In the fast-changing world of cryptocurrency and blockchain, one concept serves as the foundation for everything else: assets. These are not only the coins and tokens investors trade every day but also the digital building blocks that give blockchain technology its real-world power. When people hear the word “assets,” they might think of traditional items like property, stocks, or gold. In crypto, however, assets take on new forms, ranging from digital money to non-fungible tokens (NFTs) and governance tools that allow communities to steer decentralized projects.

Understanding assets in crypto is essential because they represent more than just value—they define ownership, rights, and opportunities in digital systems. Whether you’re an investor exploring Bitcoin, an artist minting NFTs, or a developer building decentralized applications, crypto assets are the entry point. Their flexibility and innovation mean they are not just investments; they are shaping the future of financial systems, culture, and even identity.

For beginners, learning what assets mean provides clarity in an often confusing industry. For businesses and advanced users, they present opportunities for innovation and growth. Let’s dive into what crypto assets are, how they developed, the different forms they take, and why they are crucial to the future of digital finance.

What are Assets in Crypto?

At their core, they are digital representations of value stored, transferred, or invested on blockchain systems. These can include cryptocurrencies like Bitcoin and Ethereum, tokens tied to decentralized services, or NFTs linked to collectibles, art, and identity. Unlike traditional ones such as stocks or bonds, crypto assets exist entirely in digital form, verified by cryptographic systems.

The definition of it in this space highlights two categories: fungible (interchangeable, like Bitcoin) and non-fungible (unique, like NFTs). Fungible ones can be traded one-for-one, while non-fungibles represent something distinct that cannot be replaced. Tokens may also provide special roles, such as granting access to blockchain services or allowing holders to vote in decentralized governance.

In short, they are more than financial instruments—they can be tools for participation, influence, and identity in digital communities. Synonyms and related terms include digital assets, crypto tokens, and virtual property, all reflecting their role in expanding what value means in the digital age.

Breaking Down

To better understand their significance, let’s break down the key types:

Currency

Digital money like Bitcoin, Ethereum, or stablecoins designed for payment, exchange, and storage of value.

Utility Tokens

Coins or tokens used to pay for or access blockchain services, such as gas fees on Ethereum or credits in decentralized apps.

Governance Tokens

Provide voting rights in decentralized organizations (DAOs), letting users influence policies or upgrades.

Security Tokens

Digital versions of traditional securities like stocks, bonds, or investment contracts, issued and managed on blockchain systems.

Non-Fungible Tokens (NFTs)

Unique digital items tied to art, collectibles, or identity, each one distinct and not interchangeable with another.

Example in practice: Imagine buying Bitcoin to send money abroad instantly, holding a governance token to vote on a decentralized project’s new features, or owning an NFT that certifies digital artwork. Each of these use cases shows how they empower both financial and cultural participation in blockchain ecosystems.

History

The evolution of it mirrors the growth of blockchain itself. From Bitcoin’s origin to today’s complex ecosystems, it has consistently expanded in form and function.

| Year | Milestone | Impact |

|---|---|---|

| 2009 | Bitcoin launched | First digital currency built on blockchain, proving transparency and security. |

| 2015 | Ethereum introduced | Smart contracts enabled new forms, including utility and governance tokens. |

| 2017 | ICO boom | Introduced thousands of tokens, fueling both innovation and speculation. |

| 2020 | NFT explosion | Created new markets for art, collectibles, and identity assets. |

| 2023+ | Tokenized finance | Stablecoins, tokenized securities, and virtual real estate become mainstream. |

This history shows that they are not just financial experiments—they are milestones in blockchain’s role as a transformative global technology.

Types of Assets

Crypto assets can be divided into major types, each with distinct uses and characteristics:

Fungible

Interchangeable tokens like Bitcoin or stablecoins. These act as digital money for payments and trading.

Non-Fungible (NFTs)

Unique tokens tied to digital art, collectibles, or identity. Each NFT is distinct and cannot be swapped one-for-one.

Utility Tokens

Provide access to services, power decentralized apps, or act as credits in ecosystems.

Governance Tokens

Offer decision-making power in decentralized communities and protocols.

Security Tokens

Tokenized versions of traditional ones like stocks, designed for investment under regulatory frameworks.

| Type | Description | Example |

|---|---|---|

| Fungible | Interchangeable and uniform | Bitcoin, USDT |

| Non-Fungible | Unique, not interchangeable | NFTs, digital art |

| Utility | Provide access to services | ETH gas fees |

| Governance | Voting rights in DAOs | UNI, AAVE |

| Security | Tokenized securities | On-chain stocks |

How Do They Work?

It operates through blockchain technology—a public ledger that records and verifies ownership transparently. Each asset is stored in a digital wallet, which is protected by cryptographic keys. Ownership and transfers are validated using consensus mechanisms such as Proof of Work (PoW) or Proof of Stake (PoS).

Fungible ones like Bitcoin function as money, transferred instantly without intermediaries. NFTs, by contrast, carry unique metadata that links to specific digital files, proving authenticity and ownership. Some of it earn income through staking, lending, or participation in decentralized finance (DeFi).

For example, staking Ethereum can generate rewards, while lending stablecoins in DeFi protocols provides interest. NFTs might generate royalties each time they are resold. In all cases, crypto assets provide both investment opportunities and new ways to participate in digital ecosystems.

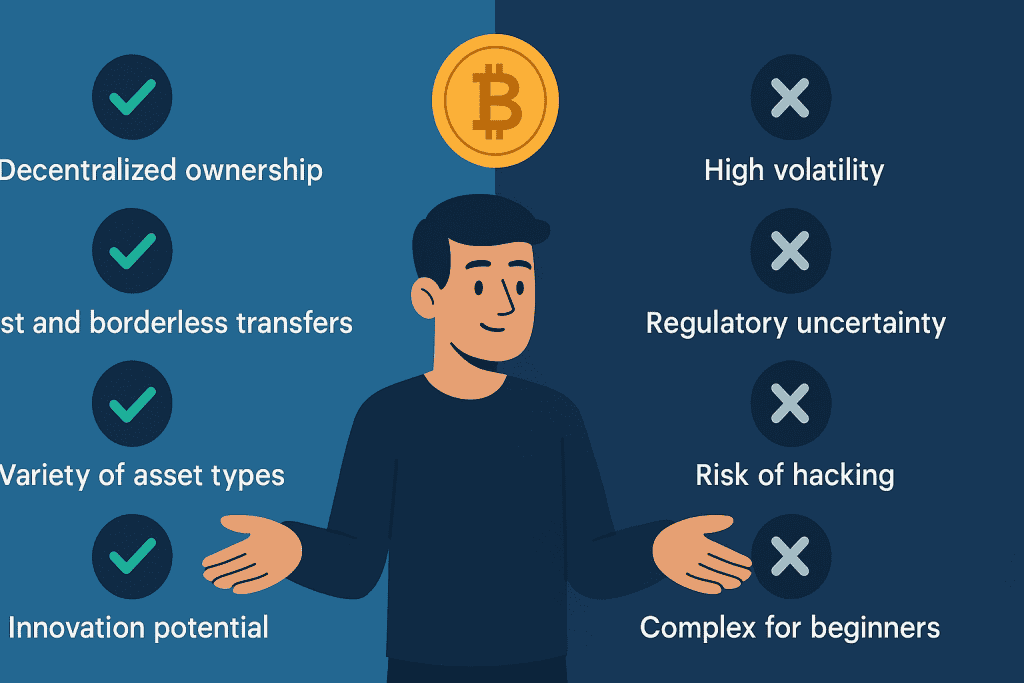

Pros & Cons

Before diving into investment or participation, it’s worth weighing the benefits and challenges of crypto assets:

| Pros | Cons |

|---|---|

| Ownership is decentralized and transparent | Prices can be highly volatile |

| Transfers are fast and borderless | Regulation is unclear in many regions |

| Assets exist in multiple forms (money, collectibles, governance) | Wallets and exchanges can be hacked |

| Enable innovation and growth in new markets | Complexity can overwhelm beginners |

The pros demonstrate why adoption is growing worldwide, while the cons underline the need for caution, regulation, and education.

Uses of Crypto Assets

- CoinMarketCap. Crypto Basics / Academy

Helps new and experienced users understand how assets are used for trading, staking, yield farming, and tracking ecosystem metrics through market data, price charts, and educational content. - Binance Academy. Digital Assets & Blockchain Industry

Explains how crypto assets serve in DeFi, tokenization, payments, and the evolving digital finance landscape—showing how they function beyond just speculative investments. - Binance. Evolution of Digital Assets and Their Growing Applications

Describes how digital assets expand into financing, tokenized value storage, and institutional use—illustrating real growth in their utility. - Investopedia. 5 Top Cryptocurrencies by Market Cap (and broader definitions)

Through concrete examples, highlights how assets like Bitcoin, Ethereum, stablecoins, and token types are used differently in portfolios, payments, and value storage. - YouTube. How to Use CoinMarketCap (Beginner’s Guide, 2025)

Provides a visual walkthrough of how users engage with assets using a platform—observing market data, tracking performance, and making decisions in real time.

By connecting to these resources, it’s clear that assets are not abstract ideas—they are practical tools shaping industries, culture, and the future of digital interaction.

Resources

- CoinMarketCap – Crypto Basics / Academy

- Binance Academy – Digital Assets & Blockchain Industry

- Binance – Evolution of Digital Assets and Their Growing Applications

- Investopedia – 5 Top Cryptocurrencies by Market Cap (and broader definitions)

- YouTube – How to Use CoinMarketCap (Beginner’s Guide, 2025)