If you’ve spent any time in the Cryptocurrency world, you’ve probably heard about Aave. Maybe a friend mentioned earning passive income. Maybe you saw it trending during a wild week in the Crypto Market. Either way, it’s one of those platforms that quietly powers a big part of decentralized finance.

Lending and borrowing isn’t just for hardcore traders. It’s for everyday crypto holders who want their assets to work for them. Instead of letting tokens sit idle in a wallet, you can lend them out and earn interest. Or, if you need liquidity but don’t want to sell your holdings, you can borrow against them.

I remember the first time I used Aave. I was holding some Ethereum and didn’t want to sell it, especially with Bitcoin surging and the Coin Market feeling unpredictable. Borrowing stablecoins instead felt smarter. That’s the power of decentralized finance. You stay in control.

In this guide, I’ll walk you through how to lend and borrow using Aave, step by step.

Tools Needed

Before you jump in, let’s make sure you have everything ready. Using Aave is straightforward, but you do need a few essentials.

First, you’ll need a crypto wallet that connects to decentralized apps. MetaMask is the most popular choice. You’ll also need some crypto assets to lend or use as collateral. And don’t forget a small amount for transaction fees.

Here’s a quick overview:

| Tool/Material | Why You Need It |

|---|---|

| Crypto Wallet (e.g., MetaMask) | To connect securely to Aave |

| Supported Crypto Assets | To lend or use as collateral for borrowing |

| Network Fees (ETH, etc.) | To pay for transactions on the Blockchain |

| Stable Internet Connection | To avoid interruptions during transactions |

| Basic DeFi Knowledge | To understand risks and manage positions properly |

That’s it. No paperwork. No banks. Just your wallet and a bit of confidence.

Aave Instructions

Step 1: Set Up and Fund Your Wallet

Start by installing MetaMask or another compatible wallet. Once installed, create your wallet and safely store your recovery phrase. Seriously, write it down and keep it offline.

Next, transfer crypto into your wallet. If you plan to lend, send the tokens you want to deposit. If you plan to borrow, make sure you have assets you’re comfortable using as collateral. I usually double-check the network before sending anything. One wrong click can mean sending funds to the wrong chain.

Step 2: Connect to Aave

Go to the official website. Always double-check the URL. In crypto, one fake link can ruin your day.

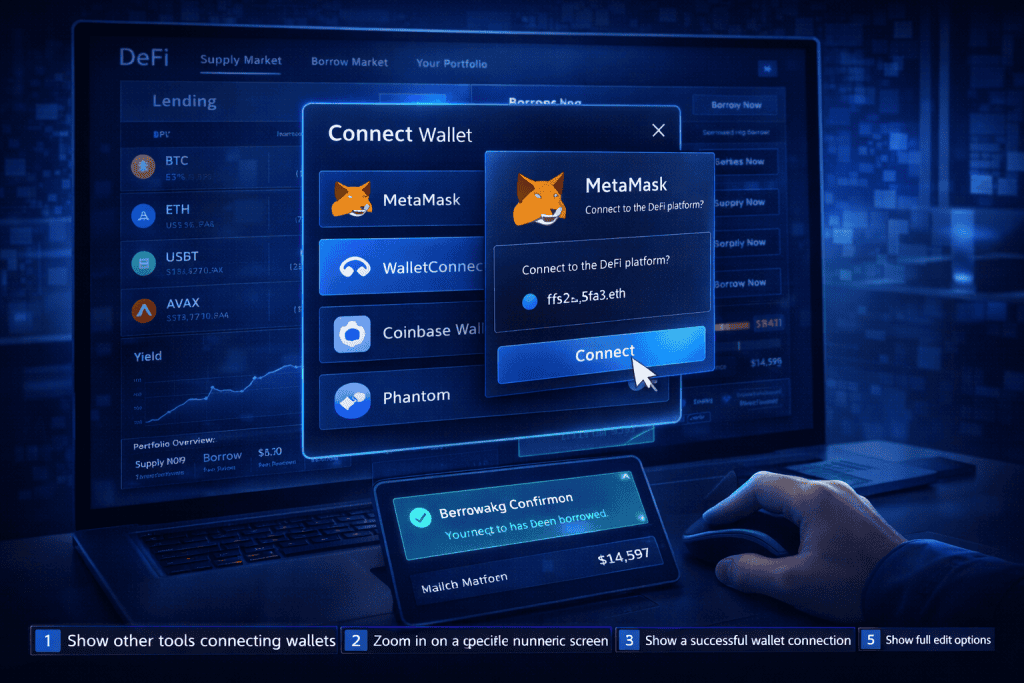

Click “Connect Wallet” and choose your wallet provider. Approve the connection request. Once connected, you’ll see the dashboard showing available markets, lending rates, and borrowing rates.

The interface may look busy at first. Take a breath. Look around. You’ll see options for depositing, borrowing, and reviewing your health factor. The health factor is important. It shows how safe your borrowed position is.

Step 3: Lend Your Crypto

To lend, choose the asset you want to deposit. Click “Supply.” Enter the amount and confirm the transaction in your wallet.

After approval, your crypto is supplied to the protocol. You’ll start earning interest almost immediately. Rates vary depending on demand. Sometimes they’re modest. Other times, especially during heavy trading in the Crypto Market, they spike.

When I first lent USDC on Aave, I kept refreshing the dashboard just to see the interest slowly accumulating. It’s subtle, but satisfying. You’ll receive aTokens in return, which represent your deposit and accrue interest automatically.

You can withdraw your funds anytime, as long as they aren’t locked as collateral for a loan.

Step 4: Borrow Against Your Collateral

If you want to borrow, first ensure your supplied assets are marked as collateral. Then select the asset you want to borrow.

Enter the amount carefully. Aave shows your borrowing power and how the loan affects your health factor. A higher health factor means lower liquidation risk.

You can choose between stable and variable interest rates. Stable rates offer predictability. Variable rates fluctuate based on market demand.

Confirm the transaction in your wallet. Once approved, the borrowed funds appear in your wallet. You now have liquidity without selling your original assets. That flexibility can be powerful, especially if you believe your holdings are a long-term Investment.

Step 5: Monitor and Repay

This step is critical. After borrowing, monitor your health factor regularly. If the value of your collateral drops sharply, you risk liquidation.

To repay, go to the dashboard, select your borrowed asset, and click “Repay.” Enter the amount and confirm.

Once fully repaid, you can withdraw your original collateral. And just like that, you’ve completed the full lending and borrowing cycle on Aave.

Aave Tips and Warnings

First tip: always maintain a safe health factor. I personally aim for at least 1.8 or higher. It gives breathing room if the Coin Market turns volatile overnight.

Second tip: understand liquidation. If your health factor drops below 1, your collateral can be partially sold to repay your debt.

Third tip: watch gas fees. On busy days, transaction costs on the Blockchain can rise.

Common mistakes include borrowing too much, ignoring market volatility, and failing to track interest rates.

Here’s a quick breakdown:

| Tip or Warning | Why It Matters |

|---|---|

| Keep Health Factor High | Reduces liquidation risk |

| Avoid Overleveraging | Protects your portfolio from sharp price swings |

| Track Market Conditions | The Crypto Market can change fast |

| Double-Check Network Fees | Prevents unnecessary costs |

| Use Official Aave Links Only | Avoid phishing scams |

Remember, decentralized finance gives you control. But it also gives you responsibility.

Conclusion

Lending and borrowing with Aave opens the door to smarter crypto management. Instead of letting assets sit idle, you can earn interest. Instead of selling during dips, you can borrow and stay invested.

The process is simple once you break it down. Set up your wallet. Connect to Aave. Supply assets. Borrow responsibly. Monitor your health factor. Repay when ready.

Whether you’re a beginner exploring Cryptocurrency or a seasoned DeFi user, Aave offers flexibility and opportunity. Take it slow at first. Start with small amounts. Learn how the system reacts to market changes.

FAQ

How does Aave lending work in the Cryptocurrency ecosystem?

In the Cryptocurrency ecosystem, Aave allows users to deposit crypto assets into liquidity pools. Borrowers take loans from those pools and pay interest. That interest is distributed to lenders. Everything runs on smart contracts on the Blockchain, meaning there’s no central authority holding your funds.

Is borrowing on Aave safe during volatile Crypto Market conditions?

Borrowing on Aave during volatile Crypto Market conditions can be safe if you maintain a strong health factor and avoid overleveraging. The biggest risk comes from rapid price drops in your collateral. Monitoring positions and understanding liquidation thresholds are essential when using decentralized finance protocols like Aave.

What is the best strategy for using Aave as a long-term crypto investment tool?

A common long-tail strategy for using Aave as a long-term crypto investment tool is lending stablecoins for consistent yield while holding volatile assets separately. Some users also borrow stablecoins against major holdings like Ethereum or Bitcoin to avoid selling during bullish cycles. The key is disciplined risk management.

Resources

- Coin Bureau. Aave Review: Complete Guide to Aave

- Aave. Official Aave Website

- CryptoNews. How to Use Aave

- Medium. How to Borrow and Lend Crypto Through Aave

- Blockchain Magazine. Aave V4 vs V3 Comparison