If you’ve ever watched a company ring the opening bell on the stock exchange and thought, “I wish I could’ve gotten in early,” you’re not alone. Learning how to invest in an IPO can feel like stepping into the inner circle of the financial world. An IPO, or Initial Public Offering, is when a private company offers its shares to the public for the first time. For everyday investors, it’s a rare opportunity to buy into a company at the very start of its public journey.

From an Economic Analysis perspective, an IPO isn’t just about hype. It reflects market confidence, sector trends, and the broader Economic System at work. When done right, investing can add strong growth potential to your portfolio. But it also comes with risks that require preparation and a solid investment plan.

In this guide, I’ll walk you through how to invest step by step, using clear explanations and practical examples. By the end, you’ll feel confident navigating the process and making informed decisions.

Tools Needed

Before you invest in an IPO, you need a few basic tools and prerequisites. This isn’t complicated, but preparation makes a huge difference.

First, you’ll need a brokerage account that provides access to shares. Not all platforms do. Some full-service and online brokers allow clients to participate in allocations, while others only let you buy shares once they begin public trading.

Second, you’ll need access to the company’s prospectus. This document outlines financial performance, risks, business strategy, and how the raised funds will be used.

Third, have your financial records and risk tolerance clearly defined. Investing can be volatile, especially during uncertain periods or a market crash.

| Tool or Requirement | Why It Matters |

|---|---|

| Brokerage account | Required to request IPO shares |

| IPO prospectus | Provides financial and risk details |

| Capital allocation plan | Prevents overexposure |

| Risk assessment checklist | Aligns IPO with your goals |

| Research sources | Helps compare opportunities |

IPO Instructions

Step 1: Research the Company Thoroughly

The first time I considered investing in an IPO, I was swept up by headlines and social media buzz. That’s when I learned an important lesson: hype fades, numbers remain.

Start by reading the company’s prospectus. Look at revenue growth, profitability, debt levels, and competitive positioning. Ask yourself: Is this company solving a real problem? Is the industry expanding? Compare it with competitors already trading publicly.

Check expert analyses such as those found on U.S. News or Techopedia, which often break down the Best stocks to buy after new listings. Pay attention to valuation metrics. An overpriced stock can struggle after launch, even if the company is strong.

This is where disciplined economic analysis separates thoughtful investors from impulsive ones.

Step 2: Evaluate Market Conditions

An IPO does not exist in isolation. It enters the broader market environment.

When markets are strong and investor confidence is high, IPOs often perform better in the short term. During economic slowdowns, new listings may struggle.

Think about interest rates, inflation, and investor sentiment. For example, during volatile cycles or fears of recession, investors may avoid riskier offerings.

Review reports like EY’s trend insights to understand global patterns. If several companies are delaying offerings, that signals caution.

Matching your decision with broader market momentum is part of smart timing.

Step 3: Confirm Your Eligibility and Place a Request

Once you’ve chosen an IPO, contact your brokerage. Some brokers require a minimum account size or trading history before granting access.

Submit an indication of interest, specifying how many shares you want to buy. Keep in mind: you might not receive the full amount requested. Allocation depends on demand and your brokerage’s distribution rules.

When the final offering price is set, you’ll confirm your order. This is your last chance to reconsider.

Stay calm. It’s tempting to request more shares than you initially planned, especially if demand is strong. Stick to your allocation strategy.

Step 4: Monitor the Stock After Listing

The opening day can feel like a roller coaster. Prices may jump dramatically or dip within hours.

Avoid reacting emotionally. Some investors use short-term trading strategies, hoping to profit from early volatility. Others prefer holding long term if they believe in the company’s fundamentals.

Decide your approach before the listing day. Will you sell if the price jumps 30 percent? Or hold for five years?

Having a rule in place keeps you disciplined.

Step 5: Integrate the IPO into Your Portfolio

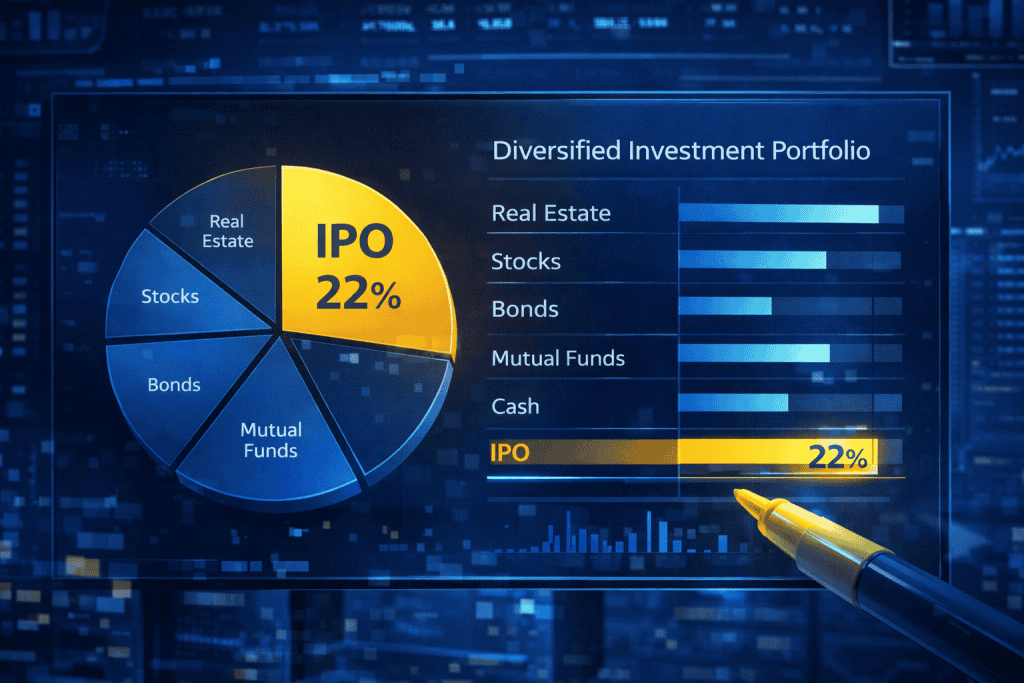

An IPO should not dominate your portfolio. Even promising companies carry uncertainty.

Diversify. Spread investments across industries and asset classes. Treat your position as one part of a balanced strategy.

Revisit your broader investment plan to ensure this new position aligns with retirement goals, risk tolerance, and time horizon.

Remember, long-term investing success rarely comes from a single stock. It comes from consistent, thoughtful decisions over time.

IPO Tips and Warnings

Investing in an IPO can be exciting. But excitement should never replace discipline.

One common mistake is overestimating early performance. Yes, some IPO stocks soar. Others drop below their offering price and take years to recover.

Another risk is ignoring valuation. A great company can still be a poor investment if the price is too high. During periods of economic uncertainty or a market crash, it may face additional pressure as investors shift to safer assets.

Here are a few practical tips:

- Limit exposure to a small percentage of your portfolio.

- Avoid investing based solely on media buzz.

- Review lock-up periods, when insiders can sell shares.

- Understand that volatility is normal.

| Tip or Warning | Why It’s Important |

|---|---|

| Avoid emotional buying | Prevents impulsive losses |

| Review financial statements | Ensures data-driven decisions |

| Watch insider lock-up dates | Anticipates potential price drops |

| Set exit rules in advance | Reduces panic selling |

| Diversify investments | Lowers overall risk |

A thoughtful strategy blends patience, research, and realism. The goal isn’t chasing quick profits. It’s building sustainable growth within your broader Economic Analysis framework.

Conclusion

Learning how to invest in an IPO isn’t about chasing the next big headline. It’s about understanding how new public companies fit into the larger market landscape.

Start by researching the company carefully. Study its financials and competitive position. Evaluate overall market conditions. Use a reliable brokerage platform to request shares. Most importantly, align the investment with your long-term strategy.

An IPO can offer growth potential, portfolio diversification, and early access to innovative companies. But it requires preparation and clear thinking.

If you approach the process with discipline and a solid economic perspective, investing in an IPO can become a powerful addition to your financial journey.

Take your time. Do your research. Then make your move with confidence.

FAQ

What is an IPO?

An IPO, or initial public offering, is the process by which a private company offers its stock to the public for the first time.

Why invest in an IPO?

IPOs offer the potential for high returns, especially if you’re investing in a company with strong growth prospects.

How can I evaluate an IPO?

You evaluate an IPO by researching the company, analyzing its financials, understanding market conditions, reviewing the prospectus, and considering the reputation of the underwriters.