The Nikkei 225 has surged into the global spotlight with its dynamic performance in the Japan stock market. Known for tracking the top 225 blue-chip companies listed on the Tokyo Stock Exchange, the index serves as a vital indicator of Japan’s economic health and investor confidence. Over the past weeks, it has demonstrated notable resilience despite global uncertainties. Investors are closely watching how domestic consumption, export activity, and shifts in government fiscal policy are impacting the index. With Japan navigating post-pandemic recovery efforts and adjusting its monetary stance, the Nikkei Index reflects both short-term sentiment and long-term structural changes in the economy.

For those involved in financial markets, the significance of the Nikkei 225 extends beyond Japan’s borders. Global fund managers, policy analysts, and economic strategists use it as a benchmark to gauge broader trends across Asia. Moreover, the index’s movements often mirror international responses to tech-sector growth, currency valuation, and trade relationships. This makes the Nikkei not just a local indicator, but a global economic barometer. With increased volatility and renewed interest from foreign investors, understanding what drives this index is more crucial than ever for professionals seeking insights into both regional and global financial ecosystems.

What Happened

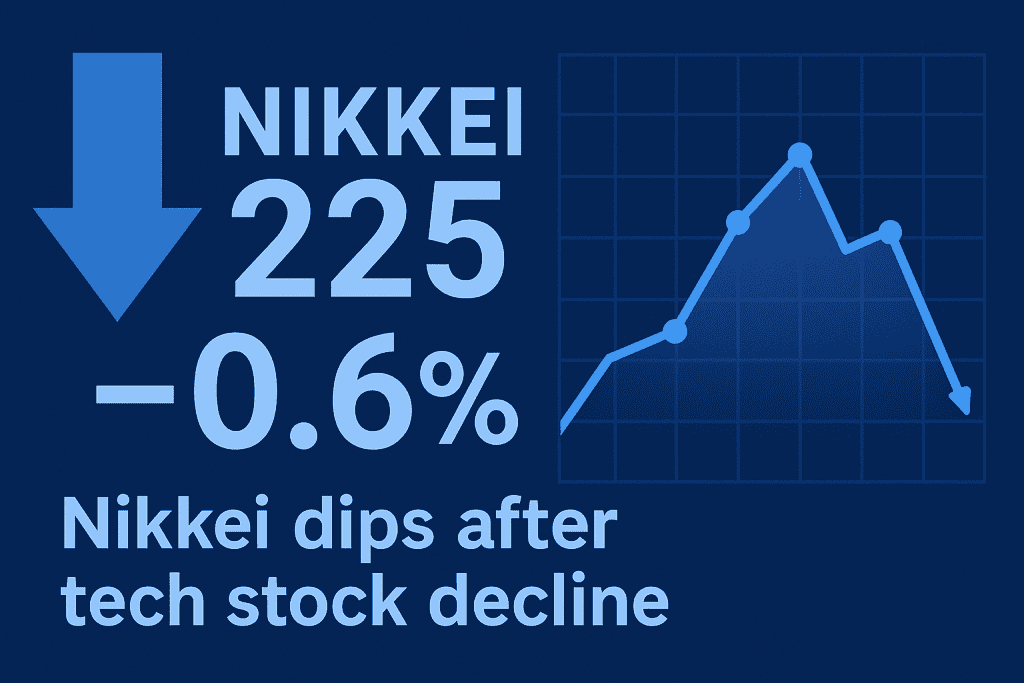

The Nikkei 225’s slight pullback on May 16, 2025, by 0.3 percent may seem minimal on the surface, but it came at a critical point following a strong rally that brought the index near a 34-year high. This movement signals a moment of recalibration for investors, who were weighing fresh economic data and global cues. Key concerns included a noticeable dip in tech stocks, which have been instrumental in the index’s recent surge.

The market was also reacting to new signals from the Bank of Japan regarding possible monetary tightening, which could have long-term effects on liquidity and investor behavior. These policy adjustments are closely monitored because even a subtle shift could alter capital flows in and out of Japanese equities.

In addition to macroeconomic factors, corporate earnings had a significant influence on market sentiment. Sony’s better-than-expected earnings provided a positive boost, showcasing strength in Japan’s consumer electronics and entertainment sectors. On the other hand, SoftBank’s underperformance raised concerns, particularly within tech-heavy segments of the market. The contrast between these corporate outcomes highlighted the uneven recovery across industries. As investors reassess their strategies, this moment of pause might serve as a healthy correction, allowing the market to stabilize before the next directional move takes shape.

When and Where

The most impactful developments regarding the Nikkei 225 took place during the Tokyo trading session on May 16, 2025. Trading began on a cautious note as investors digested a mix of local economic data and global market cues. By mid-afternoon, activity picked up significantly, triggered in part by corporate earnings updates and anticipation around policy decisions from the Bank of Japan. These factors combined to shape a volatile session that ultimately saw the index dip slightly, reflecting uncertainty in investor sentiment.

The Japan Exchange, home to the Nikkei 225, became the epicenter of this financial activity as institutional and retail investors closely monitored the index’s performance throughout the day. Tokyo, as one of Asia’s financial powerhouses, sets the tone for regional markets, and developments there often influence trading patterns in neighboring economies. On that particular day, the Tokyo session highlighted both the strengths and vulnerabilities of Japan’s equity landscape in a shifting global environment.

Who is Involved

Several key players are at the heart of the Nikkei 225’s recent market activity. The Bank of Japan remains a central force, as its stance on monetary policy continues to guide broader investor expectations. With discussions around interest rate normalization becoming more prominent, market watchers closely analyze every signal from the BoJ. The central bank’s decisions directly influence liquidity, borrowing costs, and overall confidence in the Japanese economy, making it a pivotal institution in shaping the Nikkei’s trajectory.

Equally influential are the major corporate constituents of the index, including Toyota, Sony, and Fast Retailing. These companies are not just domestic giants but global operators whose earnings and strategies impact investor sentiment across continents. Meanwhile, foreign institutional investors, especially those from the United States, have increased their presence in Japan’s markets. Their capital flows and portfolio rebalancing decisions often amplify movements in the index. Together, these stakeholders form a complex web of influence that keeps the Nikkei 225 at the center of financial analysis.

Why It Matters

The Nikkei 225 holds immense importance not only for Japan but for global markets as well. It acts as a mirror reflecting the health of Japan’s corporate sector and, by extension, its broader economy. Movements in the index influence decision-making for asset managers, hedge funds, and institutional investors worldwide.

As Japan continues to recover from decades of deflation and implement structural reforms to strengthen its economy, the Nikkei 225 provides real-time feedback on the progress and impact of these changes. Rising equity values can signal improved corporate earnings and economic confidence, while declines may point to lingering vulnerabilities or external shocks. The index also responds swiftly to developments such as interest rate changes, inflation data, and geopolitical risks, making it a reliable gauge for economists and market strategists.

On a deeper level, the Nikkei Index reflects Japan’s long-term evolution. The country is grappling with a rapidly aging population, labor shortages, and the need to digitize legacy systems. Companies within the index are increasingly investing in automation, AI, and clean energy to stay globally competitive. These transitions are captured in stock price movements, sector rotations, and investor behavior. For policymakers, the Nikkei’s performance can influence fiscal planning, while for international observers, it provides insights into the resilience and adaptability of Asia’s second-largest economy.

Quotes or Statements

A recent post pointed out that Japan’s economy contracted by 0.2 percent from the previous quarter, a sharper drop than expected. This has fueled concerns about the pace of recovery. However, the same source noted the Nikkei 225’s resilience, highlighting that investors remain optimistic due to strong corporate fundamentals and confidence in the Bank of Japan’s gradual policy transition.

Conclusion

The Nikkei 225 remains a crucial barometer for investors seeking to understand shifts in Japan’s economic position on the global stage. While short-term corrections like the recent dip may cause temporary concern, they are also part of a natural market cycle that helps re-establish fair value and investor confidence. These moments often allow analysts to reassess economic fundamentals and recalibrate expectations based on evolving macroeconomic trends and corporate performance.

Looking forward, the Nikkei is positioned to play a growing role in international portfolio strategies. As Japan continues to strengthen its economic outlook through innovation, corporate governance reform, and strategic partnerships, its stock market could attract more long-term global investment. Though volatility is expected to persist, especially amid changing monetary conditions, the underlying strength of Japan’s industries suggests a positive long-term trajectory. This makes the Nikkei 225 an essential focus for anyone tracking the future of the global economy.

Resources

- Nikkei Inc. Nikkei Index Profile

- Investopedia What is the Nikkei?

- Nikkei Inc. Nikkei Index – Index Overview

- Corporate Finance Institute Nikkei Index – Capital Markets Analysis

- Hindustan Herald Nikkei Edges Lower – 16 May 2025