Take Profit Trader is more than a trading phrase—it’s a mindset in the world of Economic Analysis. At its core, it helps traders lock in gains without getting lost in the rollercoaster of market emotions. By setting clear targets, a Take Profit Trader knows when to exit a trade instead of chasing endless profits. This strategy is relevant because it connects psychology, discipline, and financial goals in one decisive action.

If you’ve ever hesitated before closing a trade, wondering whether to hold or sell, you’ve faced the challenge this concept solves. Understanding it is not just for advanced traders; it’s for anyone who wants to trade smarter and avoid letting greed or fear rule their decisions. By learning the principles of a Take Profit Trader, you’ll gain tools to navigate volatile markets with clarity, confidence, and a sharper perspective on economic analysis in action.

What is Take Profit Trader?

A Take Profit Trader is someone who uses a predetermined level to exit a trade and secure profits. Instead of relying on gut feelings, this approach is systematic and rooted in discipline. In trading platforms, a take profit order is often placed along with a stop loss. Together, they define the boundaries of risk and reward. Synonyms for this practice include “profit target trader” or “exit strategy investor.” It’s not about chasing the perfect price; it’s about capturing gains before markets reverse.

Breaking Down Take Profit Trader

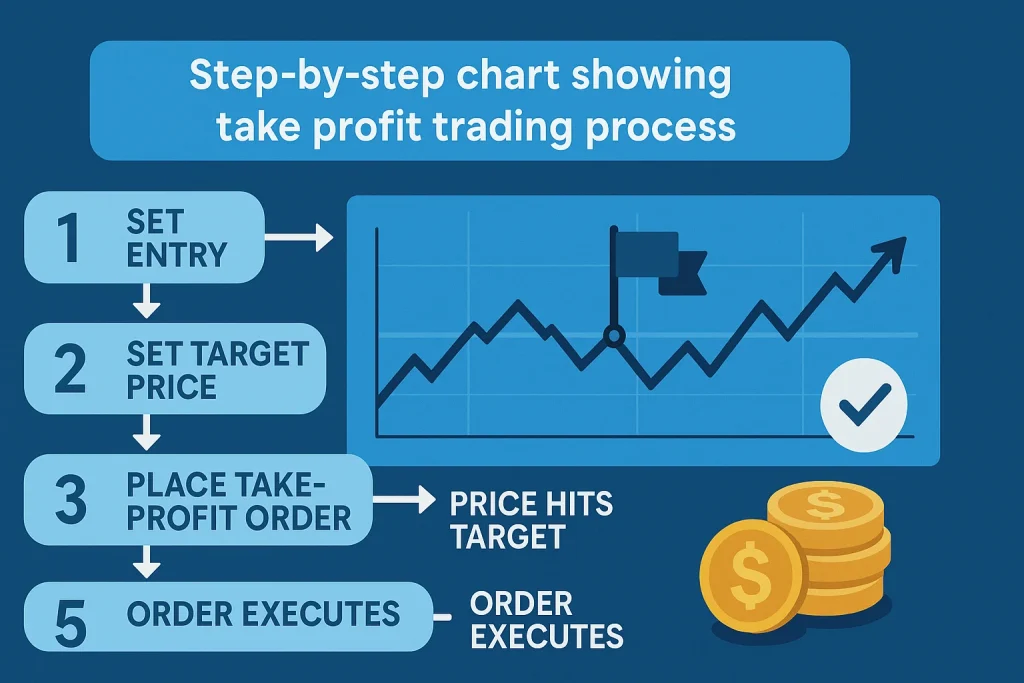

To break it down, think of a Take Profit Trader as someone who treats every trade like a well-planned journey. The destination is not “maximum profit” but “achieved target.”

- Setting the Goal – The first step is deciding the price level where the trader will exit. This is based on analysis, not impulse.

- Placing the Order – Once the take profit level is chosen, the trader sets an automatic order. This ensures the trade closes even if emotions or distractions get in the way.

- Balancing with Stop Loss – A true Take Profit Trader knows that gains mean little without protection. That’s why they balance their strategy with stop losses.

- Adapting to Market Trends – Markets change quickly, and a trader must adjust. Sometimes the profit level is raised as momentum builds, but discipline prevents overreaching.

Imagine you buy a stock at $100 and set a take profit order at $120. If the price hits $120, your order executes automatically, and you walk away with a clean gain. Without this plan, you might hold too long, waiting for $130, only to watch it drop back to $95. That’s the difference between disciplined trading and emotional guessing.

The method also reduces stress. Instead of watching every tick of the chart, a Take Profit Trader lets the strategy do the heavy lifting. This frees the mind for deeper economic analysis and prevents burnout from constant screen time. It’s similar to setting reminders for important tasks—like a Windows Update running automatically. You don’t need to manually check every moment because the system handles it.

History of Take Profit Trader

Take profit strategies have been around since the earliest stock exchanges. Traders in Amsterdam during the 1600s often used handwritten agreements to exit trades at preset levels. Over time, technology advanced, and digital platforms introduced automatic take profit orders.

| Year | Event | Impact |

|---|---|---|

| 1600s | Amsterdam stock exchange | Early preset agreements |

| 1900s | Stock ticker systems | Faster trade monitoring |

| 1980s | Rise of online trading | Automated take profit orders |

| 2000s | Advanced platforms | Integrated take profit and stop loss |

| Today | AI-driven trading | Take profit levels adjusted with algorithms |

Types of Take Profit Trader

Traders adapt the concept of take profit in different ways.

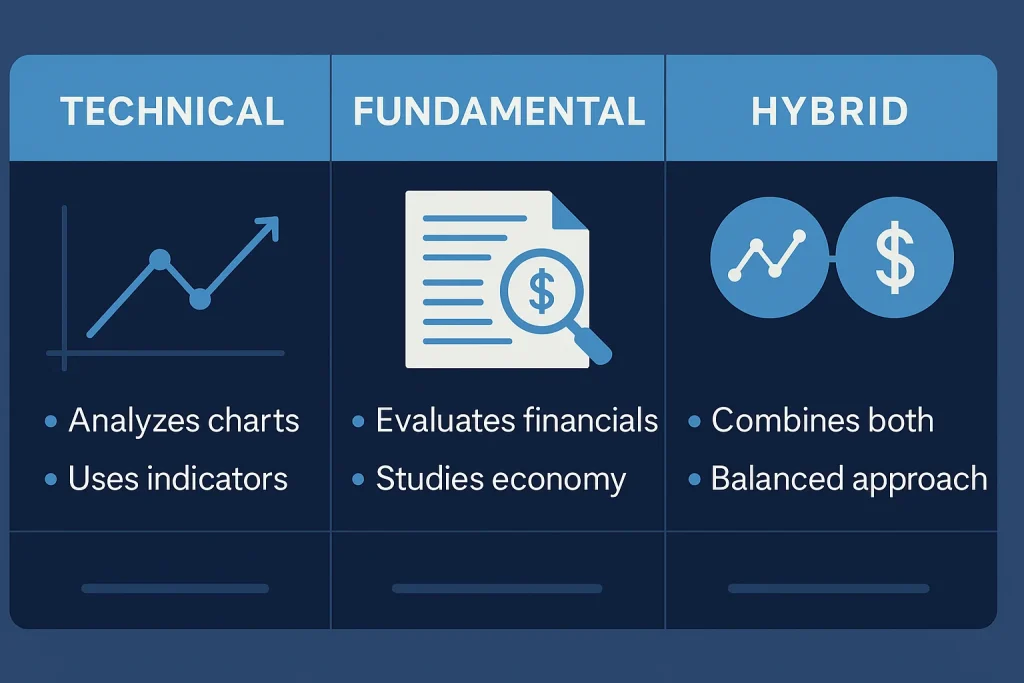

Technical Take Profit Trader

Relies on chart patterns, indicators, and price levels.

Fundamental Take Profit Trader

Focuses on company news, earnings, or economic reports to set targets.

Hybrid Take Profit Trader

Combines both technical and fundamental methods for balance.

| Type | Method | Focus |

|---|---|---|

| Technical | Chart signals | Market behavior |

| Fundamental | News/events | Economic shifts |

| Hybrid | Both combined | Flexibility |

How does Take Profit Trader work?

A Take Profit Trader works by setting exit points before emotions interfere. The system executes trades automatically once targets are hit. This approach reduces impulsive decisions and helps traders stick to their plans. Brokers often charge no extra fee for placing these orders, making them accessible to both beginners and professionals.

Pros & Cons

Like all strategies, this method has strengths and weaknesses.

| Pros | Cons |

|---|---|

| Locks in profits automatically | May miss larger moves |

| Reduces emotional decisions | Requires accurate analysis |

| Saves time and stress | Overreliance can limit flexibility |

| Works across markets | Can trigger too early in volatile markets |

Uses of Take Profit Trader

A Take Profit Trader approach has many practical uses in today’s financial world.

Protecting Gains

The main use is securing profits before markets swing back. Instead of guessing, traders have certainty.

Supporting Discipline

Discipline is hard in trading. Automatic take profit orders build accountability, ensuring traders follow their own rules.

Managing Risk

By pairing take profit with stop loss, traders balance risk and reward. This prevents catastrophic losses.

Enhancing Strategies

Professional traders often combine take profit levels with algorithms or AI. These systems can identify patterns that humans might miss.

The use of this strategy extends beyond stocks. Forex traders rely on it heavily, as currencies fluctuate by the second. Crypto traders use it to guard against sudden drops in volatile markets. Even commodity traders find it useful, especially during global disruptions. Just as financial systems face cyber threats and risks from hacking, traders face unpredictable markets. Both require safeguards. Think of take profit orders as the financial version of Express VPN—a shield that ensures safety in an uncertain environment. Without such tools, traders risk exposure to unpredictable elements, just like a system vulnerable to Deepfakes malware.

Conclusion

Becoming a Take Profit Trader is less about chasing the perfect price and more about mastering discipline, as setting clear targets and sticking to them helps protect gains, reduce emotional decisions, and build confidence across stocks, crypto, and forex. This strategy proves that success isn’t about timing every move but about having a plan and letting it work for you, and as technology and AI continue to reshape markets, the Take Profit mindset will only grow more powerful—because in fast-moving markets, knowing when to exit is just as important as knowing when to enter, and that is the true secret of trading like a pro.

Resources

- Investopedia – Take-Profit Order Definition

- TakeProfitTrader– We Fund Futures Traders

- Trust Pilot – Take Profit Trader

- Propfirmapp – Take Profit Trader

- CMC Markets – Take Profit Orders in Trading