Ever tried untangling your crypto finances and felt like your brain was about to melt? Yeah—same here. Tracking assets and liabilities in the cryptocurrency world isn’t just about staying organized—it’s survival. Whether you’re a hobbyist stacking satoshis or a serious investor knee-deep in altcoins, knowing what you own (assets) and what you owe (liabilities) can make or break your game.

The crypto market is fast, volatile, and unforgiving. One minute your Bitcoin stash is booming; the next, it’s worth less than your coffee habit. By learning how to track assets and liabilities properly, you gain control, make smarter decisions, and sleep better at night.

This post will walk you through how to track, manage, and stay on top of your digital finances without feeling like you’re drowning in spreadsheets.

Assets and Liabilities Materials or Tools Needed

Before we dive into the process, let’s talk tools. Tracking your crypto finances isn’t something you want to “eyeball.” You need systems.

Tools and Materials:

| Tool | Purpose |

|---|---|

| Spreadsheet (Excel/Google Sheets) | Manual tracking of crypto values |

| Crypto Portfolio Tracker (e.g. CoinStats, Delta, CoinTracker) | Real-time tracking and automation |

| Wallet Access (Cold/Hot Wallets) | To log actual holdings |

| Exchange Accounts | For syncing trading history |

| Notepad or Budget App | To jot down any crypto-related debts |

| Tax Calculator Tools (e.g. Koinly, TokenTax) | Track liabilities to governments |

You’ll also benefit from a basic grasp of how blockchain transactions work and staying informed about coin market conditions, especially if you hold volatile tokens or use DeFi services.

Assets and Liabilities Instructions

1. Define What You Actually Own

Let’s start with the fun stuff—what you own. These are your crypto assets. Think of it like taking inventory:

- Coins and tokens in your wallets (Bitcoin, Ethereum, Solana, etc.)

- Any crypto locked in staking protocols

- Interest-earning assets in DeFi platforms (like Aave or Compound)

- NFTs with resale value

- Stablecoins (USDC, DAI) in yield farms or liquidity pools

- Fiat balances in your crypto exchanges (USD, EUR, etc.)

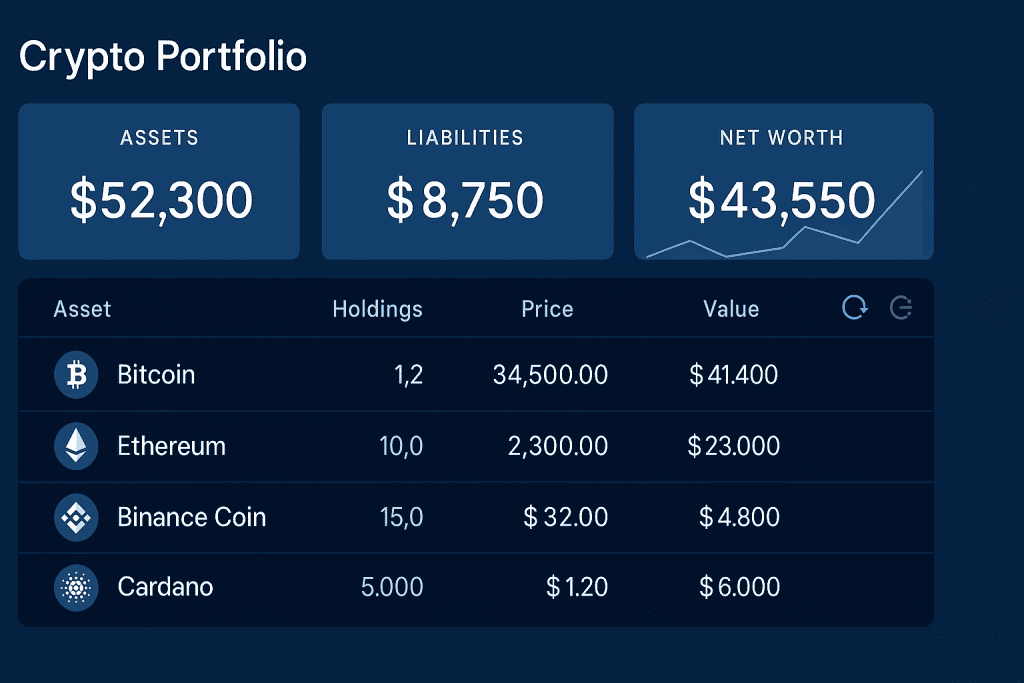

To get an accurate picture, log into your wallets and exchanges, and take note of current balances. Use a portfolio tracker or create columns in a spreadsheet for:

- Asset Name

- Quantity Held

- Current Market Value

- Total Value in Fiat (e.g., USD)

👉 Pro Tip: Use market APIs or formulas in Google Sheets to auto-pull prices, so your sheet updates in real time.

2. List Your Liabilities

Now we move to the side most people ignore—what you owe. In crypto, liabilities are easy to forget but dangerous to overlook.

Common liabilities include:

- Crypto-backed loans from platforms like Nexo or BlockFi

- Margin positions on exchanges (Binance, Kraken)

- Unpaid tax liabilities from previous crypto gains

- Fees from bots, subscriptions, or tools

- Personal loans taken to invest in crypto

Be brutally honest. If you borrowed $2,000 to ape into a meme coin, it belongs here.

Create another spreadsheet section or use your tracker’s “debt” function (if available) and list:

- Liability Type

- Owed Amount

- Repayment Date

- Interest (if any)

- Collateral used

3. Calculate Net Worth

Once your assets and liabilities are listed, subtract to find your net worth.

Net Worth = Total Assets – Total Liabilities

This isn’t just a math exercise—it tells you if your crypto journey is building real wealth or just financial noise. Aim to review this number weekly or after any major trades.

4. Automate and Stay Consistent

You don’t have to manually track everything forever. Most modern portfolio trackers sync directly with wallets and exchanges to automate:

- Asset value tracking

- Tax reporting

- Staking rewards

- DeFi balances

Recommended trackers:

- CoinStats: Great interface and tax tools

- Delta: Solid mobile app with notifications

- CoinTracker: Integrates well with tax filing

Even if you go manual, set a weekly 10-minute block to update your sheet. Make it a ritual—like Sunday coffee and crypto accounting.

Assets and Liabilities Tips and Warnings

Tips

- Keep a digital AND physical backup of your tracking sheet.

- Mark high-risk tokens and volatile assets with warning labels in your tracker.

- Use your asset data to inform rebalancing decisions—don’t just HODL everything blindly.

- Convert everything to your local currency (e.g., USD) for clarity.

Warnings

| Mistake | Why It’s Dangerous |

|---|---|

| Forgetting about DeFi loans | Many have auto-liquidation features |

| Not tracking gas fees | Ethereum fees add up and affect asset value |

| Treating crypto rewards as “free money” | They may be taxable and temporary |

| Ignoring loan interest | It can balloon fast if not monitored |

Tracking protects you. Crypto is unforgiving, and financial blind spots can burn you hard.

Conclusion

Tracking your assets and liabilities in crypto isn’t optional—it’s survival. Whether you’re trading, staking, flipping NFTs, or just holding Bitcoin, you need to know where you stand financially.

Start with your assets, add in your liabilities, calculate net worth, and update regularly. Use tools, automate where possible, and don’t fall asleep at the wheel.

You don’t need to be a spreadsheet wizard—you just need to be consistent. Once you build the habit, it becomes second nature.

So go ahead—set up that tracker, and take charge of your financial life in the wild world of crypto.

FAQ

What are crypto assets and liabilities in cryptocurrency accounting?

In the world of cryptocurrency, assets and liabilities refer to everything you own and owe digitally. Assets include your crypto holdings like Bitcoin, tokens, or NFTs. Liabilities are any debts or financial obligations—like crypto loans, margin trading debt, or unpaid taxes. Tracking both helps maintain a healthy portfolio.

Why is tracking assets and liabilities important in the crypto market?

The crypto market is known for wild swings. One day you’re in profit, the next you’re deep in the red. Keeping tabs on your assets and liabilities helps you stay grounded. It prevents over-investing, supports smarter strategies, and prepares you for tax season and audits.

Can blockchain technology help with managing assets and liabilities?

Absolutely. The blockchain records all transactions transparently, making it easier to verify asset ownership and debt histories. Some DeFi protocols also let you manage collateralized loans and track yields directly on-chain—cutting out the middleman.

Resources

- EFRA.org. Background Article

- FINRA.org. Crypto Assets

- Indeed.com. Assets and Liabilities

- Investopedia. Accounting Equation

- MYOB.com. Assets and Liabilities Guide