Funds in crypto are transforming investing by connecting Bitcoin and staking. In traditional finance, funds have always been about pooling resources to achieve greater returns. In cryptocurrency, this idea takes on a fresh role—blending the reliability of Bitcoin with the yield-generating opportunities of Proof of Stake networks. In cryptocurrency, this idea takes on a fresh role—blending the reliability of Bitcoin with the yield-generating opportunities of Proof of Stake networks. These hybrid strategies make it easier for both individuals and institutions to diversify, earn passive income, and participate in blockchain growth without technical hurdles.

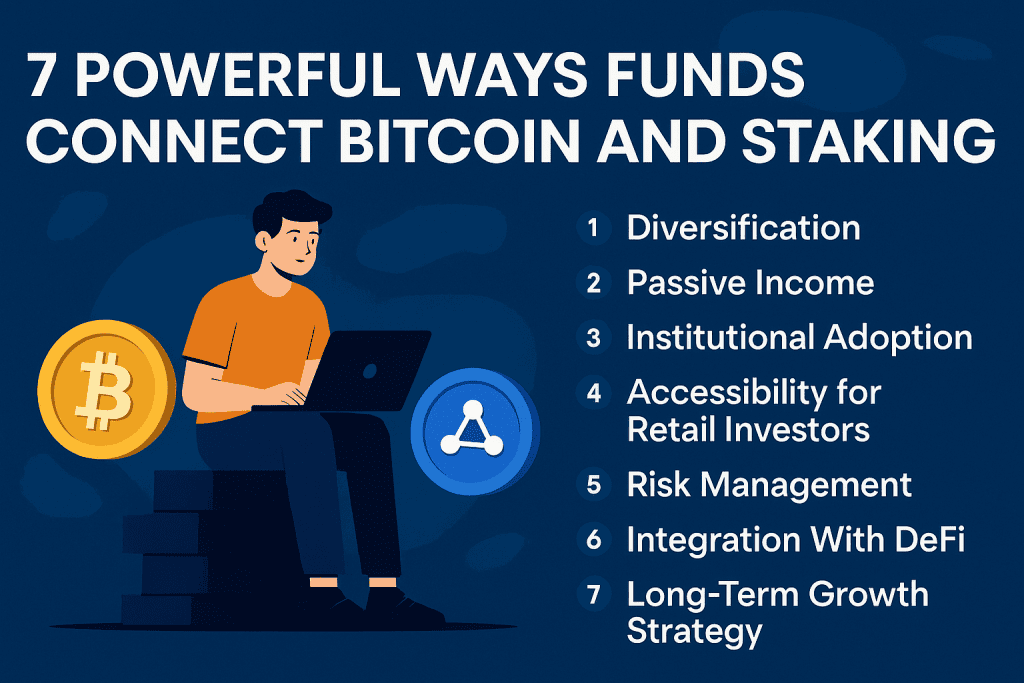

But how exactly do these vehicles bring Bitcoin and staking together, and why are they becoming essential in today’s digital economy? Here are 7 powerful ways they bridge the two worlds.

What Are Funds in Crypto?

A crypto fund is a pool of capital from multiple investors, managed collectively to achieve financial goals. These vehicles can hold assets such as Bitcoin, Ethereum, or PoS-based coins to create balanced strategies.

- BTC-focused portfolios → Provide long-term exposure to digital gold.

- Yield-based pools → Generate passive rewards by locking assets in validator networks.

- Hybrid models → Combine Bitcoin’s security with the profitability of staking.

By combining Bitcoin with Proof of Stake rewards, investors get the best of both worlds: a hedge against inflation and market uncertainty through BTC, plus steady income streams through validator participation.

7 Powerful Ways Funds Connect Bitcoin and Staking

Diversification

They balance Bitcoin’s stability with staking rewards, reducing overall risk. Instead of putting all capital into one asset, investors gain exposure to two complementary strategies—Bitcoin as a store of value and validator rewards as yield.

Passive Income

By delegating assets within the pool, investors earn regular payouts without the complexity of running validator nodes. This transforms crypto exposure from pure speculation into a reliable income strategy.

Institutional Adoption

They make it easier for hedge funds, pension funds, and asset managers to access both Bitcoin and staking opportunities. Structured vehicles remove technical hurdles, offering compliant entry points into the digital economy.

Accessibility for Retail Investors

Platforms like Coinbase or Binance allow small investors to access hybrid Bitcoin + staking products. Even with modest contributions, users can enjoy benefits once reserved for institutions.

Risk Management

These portfolios smooth out Bitcoin’s volatility with the steady yields of validator-based networks. For example, if BTC dips in value, staking rewards can help offset short-term losses.

Integration With DeFi

Some vehicles issue liquid staking tokens, letting investors earn validator rewards while simultaneously using their assets in DeFi lending or borrowing protocols. This dual use maximizes capital efficiency.

Long-Term Growth Strategy

They use Bitcoin as a long-term hedge, while validator payouts provide compounding short-term gains. Together, this creates portfolios designed for both immediate and future growth.

History

| Year | Milestone |

|---|---|

| 2013 | First Bitcoin investment funds appear. |

| 2017 | Hedge funds expand into crypto during ICO boom. |

| 2020 | Grayscale and other funds bring institutional BTC exposure. |

| 2022 | Ethereum Merge makes staking funds mainstream. |

| 2024+ | Hybrid funds combine BTC with staking rewards for growth. |

This evolution reflects how managed crypto products have matured—from experimental Bitcoin-only funds to sophisticated hybrid vehicles that merge yield generation with price exposure.

Types in Crypto

- Bitcoin Funds: ETFs, trusts, and managed pools holding BTC.

- Staking Pools: Focused on validator and delegation rewards.

- Hybrid Strategies: Mix BTC allocations with PoS assets.

- DeFi Portfolios: Use staking plus lending and liquidity pools.

- Index Trackers: Follow Bitcoin dominance and PoS projects together.

These categories allow investors to select based on goals: stability, yield, growth, or diversified blockchain exposure.

How it Works in Bitcoin and Staking?

- Investors contribute capital.

- Managers allocate to Bitcoin and PoS assets.

- Bitcoin provides price exposure.

- Staking earns rewards over time.

- Returns are distributed or reinvested.

This combination of digital gold plus yield-earning instruments makes these products attractive to investors seeking balance between security and profitability.

Pros & Cons

| Pros | Cons |

|---|---|

| Diversified exposure (BTC + staking) | Management fees apply |

| Passive income from staking | Bitcoin volatility impacts value |

| Professional management | Regulatory risks |

| Accessible to institutions + retail | Slashing risk for validators |

While the benefits are significant, risks remain—particularly around regulatory clarity and validator performance. Choosing reputable fund managers and platforms helps mitigate these challenges.

Uses and Applications

Wealth Growth → Combines BTC’s hedge-like qualities with steady validator yields.

Institutional Portfolios → Hedge funds diversify between Bitcoin and PoS coins.

Passive Yield → Investors earn without running validator nodes.

Retail Participation → ETFs, apps, and exchanges simplify access for everyday users.

DeFi Ecosystem → Liquid staking tokens integrated into lending/borrowing systems.

A practical example: A retirement fund might allocate 70% of its portfolio to Bitcoin for stability, while the remaining 30% is placed in validator assets like ETH or SOL. This not only generates yield but also provides inflation protection, creating a modernized version of the classic “balanced portfolio.”

Conclusion

Funds in crypto are no longer just experimental—they’re essential. In 2025, they have matured into one of the most reliable gateways for both individuals and institutions to participate in the digital asset economy. By combining Bitcoin’s reputation as digital gold with the yield-generating power of staking, it provide a balanced strategy that blends long-term stability with short-term profitability.

The 7 powerful ways it connect Bitcoin and staking—from diversification and passive income to institutional adoption and DeFi integration—highlight just how transformative these vehicles have become. Instead of choosing between the security of Bitcoin or the rewards of staking, investors can now access both within a single, professionally managed portfolio.

For conservative investors, this means exposure to Bitcoin as a hedge against inflation and traditional market volatility. For growth-driven investors, staking-based funds unlock continuous rewards, compounding returns over time without the technical burden of running nodes or managing wallets. Institutions, too, benefit from these funds as they seek structured, regulated entry points into the crypto space.

Ultimately, In crypto it combines Bitcoin and staking they are paving the way for a more inclusive and dynamic digital finance ecosystem. They serve as the bridge between traditional investing and the blockchain-powered future—empowering anyone, from retail traders to global financial institutions, to take part in the next chapter of financial innovation.

Resources

- SEC: Crypto Funds Overview

- Coinbase: What Is Staking?

- Investopedia: Bitcoin ETF Explained

- Binance Academy: Crypto Funds Explained

- Kraken Learn Center: Crypto Funds Guide