If you’ve ever wondered how some traders manage to amplify their gains, you’ve probably stumbled across the question: what is margin trading? At first glance, the idea sounds thrilling—using borrowed money to boost your buying power, chasing bigger profits with smaller upfront investments. It’s a strategy that has drawn investors to stocks, forex, and crypto alike.

We’ll cover the definition, history, types, how it works, and where it’s commonly used. Whether you’re just starting out or exploring advanced strategies, knowing this could mean the difference between smart investing and costly mistakes also helps alot of traders.

What is Margin Trading?

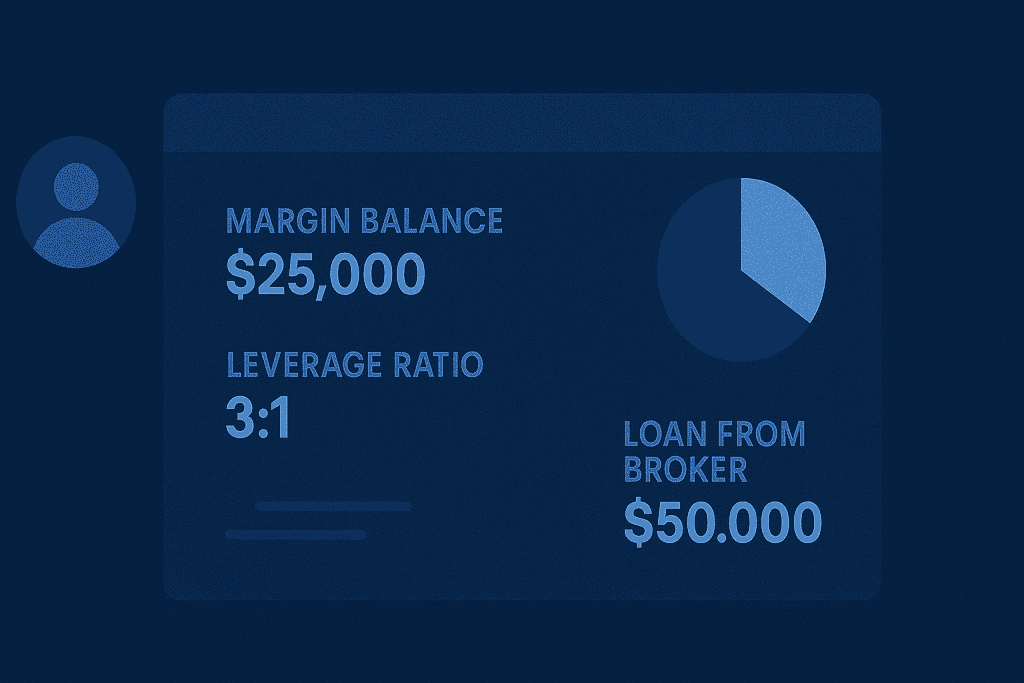

At its core, what is margin trading means buying or selling financial assets using borrowed funds from a broker. You put down a portion of the total value, called “margin,” and the broker lends you the rest. This allows you to control larger positions than your actual cash balance would allow.

It’s often referred to as “trading on leverage,” because leverage multiplies both potential gains and potential losses. In everyday language? Imagine putting a small down payment on a house, while the bank covers the majority. If the property’s value rises, your profit is magnified. But if it falls, your losses hit hard too. That’s why margin trading is considered both powerful and risky—it can accelerate your growth as a trader, but without careful risk management, it can just as quickly amplify mistakes. Understanding the mechanics and risks is crucial before diving in.

Breaking Down Margin Trading

When trying to understand margin trading, it helps to zoom in on its key elements:

Margin Account

To start, you need a margin account with your broker. This isn’t the same as a standard cash account. A margin account allows you to borrow money, but it also comes with rules, interest charges, and risks.

Initial Margin and Maintenance Margin

The “initial margin” is the minimum deposit you need to open a leveraged position. The “maintenance margin” is the minimum equity you must maintain. If your balance falls below that, you’ll face a “margin call,” meaning your broker demands you add more funds—or they may close your position.

Leverage

Leverage is the multiplier effect. If your broker offers 5x leverage, you can control $5,000 worth of assets with only $1,000 of your own money. This makes it so attractive—and so dangerous.

Real-World Example

Let’s say you deposit $2,000 into a margin account. Your broker allows 4x leverage, so you can trade up to $8,000 worth of stock. If the stock rises by 10%, your profit is $800 instead of $200. But if the stock falls 10%, you lose $800—potentially wiping out a large chunk of your original investment.

In short, it boils down to borrowing money to amplify returns. It can make you feel like a pro when things go right, but it can also drain your account faster than you might expect.

History of Margin Trading

The roots go back more than a century, evolving with stock markets and regulations.

| Period | Development in What is margin trading |

|---|---|

| Early 1900s | Margin trading popular but unregulated, leading to widespread speculation. |

| 1929 Crash | Excessive leverage contributed to the Great Depression, triggering reforms. |

| 1934 Onward | U.S. Securities Exchange Act set rules for margin requirements. |

| 2000s–Today | Expanded into forex and crypto, with stricter broker regulations and digital platforms. |

Long Margin Trading

This strategy is common in markets like stocks and crypto, where upward momentum can create strong returns. However, if prices fall, losses can be amplified, so setting stop-loss orders and managing leverage carefully is crucial.

Short Margin Trading

Here, you borrow assets instead of money, sell them immediately at the current market price, and then aim to repurchase them later at a lower price. If the market drops as expected, the difference becomes your profit after repaying the borrowed assets.

Cross Margin

This setup reduces the risk of quick liquidation because profits from one position can offset losses in another. It’s often preferred by advanced traders who want flexibility and the ability to keep positions alive longer. The downside is that if the market moves heavily against you, your entire balance is at risk, not just a portion.

Isolated Margin

In this mode, only the funds allocated to a single position are at risk if that trade goes south. Other assets in your account remain untouched. Many beginners prefer isolated margin because it limits losses to specific trades, making it easier to manage risk.

How does margin trading work?

The process begins when you open a margin account, deposit collateral, and borrow funds from your broker. You use leverage to enter positions larger than your deposit. As prices move, your gains or losses are magnified. If your account equity falls below the maintenance margin, you’ll face a margin call. So, in practice? It’s trading with borrowed power—rewarding if managed well, devastating if ignored.

Pros & Cons

Like every strategy, it comes with upsides and downsides.

| Pros | Cons |

|---|---|

| Amplifies potential profits | Magnifies losses equally |

| Increases market exposure | Risk of margin calls and forced liquidation |

| Provides flexibility across markets | Requires interest payments to brokers |

| Accessible in stocks, forex, and crypto | Not suitable for beginners without experience |

Uses of Margin Trading

Now that we’ve covered the basics, where does margin trading fit into the real world?

Stock Markets

Investors use margin trading in stock markets to increase their buying power, allowing them to take larger positions in equities than cash alone would permit. By borrowing from their broker, they can participate in more trades, amplify potential gains, and diversify across multiple companies.

Beginner Guidance

Because small market swings can lead to large gains—or heavy losses—novice traders are advised to start cautiously, using lower leverage and practicing disciplined stop-loss strategies. Education and training are crucial here, as margin amplifies not just rewards but also mistakes.

Brokerage Accounts

investors must open a margin account with their broker, which comes with specific requirements such as minimum balances and interest charges on borrowed funds. These accounts demand careful monitoring, as brokers can issue margin calls if equity falls below required levels.

Financial Literacy

Just as missing payments on a traditional loan could lead to foreclosure, failing to manage margin debt can result in forced liquidations. Building financial literacy ensures traders know exactly how much they’re borrowing, the costs involved, and the risks of over-leveraging.

Best Practices

Strategies include setting tight stop-loss orders, diversifying positions to avoid overexposure, and avoiding the temptation of maximum leverage. Consistently reviewing positions and keeping track of interest payments also helps protect capital.

Resources

- Investopedia: Understanding Margin Trading

- Forbes Advisor: Margin Trading Risks

- Charles Schwab: Margin Trading: The Starter Guide

- NerdWallet: Margin Trading Account

- Corporate Finance Institute: Margin Trading Successful Practices