Evercore Stock has steadily garnered attention in financial circles, and this interest is well justified. As a leading name in the world of independent investment banking and advisory services, Evercore has demonstrated a consistent ability to deliver value across market cycles. The firm’s credibility stems from its focus on client-first strategies, mergers and acquisitions expertise, and a strong foothold in both domestic and international markets. These strengths have enabled Evercore to outperform many of its competitors in terms of return on equity and deal volume, even during periods of economic turbulence. Its capacity to maintain solid financial health while delivering quality advisory services has made it a standout in the financial services sector.

This review aims to provide investors with a deep dive into Evercore Stock’s performance metrics, growth trajectory, and strategic advantages. More importantly, it evaluates whether the stock aligns with the objectives of a thoughtful investment plan. For those seeking to make informed decisions about building or refining their portfolio, this comprehensive analysis covers everything from dividend potential and peer comparisons to market positioning and expert ratings. If you are in search of one of the best stocks to buy that offers a balance between income and long-term value, Evercore Stock is certainly worth your consideration.

Overview of Evercore Stock

Evercore Inc. (NYSE: EVR) is a leading global investment banking advisory firm known for its independence and high-quality client service. Established in 1995, the firm has grown into a respected name in financial advisory by focusing on mergers and acquisitions, capital restructuring, and capital raising. What sets Evercore apart is its commitment to providing unbiased advice, avoiding the conflicts of interest that often accompany larger financial institutions.

Headquartered in New York City, Evercore operates globally, with offices in major financial centers including London, Hong Kong, and São Paulo. Its client base includes multinational corporations, family-owned businesses, financial sponsors, and governments. The firm is especially recognized for guiding clients through complex transactions such as cross-border mergers and distressed asset restructurings.

As of 2025, Evercore’s market capitalization stands at approximately 5.4 billion USD. The company also offers a dividend yield of around 2.75 percent, which appeals to income-focused investors. It maintains a healthy balance sheet with disciplined financial management and a focus on long-term shareholder value.

Evercore’s strategic edge lies in its client-centric approach and experienced advisory teams. In an environment where trust and insight are paramount, the firm continues to outperform expectations by delivering personalized, high-impact solutions. For investors looking at the financial services sector, Evercore Stock represents a compelling blend of stability, growth potential, and reliable dividend income..

In-Depth Analysis of Evercore Stock

Evercore’s performance has oscillated alongside global market trends. However, its strength lies in long-term strategy and agile management, which keeps it relatively resilient during downturns.

Performance Metrics

Evercore’s performance over the past five years highlights its ability to deliver sustainable growth. The stock has maintained a 5-year compound annual growth rate of approximately 7.8 percent, which is respectable for a company in the financial services sector. With a price-to-earnings ratio of 14.6 and a return on equity of 28.4 percent, Evercore demonstrates both profitability and efficient use of capital. Its debt-to-equity ratio of 0.42 also reflects prudent financial management, suggesting the company operates with low leverage. For income-focused investors, a 2.75 percent dividend yield adds ongoing value.

Usability for Investors

Evercore Stock appeals to a range of investor profiles. Its consistent dividend makes it attractive to those seeking passive income, while its growth trajectory and strong fundamentals appeal to long-term growth investors. With its proven ability to weather economic shifts, the stock suits investors looking to balance moderate risk with reliable returns. Although it may not offer high short-term gains, it remains a stable choice for those building a diversified portfolio, particularly within the financial services category.

Economic Sensitivity

As with most financial institutions, Evercore is influenced by macroeconomic conditions. Shifts in interest rates, monetary policies, and geopolitical events can impact deal volume and revenue. Nevertheless, the firm has reduced risk through industry diversification and global reach. Its adaptability to changing environments ensures that even during downturns, it continues to secure deals and maintain client trust, reinforcing its resilience across economic cycles.

Expert Analysis

Industry experts maintain a positive outlook on Evercore Stock. Analysts often cite its high return on equity and efficient cost structure as competitive advantages. CNBCPro and other financial outlets have highlighted Evercore’s potential for continued outperformance as global M&A activity gains momentum. Additionally, its executive leadership is frequently praised for making strategic acquisitions and navigating volatile markets with precision. Overall, the expert consensus views Evercore as a robust mid-cap stock in the investment banking space.

Evercore Stock Comparison

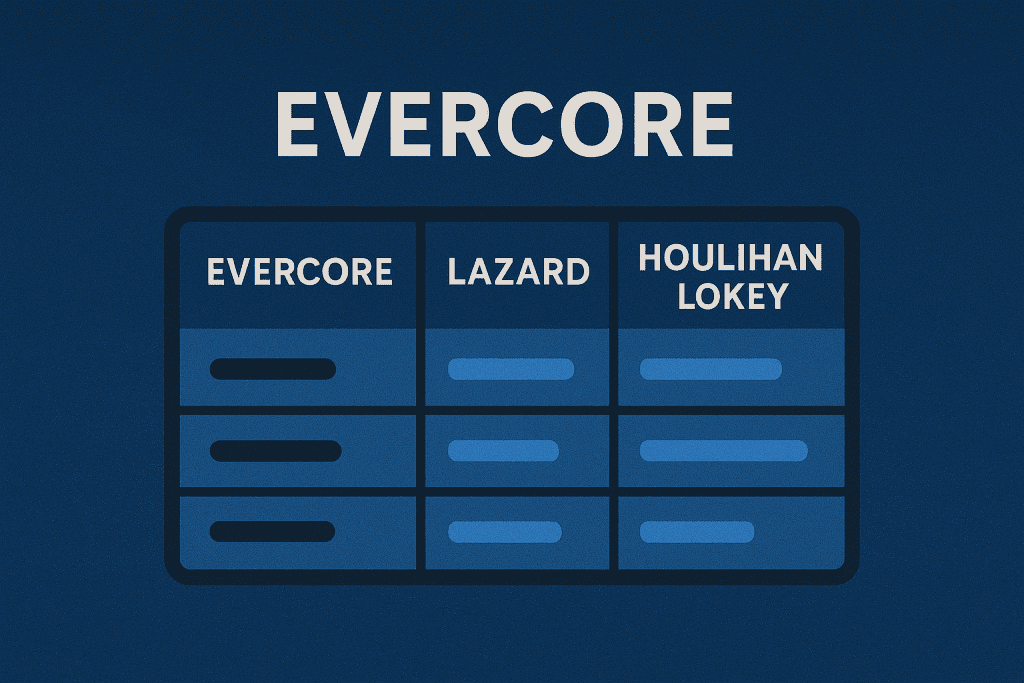

When assessing Evercore Stock, it’s crucial to benchmark it against similar financial advisory firms. Let’s take a look at how EVR compares to Lazard Ltd (LAZ) and Houlihan Lokey (HLI).

| Feature | Evercore (EVR) | Lazard (LAZ) | Houlihan Lokey (HLI) |

|---|---|---|---|

| Dividend Yield | 2.75 percent | 5.45 percent | 2.30 percent |

| Market Cap | 5.4B USD | 3.5B USD | 7.3B USD |

| P/E Ratio | 14.6 | 12.3 | 18.2 |

| Global Reach | Strong | Very Strong | Moderate |

| Revenue from M&A | High | Moderate | High |

Evercore holds its own well in this competitive field, especially in M&A advisory and return on equity.

Evercore Stock Pros and Cons

Here’s a quick snapshot of Evercore’s advantages and disadvantages for potential investors.

| Pros | Cons |

|---|---|

| Strong M&A and advisory reputation | Cyclical exposure to global capital markets |

| Solid dividend performance | Lower yield compared to some competitors |

| Strategic global presence | Sensitive to macroeconomic shocks |

| Experienced executive leadership | Moderate capital appreciation in slow markets |

Conclusion

Evercore Stock presents a well-balanced opportunity for investors seeking both stability and long-term growth. The company has built a strong reputation in the investment banking space by maintaining high-quality client relationships and delivering expert advisory services. Its consistent dividend payouts, impressive return on equity, and low debt levels suggest that it is financially sound and managed with discipline. These strengths make it appealing to conservative investors who prioritize capital preservation but still want to capture moderate gains over time.

However, potential investors should remain aware of the cyclical nature of the financial services industry. Market volatility, regulatory changes, and fluctuations in global deal-making activity can influence Evercore’s performance. Despite these risks, the firm’s strategic global presence and experienced leadership provide a buffer against unpredictable economic conditions. For those building a diversified portfolio or looking to add a quality stock within the financial advisory sector, Evercore deserves serious consideration. Its blend of income potential and growth outlook positions it as a strong candidate for a long-term investment plan.

Evercore Stock Rating

Based on recent analyst coverage and performance analysis, Evercore Stock earns a confident 4.3 out of 5 stars.

FAQs

Is Evercore Stock a good choice for long-term investment plans

Yes. Evercore Stock offers a combination of dividends and strategic growth, making it suitable for investors with a long-term horizon.

How does Evercore Stock perform compared to other financial advisory firms

Compared to peers like Lazard and Houlihan Lokey, Evercore Stock stands out in M&A advisory performance and return on equity, though it may not offer the highest yield.

What economic conditions impact Evercore Stock the most

Evercore Stock is particularly sensitive to macroeconomic shifts, especially those affecting M&A activity and capital markets. However, strategic diversification helps buffer these risks.

Resources

- Evercore. Company Overview

- Investing.com. Evercore ISI Maintains Dell Stock

- MarketWatch. Evercore Stock Performance

- Yahoo Finance. EVR Quote

- Morningstar. Evercore Analysis

- CNBC. Cloud Tech Outlook by Evercore ISI