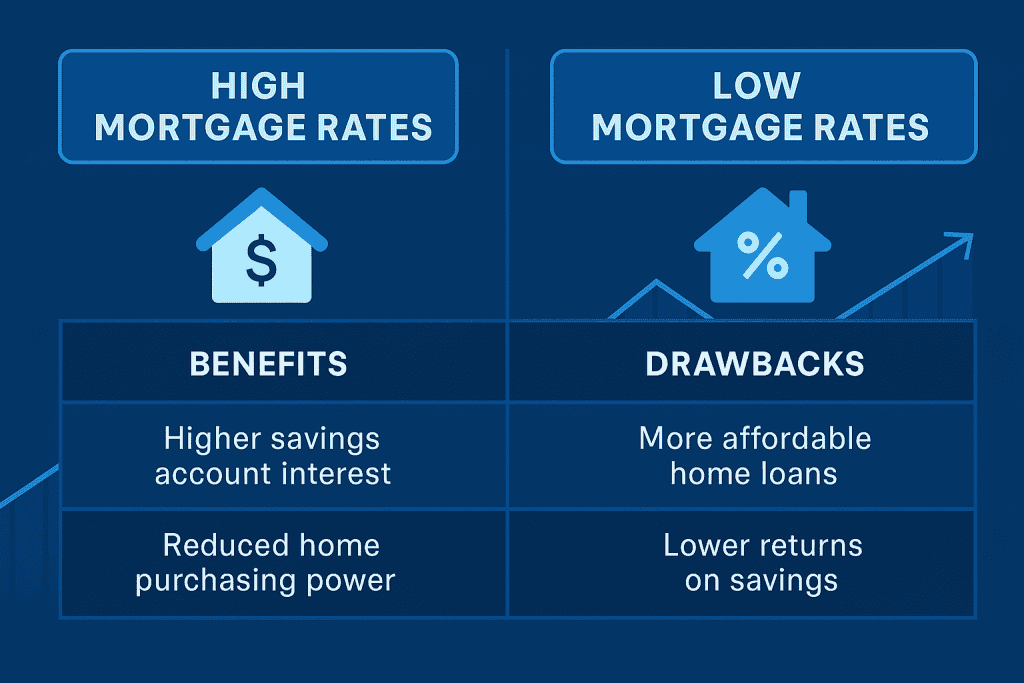

Mortgage Rates: Pros and Cons for Buyers

Buyers must weigh the benefits and drawbacks of changing mortgage rates.

| Pros | Cons |

|---|---|

| Lower monthly payments when rates decrease | Uncertainty in market predictions |

| Higher affordability for homebuyers | Rates may stay high longer than expected |

| Better investment opportunities | Impact on home values and demand |

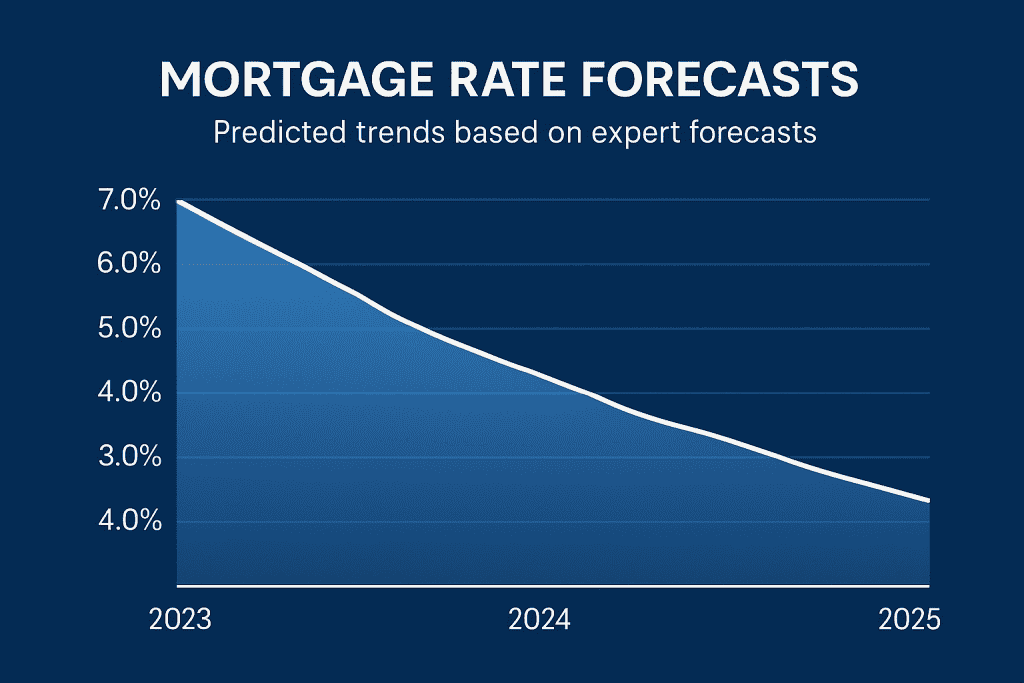

Mortgage Rate Predictions: What Experts Say

Experts provide mixed predictions on when will mortgage rates go down.

| Source | Predicted Rate Drop | Key Factors |

|---|---|---|

| Business Insider | Late 2025 | Inflation trends, Fed policy |

| PropStream | Uncertain | Market demand, economic growth |

| Mortgage Analysts | Gradual decline | Job market, consumer spending |

Some experts believe rates will stay high until inflation stabilizes, while others anticipate relief if the Fed implements aggressive fed rate cuts.

In-Depth Analysis: Mortgage Rate Projections

Trying to predict when will mortgage rates go down isn’t easy. Many factors, including the economy, inflation, and government policies, influence future rates. Here’s what experts are saying and what buyers should expect.

Housing Market Trends

The real estate market is sensitive to interest rate changes. When rates are high, fewer people buy homes, which slows down the market. If rates drop, demand increases, driving up home prices. In 2025, many experts predict a cooling market, but a rate drop could quickly change that.

Investment Strategies in a Changing Market

For investors, this will play a big role in profits. Higher rates mean higher borrowing costs, making some properties less attractive. Smart investors look for investment plans that work even when rates are high. Those who wait for fed rate cuts could find better deals later in the year.

Economic Indicators to Watch

Several key indicators help predict mortgage rate changes:

- Inflation Reports – If inflation drops, mortgage rates may follow.

- Fed Meetings – Any talk of fed rate cuts can signal future changes.

- Housing Market Data – A slowdown in sales might lead to lower rates.

- GDP Growth – A strong economic system often means higher rates.

Comparing Mortgage Rate Trends Over the Years

A historical look at mortgage rates helps predict future movements.

| Year | Average 30-Year Fixed Rate | Economic Conditions |

|---|---|---|

| 2020 | 3.00% | Low inflation, COVID-19 stimulus |

| 2022 | 5.50% | Rising inflation, Fed rate hikes |

| 2024 | 7.00% | Economic uncertainty, global instability |

Final Verdict on Mortgage Rates

The question of when will mortgage rates go down depends on multiple factors. The Fed’s decisions, inflation trends, and economic stability all play a role. While some experts predict a rate drop in late 2025, market conditions remain uncertain. Buyers should monitor fed rate cuts, economic shifts, and interest trends before making financial decisions.

Mortgage Rate Rating

In 2025 remain unpredictable. The high interest rates impact affordability, but experts suggest rates could fall if inflation stabilizes. Market analysts recommend staying informed about fed rate cuts to make strategic investment decisions.

Mortgage Rate Outlook: ★★★☆☆ (3/5)

FAQ

When will mortgage rates go down in 2025?

Experts predict a potential drop in mortgage rates by late 2025, depending on inflation, economic growth, and fed rate cuts.

How do fed rate cuts affect mortgage rates?

When the Federal Reserve lowers interest rates, borrowing becomes cheaper, leading to lower mortgage rates. However, other economic factors also play a role.

What should homebuyers do if mortgage rates remain high?

Homebuyers should explore different investment plans, consider adjustable-rate mortgages, and watch market trends for opportunities.

Resources

- Business Insider. Will Mortgage Rates Go Down This Year?

- Business Insider. Today’s Mortgage Rates – January 31, 2025

- PropStream. Will Mortgage Rates Go Down in 2025?

- YouTube. Mortgage Rate Predictions for 2025